Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Jul, 2023

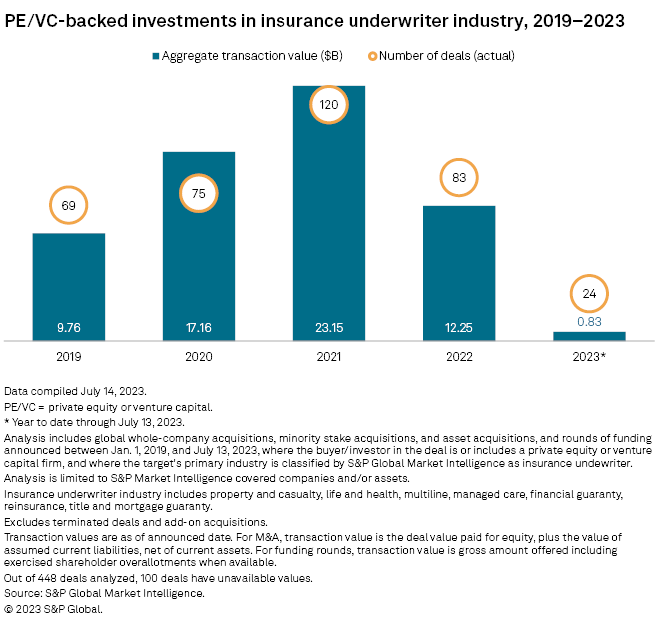

Global private equity deal values in insurance underwriter companies rose sequentially in the second quarter, but the industry total for the first half of 2023 remained shy of the $1 billion mark.

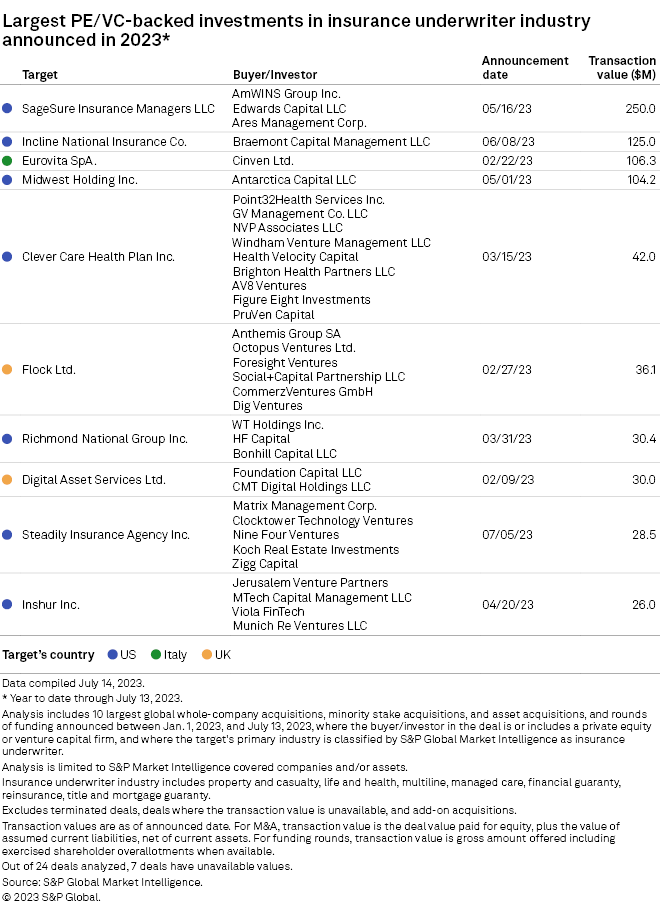

From Jan. 1 to July 13, private equity and venture capital firms announced $830 million of investments across 24 transactions in the sector worldwide, according to S&P Global Market Intelligence data.

– Download a spreadsheet with data featured in the story.

– Check out the global private equity deals with an announced value of more than $1 billion.

– Explore more private equity coverage.

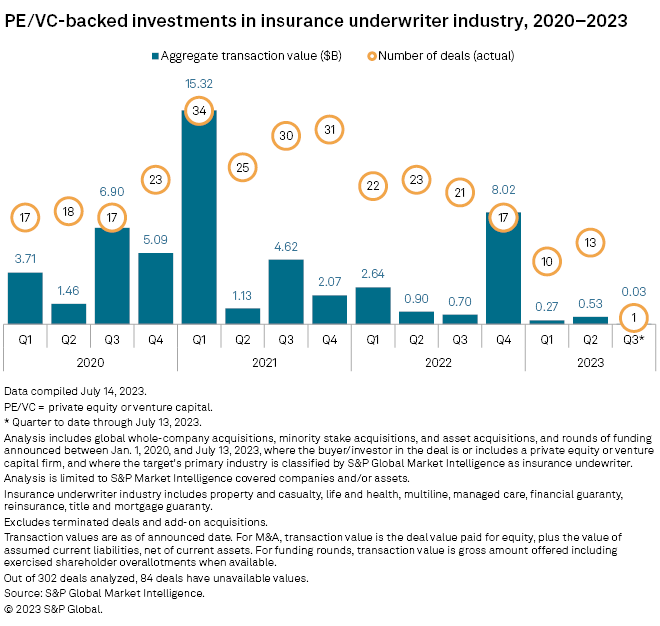

During the second quarter, insurance underwriters pulled in $530 million across 13 deals. The aggregate transaction value in the second quarter was down 41.1% from the same period last year, which saw 23 deals worth $900 million.

The second-quarter total saw a marked improvement from the previous quarter and grew 96.3% sequentially.

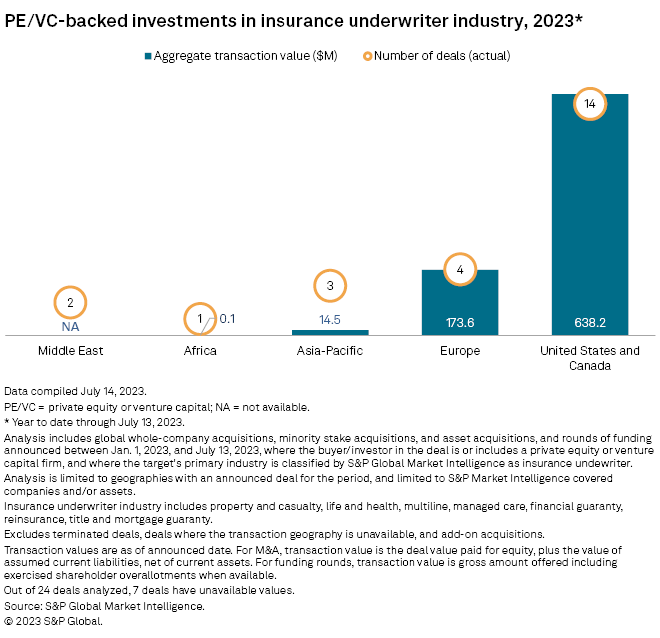

The US and Canada had the most transactions in the year to July 13, with 14 deals worth an aggregate of $638.2 million, followed by Europe with 4 transactions totaling $173.6 million.

Top transactions

In the largest private equity investment in the sector year to date, Ares Management Corp. and Edwards Capital LLC participated in the $250 million funding round for program manager and wholesale broker SageSure Insurance Managers LLC.

Braemont Capital Management LLC's investment in a $125 million round of funding for Incline Insurance Group LLC, which offers risk management, underwriting and reinsurance by partnering, marks the second-largest deal thus far in 2023.