Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Aug, 2022

|

U.S. Secretary of Energy Jennifer Granholm tours L'Air Liquide's Innovation Campus Delaware in Newark, Del. |

The ability of states and regions to marshal matching private funds will play a major role in the federal government's decision to award slices of the $8 billion Congress allocated to develop hydrogen hubs, U.S. Energy Secretary Jennifer Granholm said.

Granholm stressed the role of private capital when asked by S&P Global Commodity Insights how the agency will balance the value of spreading the investment over more than four regions with the necessity of ensuring that each area has enough capital to develop a sustainable hub.

"This is why it requires a match — a 50-50 match — and that means that there has to be private-sector involvement to be able to leverage and spend more across hopefully larger amounts," Granholm said following an Aug. 26 tour of L'Air Liquide SA's Innovation Campus Delaware and a roundtable discussion with U.S. Labor Secretary Marty Walsh, the Delaware congressional delegation, Delaware Gov. John Carney, business leaders and University of Delaware staff.

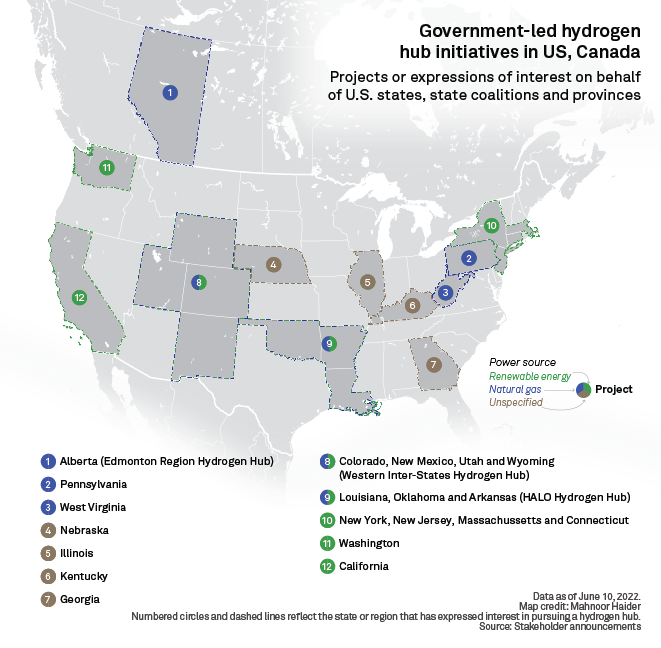

A 2021 bipartisan infrastructure law directed the DOE to invest the funds in at least four hydrogen hubs. In 2022, the department has said it could support six to 10 hubs with $6 billion to $7 billion of the money.

Sen. Chris Coons, D-Del., said Democrats' budget reconciliation bill, the Inflation Reduction Act, made it more attractive for the private sector to invest in hydrogen hubs by including $370 billion in spending for energy and climate initiatives. This included a new production tax credit for low- and zero-carbon hydrogen.

"The Inflation Reduction Act also changed the landscape ... by creating other financial incentives for players to get into this space, so that the resources that the Bipartisan Infrastructure Bill gave to the [Energy Department] will actually go broader, farther, longer," Coons said.

Carbon capture is 'key'

The DOE will have other demands. The department will want to see applications that generate hydrogen from different fuel stocks for a range of end-use applications, Granholm said. It also will be "super important" for applicants to demonstrate that they can develop the ecosystem to support their vision for a hydrogen hub, inclusive of physical infrastructure, hydrogen off-takers, and educational and workforce training programs, Granholm said.

Additionally, the DOE will prioritize the potential for carbon reduction, including by mitigating emissions from hydrogen production, Granholm said. Congress structured the tax credit so that it can be claimed by some blue hydrogen facilities, which use carbon capture technology to offset emissions from natural gas-derived hydrogen, a divisive topic among Democrats.

Sen. Tom Carper, D-Del., whose office devised the hydrogen production tax credit, said figuring out how to capture carbon and sequester it or repurpose it for productive end uses, such as fertilizer for the region's farmers, was critical.

"That's the key," Carper said. "We can't get where we need to go on climate without that."

Del. stakeholders pitch state as hydrogen hub

The U.S. produces about 10 million tonnes of hydrogen per year, almost entirely through a carbon-intensive process of breaking down natural gas with steam. The chief consumers are refineries and chemical plants, which are widely seen as candidates for conversion to low-carbon hydrogen.

In Delaware, PBF Energy Inc.'s Delaware City refinery, which sits on 5,000 acres with rail, river and interstate highway access, would serve as the linchpin for a regional hub, according to Delaware Sustainable Chemistry Alliance Executive Director Dora Cheatham, who moderated the roundtable.

The site would let renewable energy resources support green hydrogen production, PBF Energy President Matthew Lucey said during the discussion. The company is trying to develop the acreage into warehouse distribution, refrigerated storage and data warehouse sites, which would create additional hydrogen off-takers, Lucey said.

"We have the capability to build out not only a perfect supply center but a built-in demand center as well," Lucey said.

L'Air Liquide's Newark, Del., campus is the company's flagship research and development site for the Americas. Researchers are demonstrating hydrogen production and end-use capabilities, including carbon capture applications and vehicle refueling.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.