Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 Feb, 2023

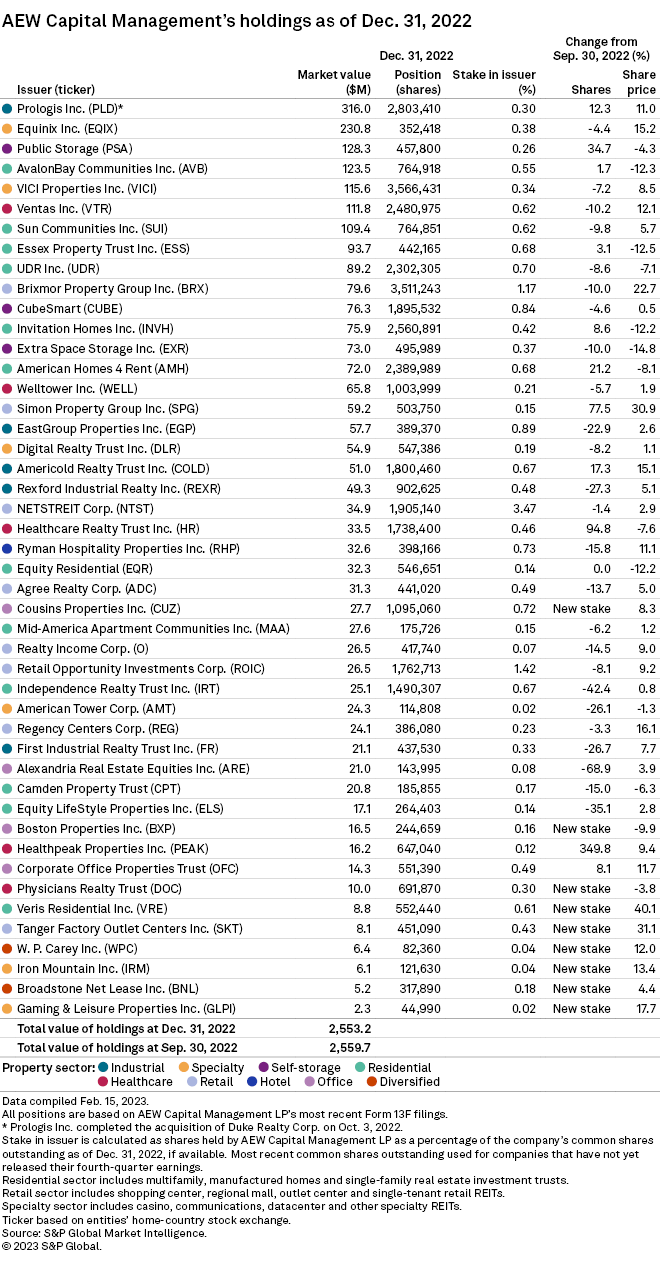

AEW Capital Management LP reduced its share count in 25 of its U.S. real estate investment trust holdings and fully exited three of its REIT positions during the fourth quarter of 2022.

The investor's total REIT holdings decreased slightly, by 0.3% to $2.55 billion during the quarter from $2.56 billion in the third quarter of 2022, according to the firm's most recent Form 13F filing.

Major cutbacks in residential, retail REITs

Residential and retail were the REIT sectors with the most cutbacks in AEW's portfolio during the fourth quarter. The Boston-based asset manager pared its holdings in six companies each from both segments.

AEW also reduced its holdings in four REITs in the specialty sector, a category that includes advertising, casino, communications, data center, prison and timber REITs.

The asset manager's largest reduction in holdings during the quarter was in office REIT Alexandria Real Estate Equities Inc. AEW divested 68.9% of its stake in the company, a position valued at $21 million at quarter-end.

* Set email alerts for future Data Dispatch articles.

* For further institutional investor research, try the Investor Targeting tool.

* Read some of the day's top real estate news and insights from S&P Global Market Intelligence.

During the fourth quarter of 2022, AEW bought nine new stakes, which included two each in the specialty, diversified and office sectors.

The firm increased holdings in 11 companies, led by a 349.8% increase in Healthpeak Properties Inc., which had a market value of $16.2 million at quarter-end.

A stake increase in Healthcare Realty Trust Inc. was the second-highest in the group. AEW bought a new stake in the healthcare REIT in the third quarter of 2022, and a fourth-quarter increase of 94.8% to $33.5 million pushed it to the 22nd spot on the list, 15 places higher from the third quarter.

The next-largest stake increase was in Simon Property Group Inc. AEW upped its stake in the retail REIT by 77.5% to $59.2 million in the fourth quarter of 2022.

Prologis Inc. remained the top REIT holding of the asset manager at the end of 2022 by market value. AEW upped its stake in the industrial REIT by 12.3% to $316 million in the fourth quarter. On Oct. 3, 2022, Prologis completed its acquisition of Duke Realty Corp.

Portfolio exits

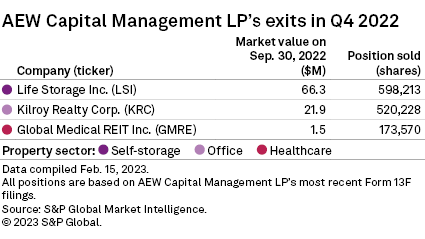

In the fourth quarter of 2022, AEW exited three REIT holdings, one each in the office, healthcare and self-storage sectors.

The firm's largest exit was in self-storage REIT Life Storage Inc., a position valued at $66.3 million at the end of the third quarter of 2022.

Sector holdings

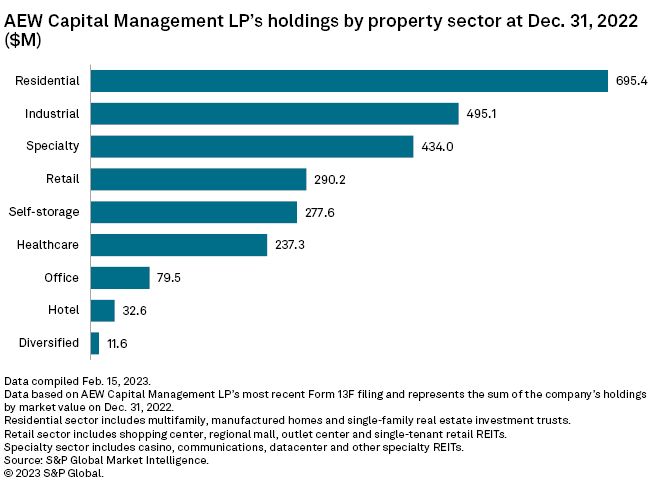

Residential REITs emerged as AEW Capital's most preferred sector at the end of 2022, with the market value of its holdings in the space totaling $695.4 million.

Industrial REITs followed next with a market value amounting to $495.1 million. Specialty REITs took the third spot with a total market value of $434 million.

AEW entered a new sector — diversified REITs — during the fourth quarter of 2022, having bought new stakes in W. P. Carey Inc. and Broadstone Net Lease Inc. worth $6.4 million and $5.2 million, respectively.