Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 May, 2022

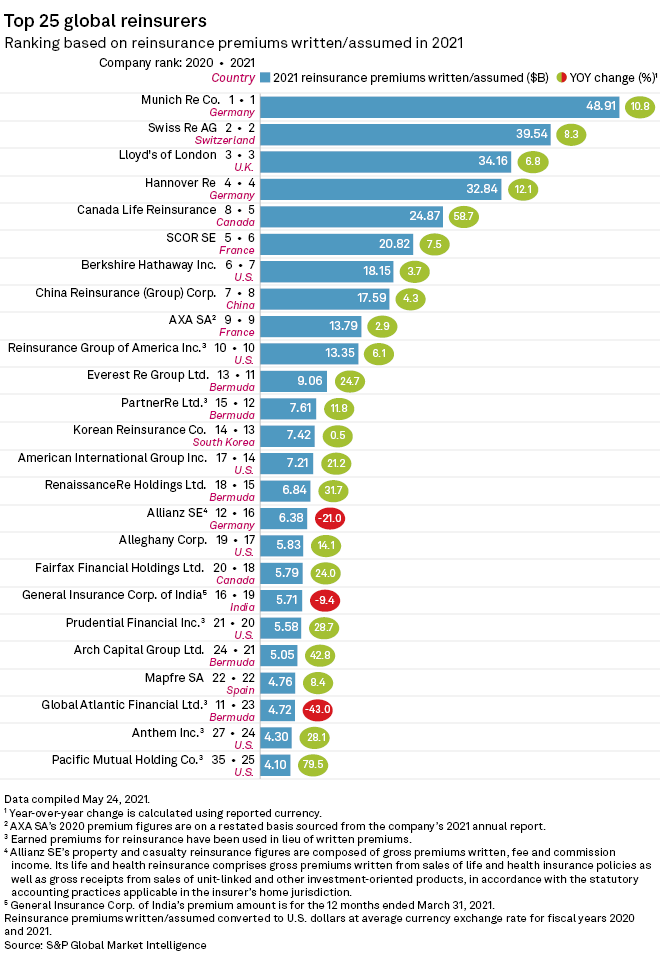

The list of the top 10 biggest global reinsurers remained mostly unchanged in 2021, with Munich Re staying on top after posting double-digit premium growth.

Scor falls out of top 5

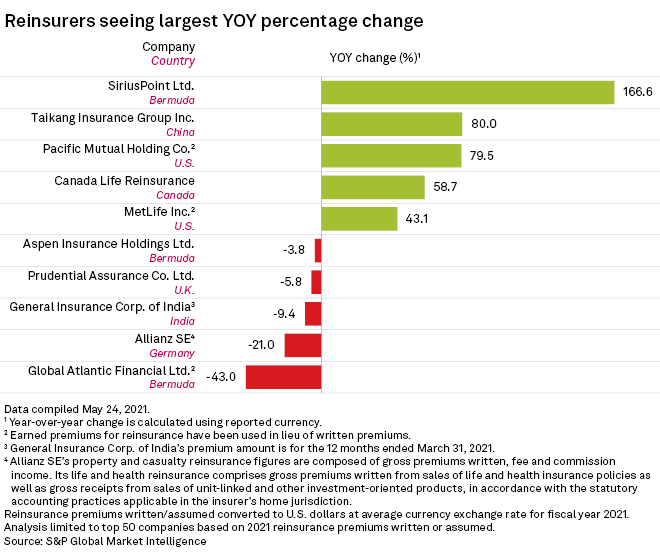

Great-West Lifeco Inc.'s Canada Life Reinsurance climbed three places to take the No. 5 position from Scor SE after logging a year-over-year increase in assumed premiums written of 58.7% to $24.87 billion. Great-West Lifeco's capital and risk solutions segment, which includes the reinsurance business, entered new reinsurance markets in Japan and Israel in 2021.

Scor dropped out of the top five to 6th place despite a modest increase in premiums written at 7.5% to $20.82 billion. The French reinsurer saw strong growth in its property and casualty reinsurance segment and slightly improved results from its life and health segment in 2021. However, it racked up significant catastrophe claims and COVID-19 losses throughout the year.

For 2022, Scor expects COVID-19-related impacts to diminish as the vaccine rollout has expanded globally and mortality is expected to somewhat decrease. The company is also closely looking at the effects of climate change as it watches its own natural catastrophe claims.

Munich Re keeps crown

Munich Re held on to its position as the largest reinsurer in the world after logging 10.8% year-over-year growth in premiums written. The German reinsurer remains optimistic about the market environment after its reinsurance business met its profit target of €2.3 billion in 2021 despite several natural catastrophes and significant COVID-19-related losses in life and health reinsurance.

Swiss Re AG followed closely behind Munich Re with an 8.3% increase in premiums written in 2021.

China Reinsurance (Group) Corp. was the only Asia-based reinsurer in the top 10. The Chinese reinsurer recorded premiums written of $17.59 billion, up 4.3% year over year.

The most significant drop in rankings was private-equity backed Global Atlantic Financial Ltd.'s fall to 23rd place in 2021 from 11th place the year before as assumed premiums earned declined 43% year over year. The entirety of the KKR & Co. Inc. subsidiary's premiums written in 2021 came from a reinsurance transaction with Axa SA's China-focused units, Axa China Region Insurance Co. Ltd. and Axa China Region Insurance Co. (Bermuda) Ltd.