Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Jun, 2022

By Sanne Wass and Marissa Ramos

Jyske Bank A/S is poised for pretax profit growth of 25% by 2025 with its acquisition of Svenska Handelsbanken AB (publ)'s Danish business, CFO Birger Krøgh Nielsen said.

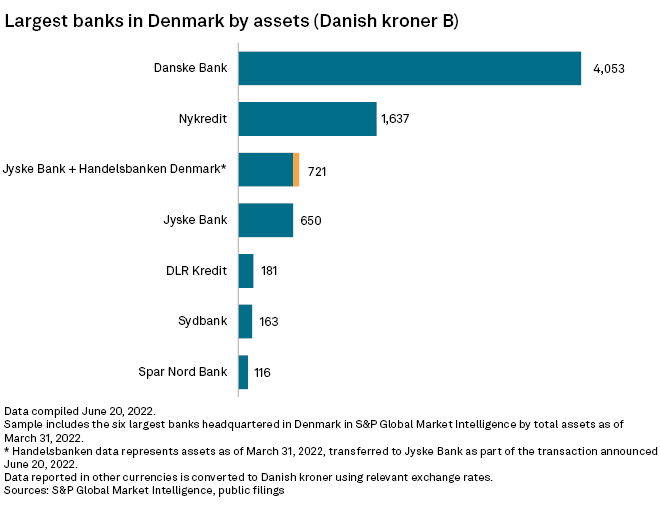

Jyske, Denmark's third-largest bank by assets, said June 20 that it had entered into a binding agreement with Sweden-based Handelsbanken to buy the latter's Danish business activities. Jyske's share price rose more than 16% by mid-afternoon Copenhagen time following the deal announcement.

Assets worth about 70 billion Danish kroner as of the end of the first quarter will be transferred as part of the transaction, which is expected to be completed in the fourth quarter of 2022, Handelsbanken said in a statement. The price will be determined at closing based on the assets and liabilities assumed by Jyske, plus 3 billion kroner of goodwill.

Handelsbanken announced in October that it would divest its operations in both Denmark and Finland because it saw little opportunity to scale up its offerings without significant investment.

Jyske expects to have fully migrated the Danish business by the end of 2023, with synergies amounting to 300 million Danish kroner annually being fully realized during 2024, CEO Anders Christian Dam said on a June 20 analyst call.

The transaction will see Jyske take over more than 113,000 customers, 66 billion kroner of loans and 36 billion kroner in deposits, boosting its own lending volumes by approximately 15% and deposits by 30%.

The merger will lift Jyske's annual pretax profit by approximately 1 billion kroner in 2025 and onwards, a 25% rise from 4 billion kroner in 2021, according to Krøgh Nielsen. The bank expects to deliver an additional 300 million kroner pretax profit in the transition year of 2023, he said.

"From day one, this transaction will have a positive impact on our financials," said Krøgh Nielsen.

Selected large Danish corporates are currently excluded from the deal due to "special terms and conditions they have in the agreements with Svenska Handelsbanken," said Krøgh Nielsen. Some of those customers may want to engage with Jyske Bank, which could potentially lead to higher volumes, he added.

Other Danish banks, including Spar Nord Bank A/S and Nykredit A/S, also considered bidding for Handelsbanken's business in Denmark but withdrew their interest in recent weeks, according to newspaper Berlingske Tidende.

Analysts have previously suggested Jyske Bank was not an obvious buyer because it uses a different IT provider to Handelsbanken and would face large costs to move acquired customers to its own platform. According to the deal announcement June 20, Handelsbanken will incur the full exit fee related to this transfer.

Jyske, meanwhile, expects to incur one-off restructuring and integration costs related to the transaction of approximately 500 million Danish kroner before tax.

Handelsbanken Denmark has 43 branches and about 600 employees, while Jyske has 80 branches and 3,200 employees in the country.

Handelsbanken has not yet found a buyer in Finland, and analysts have deemed the sale of this unit a harder task, saying the Sweden-based lender may have to sell the business in parts rather than in one piece.

As of June 17, US$1 was equivalent to 7.11 Danish kroner.