Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Apr, 2022

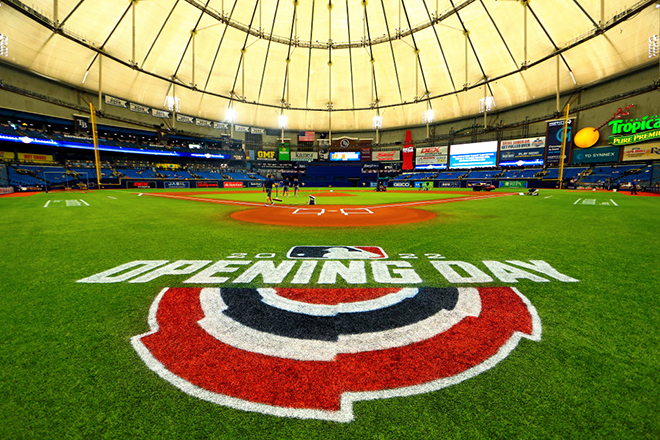

| The Opening Day game between the Tampa Bay Rays and the Baltimore Orioles at Tropicana Field. Source: Mike Ehrmann / Getty Images Sport via Getty Images) |

The largest U.S. regional sports network owner has yet to launch Major League Baseball games on streaming platforms, meaning many fans may miss out on streaming options until mid-season or later.

Sinclair has said it would soft-launch in-market streaming options for five MLB teams this year. At this point, that may not occur before summer, well after baseball season's April start. Such a delay could weigh on the success of Sinclair's MLB streaming launch this year, as fans must decide whether to switch viewing platforms or formats mid-season.

Analysts attribute part of the delay to a protracted negotiation process leading to Sinclair Broadcast Group Inc.'s recently signed renewal deal with Charter Communications Inc., the largest pay TV distributor in several key markets for the broadcaster's regional sports networks.

Sinclair declined to disclose its planned starting dates for in-market streaming services, but several analysts who spoke to S&P Global Market Intelligence expect a soft launch sometime between June and September. The MLB season this year started April 7.

Analysts believe Sinclair aims to use the Charter agreement to set a precedent regarding carriage of its recently expanded RSN portfolio ahead of future negotiations with other pay TV distributors, including DIRECTV and Comcast Corp.

"If the Charter deal does allow for in-market streaming, we might get to see that in June," said Lee Berke, principal of consultancy LHB Sports Entertainment & Media Inc.

Although Sinclair has never officially identified the five MLB teams for which it holds in-market streaming rights, those teams are widely believed to be the Milwaukee Brewers, Tampa Bay Rays, Kansas City Royals, Miami Marlins and Detroit Tigers.

Charter is the top distributor in Milwaukee, Kansas City and Tampa Bay, according to data from Kagan, a media research group within S&P Global Market Intelligence. That made reaching a carriage accord with Charter that included Sinclair's RSNs critical to ensuring their success, said Kagan analyst Daniel Alkon, who envisions Sinclair's streaming rollout occurring in July.

To read more about other companies' live sports streaming strategies, click here: Fox Sports remains in streaming sidelines ... for now

Sinclair scenarios

In the most bullish scenario from a recent filing, Sinclair's Diamond Sports subsidiary said that if the planned services launched in April, it could count as many as 975,000 streaming subscribers by the close of 2022, generating $237 million in streaming revenue. Those customer bases could grow to 2.98 million and generate $635 million in streaming revenues the following year, according to the filing.

Although it is unlikely to approach those 2022 projections at this juncture, Sinclair is contractually obligated to launch a service by September as a provision of a series of deals with the NBA allowing for in-market streaming of 16 professional basketball teams. Sinclair is also expected to offer in-market streaming for professional hockey: It has streaming rights to a dozen NHL clubs for the circuit's 2022-23 season.

The NBA could look to cut out the middle man and launch its own in-market streaming services if Sinclair does not meet certain obligations, Alkon said. Reports indicate that the MLB may also be interested in rolling out its own in-market streaming product in 2023 in addition to its out-of-market package, MLB.tv.

Alkon expects Sinclair's in-market offerings to cost about $20 to $23 per month. Looking at other sports streaming packages, a basic subscription to Walt Disney Co.'s ESPN+ costs $6.99 a month. Meanwhile, an out-of-market MLB.tv package for all teams costs $139.99 for the season, or $24.99 per month.

The Sinclair streaming services are likely to attract price-sensitive cord-cutters and die-hard sports fans unwilling to subscribe to broader video packages, Alkon said.

RSN streaming scorecard

While Sinclair's plans remain uncertain, Amazon Prime Video is leading the MLB streaming scorecard by offering free streaming of New York Yankees games to its subscribers who reside within YES Network's market beginning April 22. YES, in which Sinclair holds a 20% stake, also was part of the broadcaster's carriage renewal with Charter.

Amazon holds a 15% stake in YES. In 2021, the company simul-streamed some contests that aired on broadcaster WPIX.

Offering the Yankees games

Pires thinks the MLB may choose to partner with Amazon on other broadcast packages or small groups of games in other regional markets, depending on the success of the Yankees offering.

Other New York-area sports franchises are also likely to hit streaming platforms soon. Executives at MSG Networks Inc., the RSN home of the NBA's New York Knicks and the NHL's New York Rangers and Islanders and New Jersey Devils, indicated on the company's most recent earnings call that plans are underway to launch a direct-to-consumer offering by year-end. The company has been embroiled in a carriage dispute with Comcast that has kept MSG and MSG2 off the cable operator's systems in the networks' New Jersey footprint since September.

Meanwhile, Comcast's NBCU has yet to declare its streaming plan for its six-owned RSNs. On Jan. 31, the company in a release indicated a launch would come late in 2022. It backtracked from that position the following day, however, stating that the personnel announcement inadvertently included a reference to the DTC plans and was misleading.

"We're going to know a lot more in the next four to six months," said Alkon, adding the other RSN owners are likely waiting to see how Sinclair's initial in-market streaming efforts turn out.