Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Sep, 2022

By Tyler Hammel and Hassan Javed

Continuing a post-COVID-19 growth in demand, U.S. life insurers' direct individual life premiums increased 2.5% year over year in the second quarter to $41.37 billion.

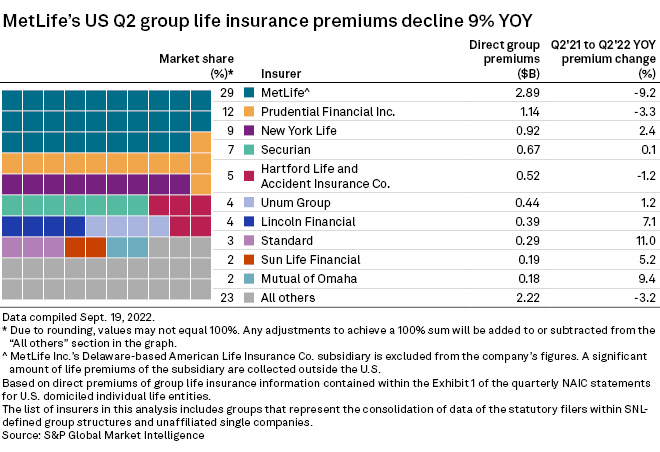

However, direct group life premiums decreased 3.0% to $9.85 billion from $10.15 billion a year earlier.

Combined, individual and group direct premiums amounted to $51.21 billion in the second quarter, up slightly from $50.49 billion in the prior-year period but down from $52.26 billion in the first quarter. The Life Insurance Marketing and Research Association, which conducts quarterly surveys of life insurance companies, said indexed universal life and variable universal life sales drove overall premium growth in the second quarter.

MetLife sees largest group decline

Among the top 10 largest U.S. group life underwriters, MetLife Inc. recorded the steepest drop in group life premiums as they fell 9.2% to $2.89 billion. Despite that decline, MetLife remained the largest provider of group insurance premiums.

In an August earnings call, MetLife President Ramy Tadros said the year-to-date drop in sales was "very much a function" of the record year the insurer experienced in 2021.

Written premiums also declined year over year for the second-largest group insurer, Prudential Financial Inc., falling 3.3% to $1.14 billion. Seven of the top 10 largest group life underwriters saw gains.

|

* |

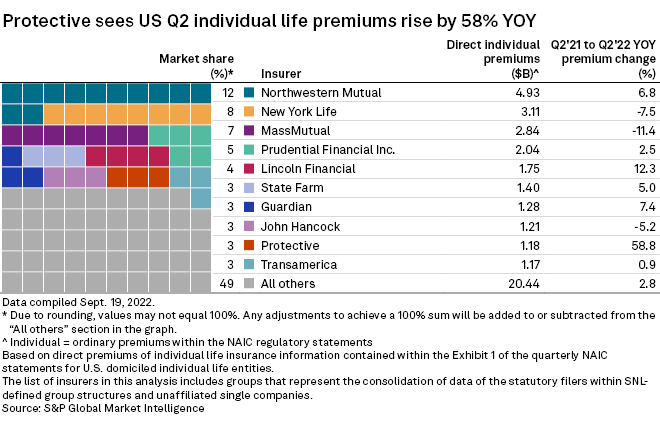

Protective leads individual market

Among the top 10 largest individual life insurance underwriters, Protective Life Corp., saw the largest year-over-year change, growing its individual premiums by 58.8%, followed by Lincoln National Corp., whose individual premiums grew by 12.3%.

Protective entered into the bank-owned life insurance/company-owned life insurance, or BOLI/COLI, business in 2019 after acquiring Great-West Lifeco Inc.'s U.S. life and annuity business. According to Protective's supplemental schedules for the first and second quarters, the company's BOLI/COLI sales totaled $1.35 billion in the first half of 2022, up from $519 million in the first half of 2021.

Three of the top 10 largest individual life insurance underwriters saw a year-over-year decline in individual premiums, the largest of which was an 11.4% decline in the second quarter of 2022 for Massachusetts Mutual Life Insurance Co.

New York Life Insurance Co. and John Hancock Life Insurance Co. (USA) also declined year over year, falling 7.5% and 5.2% respectively.