Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Jan, 2024

By Brian Scheid and Umer Khan

The S&P 500 has soared to new all-time highs, partly due to the strength of five mega-cap tech stocks that have been carrying the index for months.

The index, which on Jan. 19 settled above the previous all-time high reached roughly two years ago, has climbed 17.8% since its most recent low on Oct. 27, 2023. Without five mega-cap stocks — Alphabet Inc., Amazon.com Inc., Meta Platforms Inc., Microsoft Corp. and NVIDIA Corp. — the index has increased 15.8%.

'Magnificent Seven' effect

The five stocks are part of the seven mega-cap technology stocks — dubbed the "Magnificent Seven" — that have gained an outsized influence on the S&P 500's direction as they have collectively nearly doubled in market capitalization since the beginning of 2023.

The market cap for these seven stocks has risen to nearly $12.5 trillion, up $5.67 trillion from the start of 2023. NVIDIA's market cap has more than tripled to $1.473 trillion over that time, and Meta Platforms' market cap doubled to $981.1 billion.

Uneven gains

Apple Inc.'s market cap has increased about 51% from the start of 2023 to $2.998 trillion, making it the world's largest stock. But Apple's market cap has fallen from its peak of $3.08 trillion in mid-December 2023.

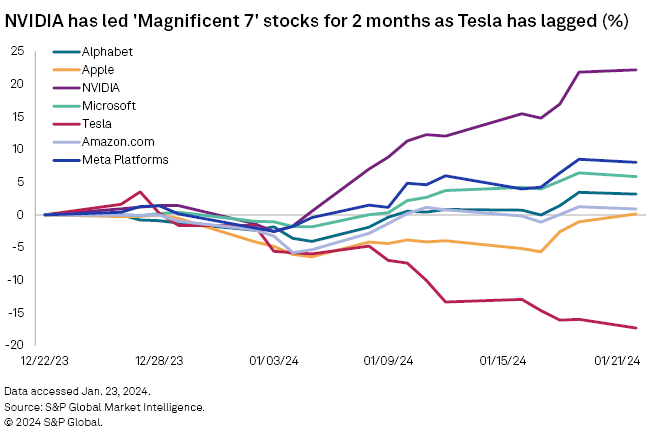

Apple has lagged the other Magnificent Seven stocks over the past two months, up less than 0.2% over that time after falling as much as 6.4% early in 2024.

Tesla Inc. has fared the worst of the mega-caps, losing more than 17.3% over that stretch.

NVIDIA, however, has continued to rally strongly, rising about 22.2% over the past two months. This rally has persisted as investors continue to bet on AI breakthroughs.

Sector gains

While the S&P 500 has risen less than 2.3% since the start of the year, communication services stocks have rallied more than 5.2% and IT stocks have jumped more than 8.1%.

The remaining sectors have either lost ground in 2024 or gained less than 0.9%.