Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Mar, 2023

By Karl Decena and Darakhshan Nazir

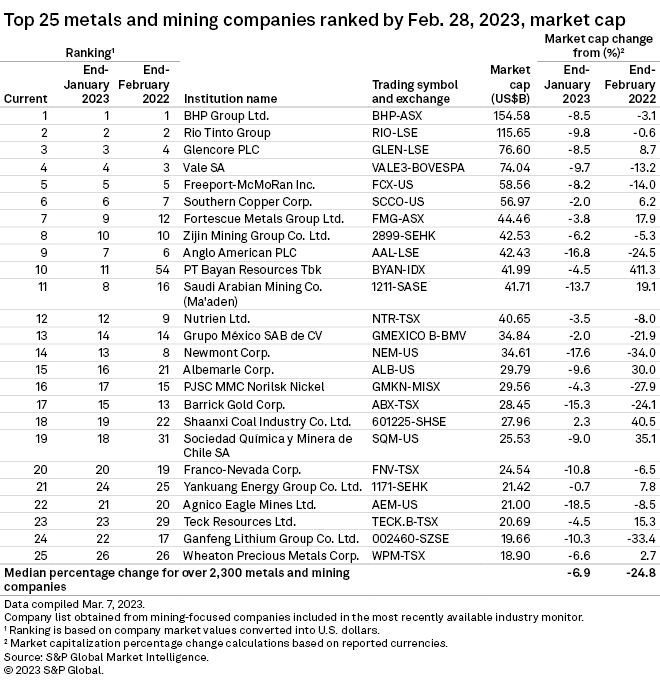

The median market capitalization for a pool of over 2,300 metals and mining companies slumped 24.8% year over year and dropped 6.9% month over month in February, according to S&P Global Market Intelligence data.

The combined market valuations of the 25 largest miners analyzed slipped to $1.13 trillion at the end of February from $1.21 trillion at the end of January. All but one of the 25 companies lost market value month over month, while 14 recorded year-over-year declines.

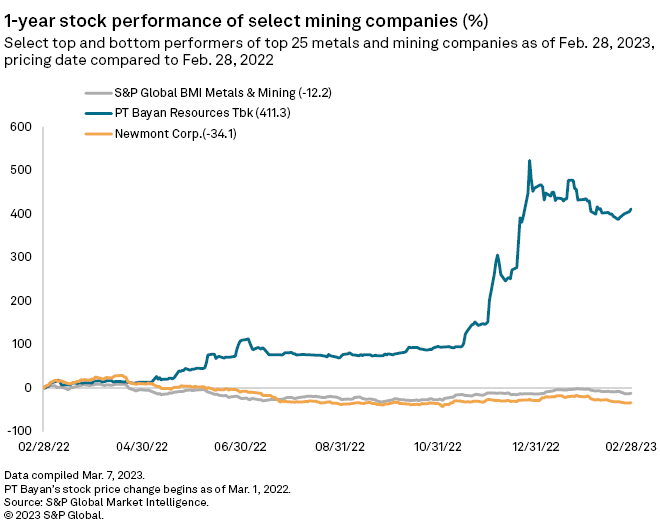

Gold major Newmont Corp.'s valuation fell 34.0% year over year, the largest drop among the largest miners analyzed. Ganfeng Lithium Group Co. Ltd. followed with a 33.4% decline in market value. The U.S. Federal Reserve's interest rate hikes are weighing on the price of gold, while prices for battery raw materials are retreating amid slowing electric vehicle sales and projections of strong supply, ANZ analysts said in a Feb. 16 note.

The valuations of PJSC MMC Norilsk Nickel, Anglo American PLC, Barrick Gold Corp. and Grupo México SAB de CV all fell by at least 20%. Vale SA and Freeport-McMoRan Inc. also recorded double-digit percentage declines in market caps. Demand recovery for metals has been weaker than expected following a rise in prices in January as China relaxed some pandemic-related restrictions, ANZ analysts said.

Indonesian coal miner PT Bayan Resources Tbk vaulted into the top 10 as its market cap soared 411.3% year over year. Its valuation has been on the rise since late 2022 amid higher coal prices. The company also implemented a stock split in December 2022 to improve liquidity.

|

* View the consensus metals price forecasts for February * Learn more about the significance of a potential Newmont-Newcrest merger. |

Glencore PLC's valuation rose 8.7% year over year, making it the only miner in the top five whose market value increased. BHP Group Ltd. remained the largest miner by market capitalization among those assessed by Market Intelligence, although its market cap fell 3.1% year over year to $154.58 billion.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.