Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Aug, 2022

By Joyce Guevarra and Karl Angelo Vidal

S&P Global Market Intelligence offers our top picks of real estate news stories published throughout the week.

Office foot traffic in July 2022 shows gaps similar to the previous two months when compared to 2019 figures, suggesting many employees that will return to the office have already done so, a report from analytics firm Placer.ai said.

Boston showed the quickest office recovery among cities analyzed by the firm, which also included San Francisco, New York, Los Angeles, Atlanta and Chicago. Foot traffic in the city was down 17.5% in July compared to 2019, coming from a 25.4% drop in June. Traffic in tech hub San Francisco was down 65.8% in July and down 61.0% in June.

Year-over-year visits continue to rise, although the increase in July was the smallest since the start of 2022. On a month-over-month basis, visit data has levelled out since April, following huge fluctuations in February and March, according to the report.

Growth in foot traffic could be minimal in the coming months or years as most office workers prefer working remotely or in a hybrid setup, the report added.

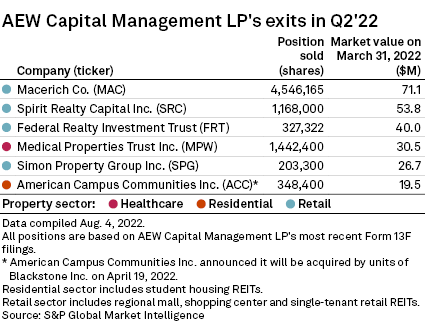

CHART OF THE WEEK: AEW Capital Management exits mall REIT holdings in Q2

⮞

⮞

⮞

Joining forces

* Ground lease REITs Safehold Inc. and iStar Inc. agreed to a tax-free, strategic combination. Following the deal, iStar will sell 5.4 million Safehold shares to MSD Partners for $37 per share, or $200 million in total.

* Blackstone Inc. closed the acquisition of all of the outstanding shares of common stock of student housing developer American Campus Communities Inc. for approximately $12.8 billion, including the assumption of debt.

* Choice Hotels International Inc. completed the acquisition of Radisson Hotels Americas' franchise business, operations and intellectual property for approximately $675 million. The transaction includes approximately 67,000 rooms across nine brands.

* Aimco and Alaska Permanent Fund Corp. agreed to fund up to $1 billion worth of multifamily projects led by Aimco. The Alaskan sovereign wealth fund will invest up to $360 million of limited partner equity into the projects, while Aimco will act as general partner and developer, committing at least $40 million.

Property deals

* Hersha Hospitality Trust sold six hotels for a total of $435.9 million. An unnamed, unaffiliated entity bought Courtyard Brookline, Hampton Inn Washington D.C., Hilton Garden Inn M Street, Hampton Inn Philadelphia, TownePlace Suites Sunnyvale and Courtyard Los Angeles Westside.

* KKR & Co. Inc. bought two industrial properties in Buford, Ga., and Dallas for a total of approximately $300 million in two separate transactions. The Buford property comprises four newly built, class A warehouses totaling 1.1 million square feet, while the Dallas asset consists of two class A warehouses totaling roughly 1.0 million square feet.

* Digital Realty Trust Inc. agreed to sell a 370,000-square-foot data center in a transaction valuing the asset at about $205 million.

Data Dispatch: 7 US REITs raise dividend payments in July

REIT Replay: US REIT share prices fall during 1st week of August