Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Dec, 2024

| Fenix Resources' Shine iron ore mine in Western Australia. Exploration for the steelmaking commodity Down Under hit a decade high in the September quarter. |

Australian iron ore exploration hit a decade high in the September quarter amid concerns about the potential impact on prices resulting from slowing economic growth in China.

Iron ore exploration spending in Australia rose 9.7% year over year to A$216 million in the September quarter, the highest level recorded since the same quarter of 2013, according to the government's Resources and Energy Quarterly issued Dec. 20. Australia is the world's largest iron ore producer.

"The latest results continue the robust levels of iron ore exploration triggered by the historical high in iron ore prices (of above US$200 a metric ton) in early 2021," the report said.

Dean de Largie, managing director of explorer Australian Critical Minerals Ltd., said "there is continued focus on iron ore by Western Australian explorers contrary to some global negativity from the perceived Chinese economic slowdown." Australian Critical Minerals has several iron ore projects in Western Australia's prolific Pilbara region,

Local producers all "have prospective ground they need to continue to firm up so they can understand where it sits in a future production pipeline," said Trevor Hart, global mining leader at KPMG Australia.

"Considering what they're going to need to produce [to meet ongoing demand], companies are certainly not stepping back from that [drive for more tons], so I certainly see continued healthy activity" in iron ore exploration Down Under, Hart told S&P Global Commodity Insights.

|

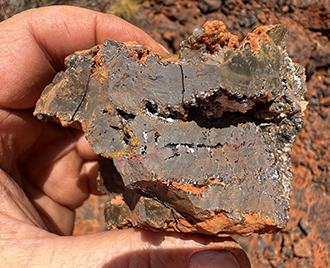

| An iron ore sample from recent drilling by Australian Critical Minerals in Western Australia's Pilbara region. |

Explorers' optimism

John Welborn, executive chairman of Fenix Resources Ltd., said the company is "really excited about iron ore" as "it is clear there is plenty more iron ore to be found" in Australia, particularly with the aid of evolving technology.

"Fortescue Ltd.'s deposits are largely hidden under geological cover, and those big monsters [of projects] are still out there" to be found, Welborn told Commodity Insights.

Welborn also highlighted recent reports that researchers from Western Australia's Curtin University had found an iron ore deposit of an estimated 55 billion metric tons in Western Australia's Hamersley province, where the bulk of the state's iron ore is mined.

"Companies with high-quality iron ore products understand that grade is king in the mineral industry and that good quality iron ore will always find a home irrespective of the global economy," de Largie told Commodity Insights.

"Some of the major producers are committed to long-term production of mid-range quality due to the scale of their production," de Largie said. "They, therefore, will always be happy to add in some additional high-quality iron ore, especially with low deleterious elements, such as the products in [our] properties."

Decarbonization upside

Exploration is also being incentivized by the significant investments in downstream processing Down Under, which need "higher-quality [iron ore] products that lend themselves to green iron and green steel," Welborn said.

Miners have "traditionally looked for billions of tons of magnetite" needed to underpin huge capital expenditure projects, but plants that produce direct reduced iron only need very small quantities, Welborn said. This suits the high-grade magnetite targeted by miners in Western Australia, he added. Direct reduced iron, also known as sponge iron, is the raw material used in electric arc furnaces that can make steel with lower emissions than traditional coal-fired blast furnaces.

The same rationale is being used for the substantial magnetite potential that exists in South Australia, where a green steel hub is being developed.

Bearishness in iron ore

Amid this optimism, Welborn also warned about "structural bearishness" in the market around iron ore.

Global decarbonization trends and the huge Simandou project coming online will likely contribute to a seaborne trade surplus reaching 22 million metric tons by 2028, Tamara Thorne, a senior metals analyst at Commodity Insights, said in an email. Commodity Insights has conservatively projected that the Simandou operation in Guinea will start shipping ore in 2026, in line with other analyst projections.

Gloomy sentiment weighed on prices during the September quarter, and Commodity Insights expects China's steel production to decline by 1.2% year over year in 2025, Thorne said.

"Combined with China's strategic move away from relying on imports, this will lead to a significant drop in iron ore imports, likely pushing prices down to an average of US$95/dmt by the end of 2025," Thorne said.

"Additionally, geopolitical and trade uncertainties could further weaken China's economy and exacerbate the ongoing crisis in its property sector, which is projected to remain weak in the near term despite anticipated stimulus measures," Thorne said.

However, de Largie said China has "substantial internal control of its own economy" and "many levers available to ensure economic viability."

China is "unlikely to slow to a level that cripples the iron ore industry," de Largie said. "Steel cannot be replaced substantially by anything in global infrastructure construction, and thus, the future long-term demand scenario is unaffected by short-term slowdowns in larger economies."