Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 May, 2022

By Joyce Guevarra and Karl Angelo Vidal

S&P Global Market Intelligence offers our top picks of real estate news stories published throughout the week.

U.S. hotel revenue per available room in March and April surpassed comparable levels in 2019 and is expected to increase 28.1% in 2022, or roughly 106% of pre-pandemic levels on a nominal-dollar basis, as the average daily room rate strengthens, according to PwC's latest forecast for the U.S. hospitality industry.

ADR exceeded comparable 2019 levels in every month of the third and fourth quarters of 2021, as well as in February, March and April of 2022 and is projected to rise 16.9% this year, according to the report.

The outlook for occupancy is likewise looking up. PwC estimates annual occupancy for U.S. hotels to increase to 63.1%, with a boost from rising demand for leisure travel, individual business travel and group business.

A macro sell-off in recent weeks impacted lodging industry players, but this negative sentiment could be offset by a strong recovery in fundamentals throughout the group, Stifel analyst Simon Yarmak wrote in a May 23 note. Management teams expect business travel to "meaningfully increase" throughout the remainder of 2022 given the pent-up demand, Yarmak added. Additionally, most companies see group travel pace approaching 2019 levels as the bulk of group cancellations at the start of the year due to the omicron variant have been rebooked for later in 2022 at higher rates, Yarmak said in the research note.

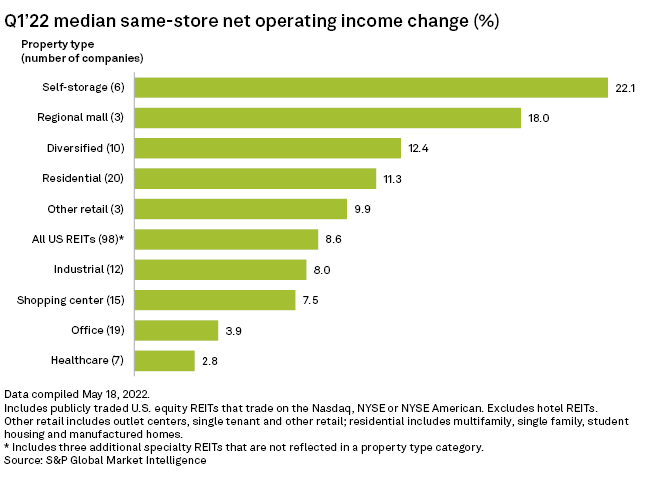

CHART OF THE WEEK: Same-store NOI picks up for US REITs in Q1

⮞

⮞

⮞

Investments

* Legal & General Capital formed a 50/50 partnership with real estate developer Ancora Partners LLC to invest in life sciences, research and technology real estate properties across the U.S. Legal & General will invest $500 million in seed capital for the new company, called Ancora L&G LLC, which aims to put $4 billion to work on acquisitions and developments over the next five years.

* National Real Estate Advisors LLC is investing $775 million in the residential component of the HYM Investment Group's Suffolk Downs redevelopment in Boston, the Boston Business Journal reported.

Property trade

* Service Properties Trust sold 42 Sonesta-branded hotels totaling 6,348 keys for an aggregate $397.6 million. The hotel real estate investment trust also agreed to sell an additional 22 hotels with 1,781 keys for a combined $141.0 million. The transactions are part of its plan to sell 68 noncore hotels.

* Nuveen Real Estate sold the 24-story 475 Fifth Avenue office building in Manhattan, N.Y., to a partnership between RFR Holding and magazine publisher Penske Media Corp. for $290 million, The Real Deal reported.

M&A

* An Almanac Realty Investors LLC-managed fund agreed to buy a passive minority stake in Waterton Investment Adviser LLC, which focuses on multifamily, senior living and hospitality properties across the U.S.

* DR Horton Inc. completed its cash tender offer of $15.75 per share in cash for Vidler Water Resources Inc. The homebuilder secured 14,229,878 common shares of Vidler, representing about 77.8% of its outstanding shares.

Data Dispatch: J.P. Morgan books $48.1M advisory fee as REIT M&A rebound continues

Data Dispatch: J.P. Morgan books $48.1M advisory fee as REIT M&A rebound continues

REIT Replay: REIT share prices continue to fall during week ended May 20