Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Sep, 2022

By Alex Graf and David Hayes

Southern Missouri Bancorp Inc. is looking to put Citizens Bancshares Co.'s low-cost deposit base to work to support its loan growth.

Poplar Bluff, Mo.-based Southern Missouri is pushing further north in the Show-Me State, specifically into the Kansas City area, with its planned acquisition of Citizens. Once the transaction closes, Southern Missouri hopes to leverage Citizens' liquidity to expand its lending capacity and keep up with its "strong pipeline," Chairman and CEO Greg Steffens told S&P Global Market Intelligence.

"Their liquidity provides us a lot lower cost than what we have," Steffens said. "We see the opportunity to expand some lending operations and some of their footprint."

Noninterest bearing deposits made up 26.4% of Citizens Bank and Trust Co.'s total deposit base at June 30, compared to just 15% at Southern Bank as of the same date.

Citizens' credit quality and its lending niches, which include commercial and industrial, commercial real estate and construction, made it an attractive target, according to Southern Missouri President and Chief Administrative Officer Matthew Funke.

"We're looking for somebody that's in good markets and somebody that provides a good source of deposits," Funke said. "They've got both."

Piper Sandler analyst Andrew Liesch applauded the deal, saying in a Sept. 21 that Citizens' solid deposit base and liquidity position should lower Southern Missouri's reliance on higher-cost CDs. The acquisition also brings in a trust and investment management business, Liesch said, as well as complementary small business lending and agribusiness banking verticals.

|

* Click here to read S&P Global Market Intelligence's Data Dispatch coverage * Click here to set email alerts for future Data Dispatch articles. |

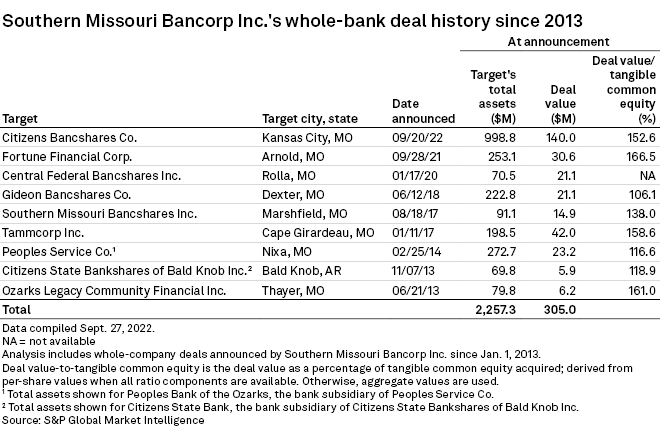

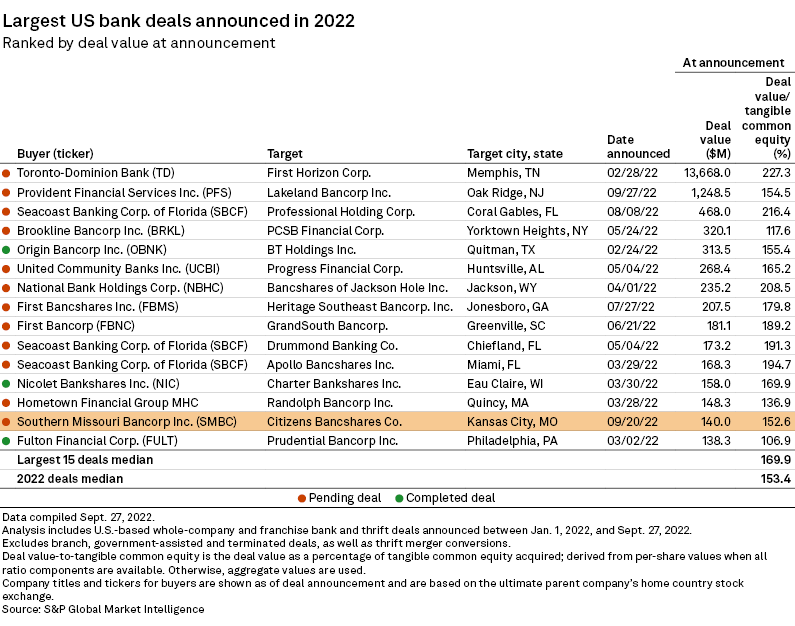

Citizens is the largest bank target Southern Missouri has ever pursued, based on the target's $998.8 million in assets as of June 30 and the announced transaction value of $140 million. The planned purchase is the 14th-largest U.S. bank deal announced thus far in 2022, according to S&P Global Market Intelligence data.

Given the transaction's size, Southern Missouri will have its hands full with integration and is unlikely to pursue further M&A in the upcoming year, Steffens said.

"This is the largest asset size and branch number that we have taken on," Steffens said. "We're going to be concentrating on integration and systems conversions and working on generating loan growth."

In the longer run, however, Southern Missouri may still turn to M&A to fill gaps in its Missouri coverage.

"There are some markets between our Springfield footprint and the Kansas City market," Funke said. "We would have some interest longer term and we think will have opportunities to continue to expand through M&A."