Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Jun, 2022

By Iuri Struta

A proposal to combine Open Fiber Spa with Telecom Italia SpA's fixed-line network to create a single national fiber infrastructure in Italy is raising questions about managing buildout costs versus market competition.

Telecom Italia, state-owned investment bank Cassa depositi e prestiti SpA and private equity firms KKR & Co. Inc. and Macquarie Asset Management Inc. signed an accord in late May to hold exclusive discussions regarding a potential deal, which would include Telecom Italia's last-mile unit FiberCop. Cassa depositi e prestiti is leading the initiative and is expected to maintain control over the new entity if the merger closes. The bank currently owns a sizable stake in Telecom Italia and controls Open Fiber. KKR and Macquarie are capital providers, owning minority stakes in FiberCop and Open Fiber, respectively.

The Italian government hopes the merger will accelerate the buildout of the country's fiber network as the companies join forces to lay cables more cheaply in hard-to-reach rural regions, which make up around 40% of the country, according to a paper by Italy's Prime Minister's Office.

The deal's critics argue that it may do the opposite, with current projects stalling as the transaction works its way through regulatory approvals and then the companies turn to integrating operations. Some have also raised concerns about a lack of competition in the market.

"The presence of a competitive regime between TIM and Open Fiber has been good for the country and has accelerated the rollout of ultra broadband ... Italy has strongly improved its fiber network growth in recent years," said Edoardo Crivellaro, a director of Digital & ICT at Rome-based think tank AWARE.

Italy lags many European countries in both fiber network availability and utilization. About 47.7% of Italian homes have access to fiber connections, putting Italy in the bottom half of countries tracked by FTTH Council Europe, an industry trade group dedicated to promoting fiber rollouts in Europe.

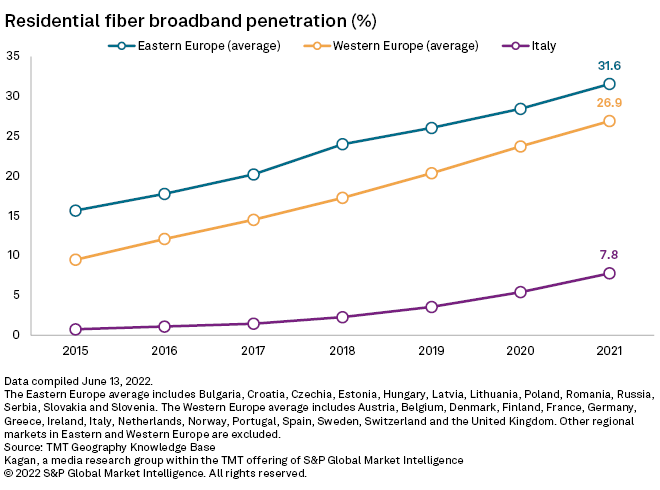

Overall, only 7.8% of Italian households are connected to fiber, compared to an average of 26.9% in Western Europe more broadly, according to data from S&P Global Market Intelligence.

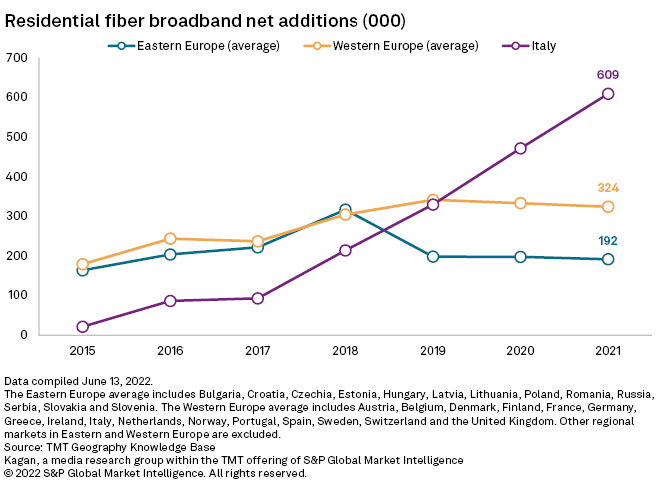

The number of Italian homes connected to fiber has grown sharply in recent years, however. About 609,000 homes were connected during 2021, up from 21,000 in 2015. Annual connections in Eastern and Western Europe started higher in 2015 but grew at a slower pace, with 192,000 and 324,000 households, respectively, added during 2021.

Even so, to reach the Western Europe average by 2025, Italy would need to add at least 1 million homes per year. Spain, a leader in fiber rollout, connected between 1.3 million and 1.7 million homes per year between 2015 and 2020, according to data from Market Intelligence.

Massimo Comito, an independent telecom adviser and former Telecom Italia executive, said it makes sense to have joint efforts in the hard-to-reach areas of the country, also called white areas, but infrastructure competition would benefit customers in urban and suburban regions where fiber network builds are less costly for companies. Open Fiber and FiberCop agreed in mid-May to collaborate in white areas.

"Where there are small regional or local telcos that know their territory very well and often coordinate the work of multiple competitors of national size, really effective FTTH coverage has been achieved," Comito said, pointing to examples in Portugal, Spain and the Piedmont region of Italy.

The proposed merger still faces potentially tough negotiations. "I think the main difficulties of this merger are the perimeter of the new company, its governance, and the valuation of the assets that will be brought into it," Crivellaro said.

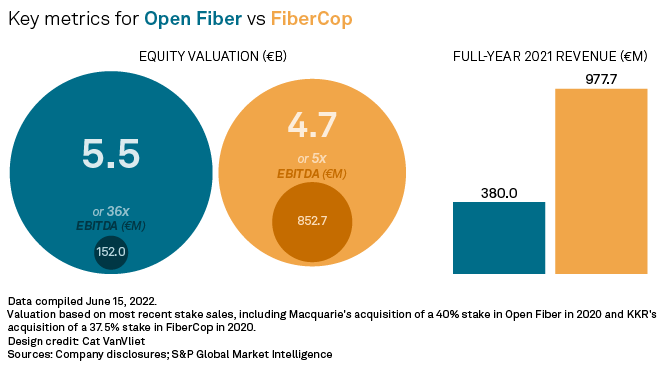

Open Fiber is valued at a higher multiple than FiberCop, based on prices paid by private equity firms for stakes of each in 2020. FiberCop brings in more than twice as much revenue as Open Fiber, though Open Fiber's income has been growing more rapidly. It remains unclear if Telecom Italia will contribute only FiberCop to the merger or its entire fixed-line network.

Vivendi SE, Telecom Italia's largest shareholder, indicated that it would not accept a proposed valuation for the fixed-line network at between €17 billion and €20 billion, arguing it could push for alternatives instead.