Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Jun, 2022

Smaller Indonesian banks will likely turn to foreign investors for fresh funding to meet the country's new capital requirements, analysts said.

Under new requirements introduced in 2020, commercial banks will lose their licenses to provide current account services, foreign exchange activities and insurance if they do not have at least 3 trillion rupiah of Tier 1 capital by the end of 2022. If banks fail to meet this threshold, they face being classified as a rural bank, and as such, their customer base will be limited to a specific province and they will not be allowed to issue credit cards.

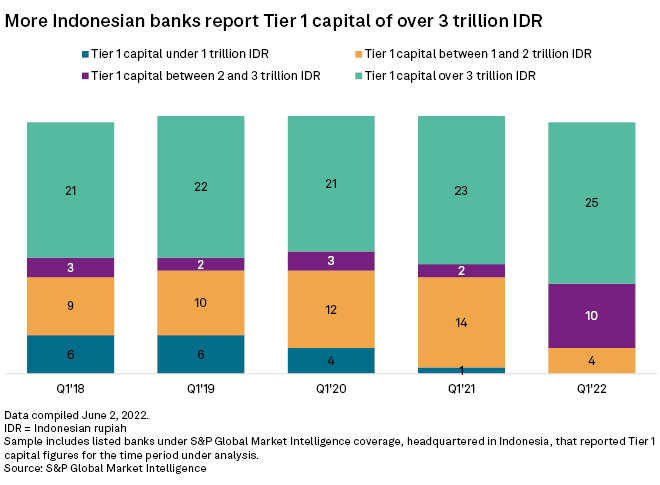

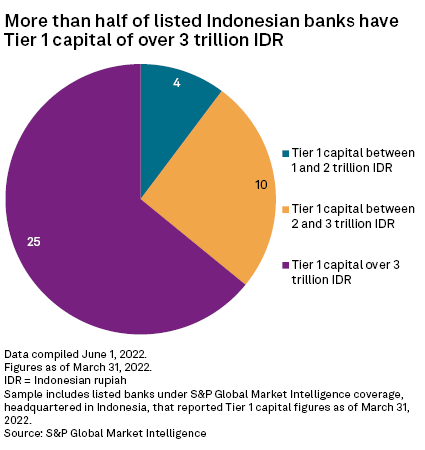

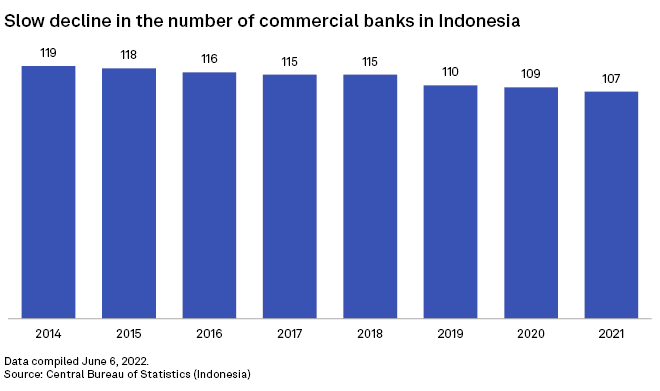

As of March 31, 14 of 39 listed banks in Indonesia had yet to meet that minimum requirement, according to S&P Global Market Intelligence data. Among all 107 banks in the country, 30 of them did not meet the new capital requirement as of the end of the first quarter.

"The smaller Indonesian banks will likely have to seek foreign investments or merge amongst themselves to meet the 3 trillion rupiah of capital requirements," said Ivan Tan, a banking analyst at S&P Global Ratings. "We believe that foreign investors will be drawn to Indonesia. It is one of the largest unbanked populations in the world and offers good growth prospects and high margins."

Indonesia is one of the top destinations in Southeast Asia among overseas lenders due to the archipelago's relatively high net interest margins and unbanked population. Banks from Japan, Singapore, South Korea and Thailand have been among the most active foreign investors in Indonesia in recent years.

Indonesia's Financial Services Authority, or OJK, in March 2020 announced the requirement to have Tier 1 capital level of 3 trillion rupiah, or roughly $207 million, by the end of 2022. The rule was applied in stages: banks needed to have Tier 1 capital of 1 trillion rupiah by the end of 2020, 2 trillion rupiah by the end of 2021 and 3 trillion rupiah by the end of 2022.

Foreign interest

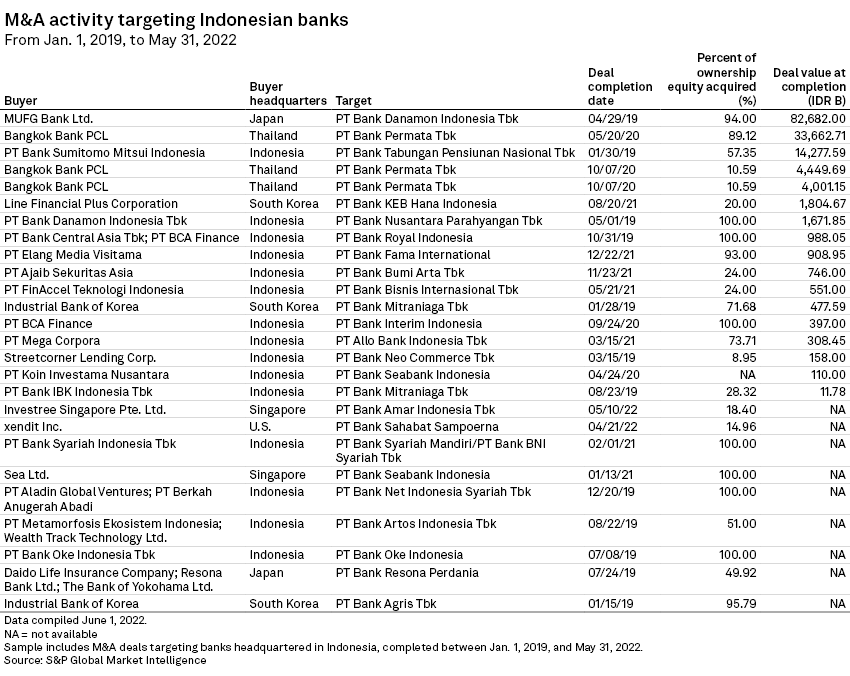

The new capital rule has prompted more banks to increase their capital via mergers or fundraising on their own. Fourteen M&A deals have been completed since the new rule was announced, in which five non-Indonesian investors were involved.

In 2020, Bangkok Bank PCL completed its acquisition of PT Bank Permata Tbk, while South Korea's Line Financial Plus Corp. acquired a 20% stake in PT Bank KEB Hana Indonesia in 2021.

Some banks might also have to give up a majority of their ownership to a foreign investor to meet the capital requirements.

"Just look at the case of PT Bank Maspion Indonesia Tbk. It had to resort to selling 67.5% of its stake to Kasikornbank PCL, a Thai bank, recently," said Harry Su, head of equity capital markets at Samuel Sekuritas Indonesia, referring to a transaction announced May 30.

In some cases, banks have been acquired by foreign tech companies to compete on the digital banking front. In 2021, Singapore-based tech company Sea Ltd. acquired Bank Kesejahteraan Ekonomi, now PT Bank Seabank Indonesia, to enter the digital banking market. Hong Kong-based digital bank WeLab Bank Ltd. made a similar acquisition of PT Bank Jasa Jakarta with similar ambitions. Both of them will compete with PT GoTo Gojek Tokopedia Tbk-backed PT Bank Jago Tbk.

The median net interest margin for lenders in Indonesia was about 5.40% in 2021, the highest in the Asia-Pacific region, according to S&P Capital IQ Pro. Banks in Asia-Pacific operated at a median net interest margin of around 3.57% in 2021.

Possible downgrade

To avoid the loss of their conventional banking license and being reclassified as a rural bank, smaller banks that have less than 1 trillion rupiah in capital by the end of 2022 can group together to reach the 3 trillion rupiah requirement to obtain a conventional banking license, analysts said.

Such a move would enable smaller banks to operate as a "banking business group" to carry out activities that require a conventional banking license. Should they wish to increase their operational business scale, they will need to go through a formal merger. The parent company and controlling shareholder within the group needs to have 1 trillion rupiah in capital, according to the OJK.

This structure will enable the smaller lenders to "operate under another bank with a stronger and healthier balance sheet as the controlling shareholder, while allowing them to have just 1 trillion rupiah of capital," said Rahmi Marina, a bank analyst at Maybank Sekuritas.

After the period for new bank capitalization is complete, the OJK will move classify banks according to a new tiering system based on higher core capital requirements, Su said.

The highest category will have a core capital cutoff of 70 trillion rupiah, up from 30 trillion rupiah previously, according to the OJK. The lowest category will be for banks under 6 trillion rupiah in core capital, up from the previous 3 trillion rupiah.

As of June 6, US$1 was equivalent to 14,433 Indonesian rupiah.