Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Feb, 2022

By Brian Scheid and Annie Sabater

Short sellers have boosted their bets against consumer discretionary stocks in response to lingering supply chain issues, inflation and plunging consumer confidence.

The latest data from S&P Global Market Intelligence shows that short sellers believe consumer spending could struggle as the economy attempts to emerge from a nearly two-year pandemic.

Climbing shorts

Short interest in consumer discretionary stocks climbed to 4.62% as of mid-January, up 85 basis points from its most recent low at the end of October 2021, according to the data.

Most shorted sector

Short selling, in which investors bet on a stock's fall by selling borrowed shares in hopes of buying them later at a lower price, had been in decline throughout 2021 in nearly every sector in the U.S. stock market.

The consumer discretionary sector, however, remained the most shorted sector throughout much of the year, as short sellers believed pandemic-wary consumers were likely to rein in spending. Consumer discretionary businesses sell goods and services viewed as nonessential, such as apparel, vehicles and restaurants. Short interest in consumer discretionary stocks was more than twice the average for stocks on the S&P 500.

Top shorted stocks

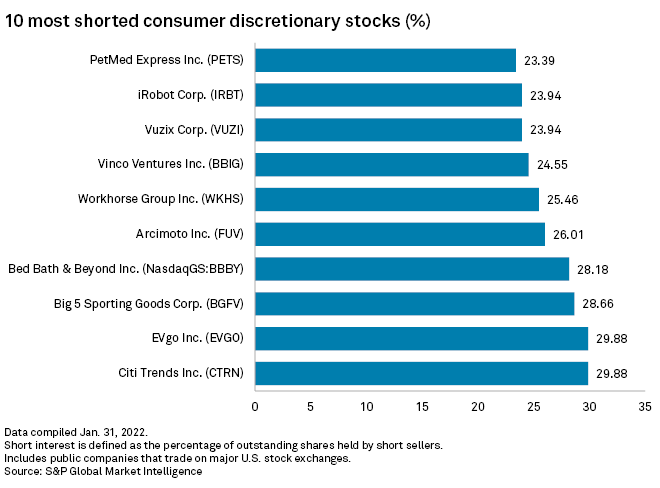

Nine of the most shorted stocks on major U.S. stock exchanges were consumer discretionary stocks. Three of the S&P 500's largest stocks by market cap had short interest well below the S&P 500 average of 2.08% in mid-January. Amazon.com Inc. saw short interest of 0.7%; this value was 0.8% for The Home Depot Inc. and 0.7% for McDonald's Corp. Tesla Inc., the large-cap index's second-largest stock, saw short interest of 2.2%.

Index underperformance

The consumer discretionary sector has underperformed the S&P 500 during the past year, climbing 6.8% over this time frame compared with the large-cap index's gain of 18.8%. In 2022, the sector has fallen 9.1%, compared to a 4.6% drop for the S&P 500.

The increase in short selling in the consumer discretionary sector hit as inflation spiked. In December 2021, inflation reached its highest annual gain since 1982, and the University of Michigan's Index of Consumer Sentiment fell to its lowest point since November 2011.