Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

10 Mar, 2023

S&P Global Market Intelligence offers our top picks of real estate news stories published throughout the week.

Office landlords are offering free rent for longer periods along with other perks to attract tenants, The Wall Street Journal reported.

In the top office deals in New York in 2022, tenants got 7% of the lease term free of rent, up from 3% in 2019, the publication reported, citing CompStak. In San Francisco, the rent-free period was at 6% of the tenure, or more than twice since before the pandemic.

Landlords have also given higher improvement allowances to tenants compared to 2019, according to CBRE.

According to the publication, building owners turn to perks instead of cutting rent, in part because the latter could negatively impact the value of an entire office block.

The national office vacancy rate in the U.S. is expected to peak at 13.8% in the second quarter of 2024 before gradually improving, BMO Capital Markets analyst John Kim said in a March 3 research note, citing CoStar. The vacancy rate is at an all time high of 12.9%.

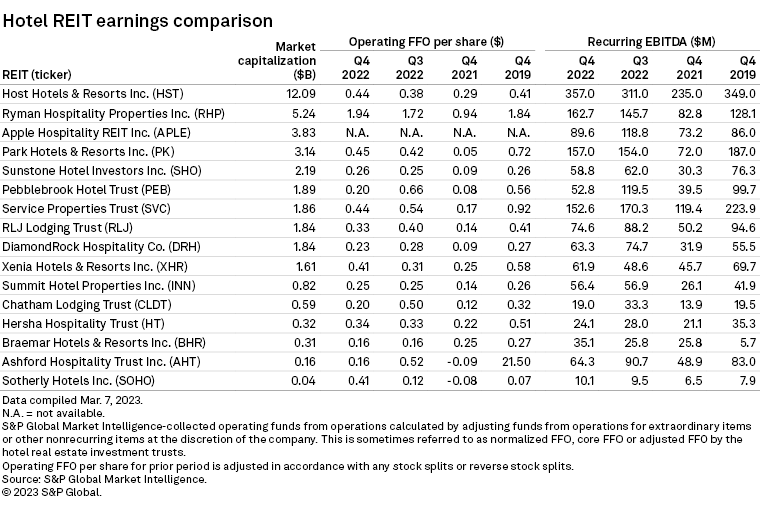

CHART OF THE WEEK: Hotel REITs post strong earnings in Q4'22

⮞

⮞

⮞

Property trades

* Realty Income Corp. is acquiring up to 415 single-tenant convenience store properties in the U.S. in a $1.5 billion sale-leaseback transaction with U.K.-based convenience retailer EG Group Ltd. The deal is expected to close in the second quarter.

* JDS Development Group LLC listed its Brooklyn Tower rental property in New York City for sale, Green Street's Real Estate Alert reported. The residential property, which rises 1,000 feet, has an estimated valuation of more than $600 million.

* Griffin Realty Trust Inc. sold the Amazon Web Services-leased South Lake at Dulles Corner Business Park, a 270,000-square-foot office property in Herndon, Va., to Vision Properties LLC for $110 million, Commercial Observer reported.

Data Dispatch: US housing prices decline for 6th straight month

REIT Replay: Diversified Healthcare Trust shares skyrocket after Q4'22 earnings