Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Nov, 2023

Private funding for media and telecom startups this year is falling well below historical levels seen over the past decade, as higher interest rates and other factors make investors more skittish of young firms.

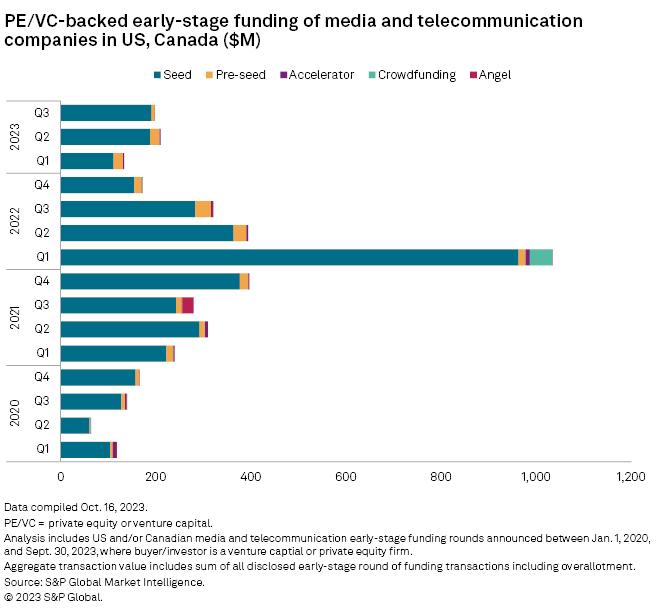

The number of early funding transactions in the sectors by private equity and venture capital firms dropped to 40 in the quarter ended Sept. 30. That is the lowest number of transactions since the first quarter of 2018 — and it is a sharp pullback from the most recent high of 135 transactions recorded in the first quarter of 2022.

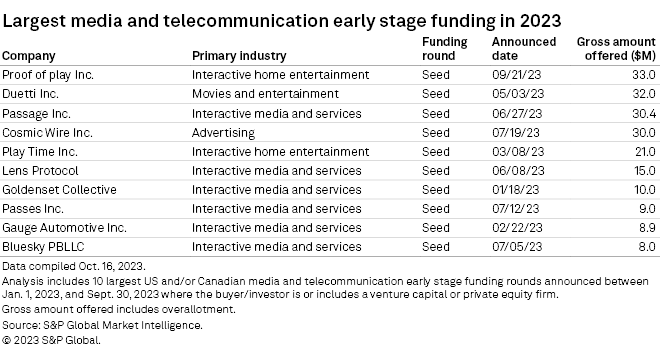

Onchain game developer Proof of play Inc. raised the highest amount of early-stage funding among media and telecom companies in the US and Canada in the third quarter, receiving $33.0 million in September. This was also the highest amount raised in the sectors for the year to date.

Onchain games run on and have all of their data on a decentralized blockchain. Proof of play's first game is Pirate Nation, a fully onchain role-playing game.

Proof of play was co-founded by CEO Amitt Mahajan, who was co-creator of FarmVille at Zynga Inc. The funding round was led by Chris Dixon at Andreessen Horowitz LLC and Neil Mehta at Greenoaks Capital Partners LLC.

The Web3 company Cosmic Wire raised the second-highest amount of early-stage funding in the third quarter, with $30 million. The seed round was led by Solana Foundation and Polygon. Solana is a blockchain platform, and Cosmic Wire's Web3 infrastructure will be built on its network.

All told, media and telecommunication startups raised $191.4 million from seed funding in the third quarter, a decrease from $283.3 million compared to the previous year.

Pre-seed funding amounted to $6.9 million, down from $33.5 million in the same quarter of 2022. Accelerator funding accounted for just $400,000 of the total raised in the quarter.

The sectors have not received any crowdfunding since the fourth quarter of 2022.