Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

3 Feb, 2022

By RJ Dumaual

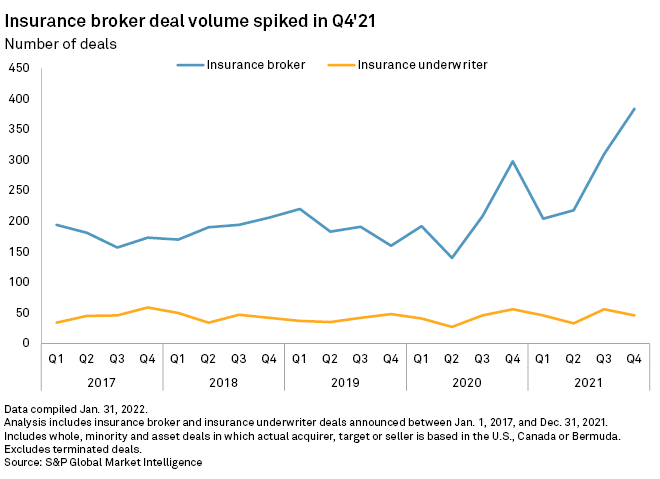

Transaction activity involving insurance brokers surged year over year in the fourth quarter of 2021, while underwriters saw a drop in volume but an increase in aggregate transaction value, according to an S&P Global Market Intelligence analysis.

Broker deal activity jumps

There were a total of 384 insurance broker deals with a combined transaction value of about $2.53 billion announced during the period, compared to 298 with a combined value of $2.16 billion a year ago, the analysis found.

Brown & Brown Inc. completed eight acquisitions with annual revenues of approximately $67 million in the fourth quarter of 2021, and 19 acquisitions with approximately $132 million of annualized revenue for the year, President and CEO J. Powell Brown said during the broker's latest earnings call.

The CEO expects competition and valuations to remain at peak levels in the M&A market until interest rates increase materially and capital becomes constrained.

Arthur J. Gallagher & Co. has the capacity to do $4 billion of M&A without using any stock over the next couple of years, CFO Douglas Howell said. The broker closed the acquisition of the treaty reinsurance brokerage operations of Willis Re Inc. in December 2021.

Underwriter M&A slows, deal values up

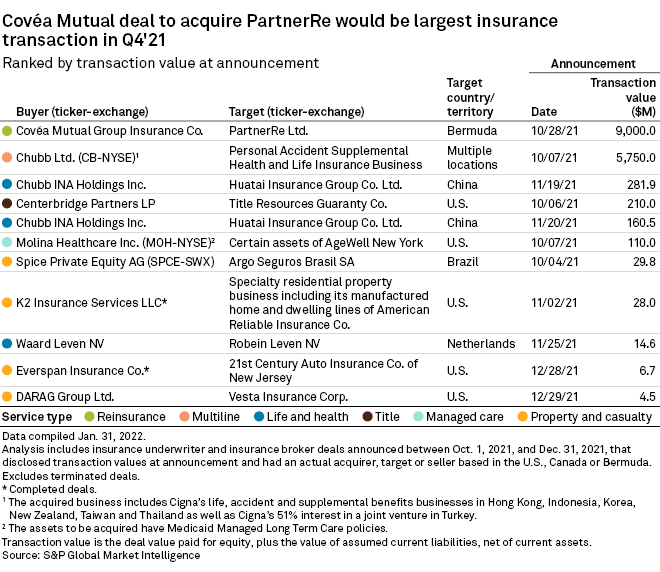

There were 46 transactions involving underwriters announced with an aggregate value of $15.60 billion in the fourth quarter of 2021, versus 56 with a combined value of $10.75 billion in the fourth quarter of 2020.

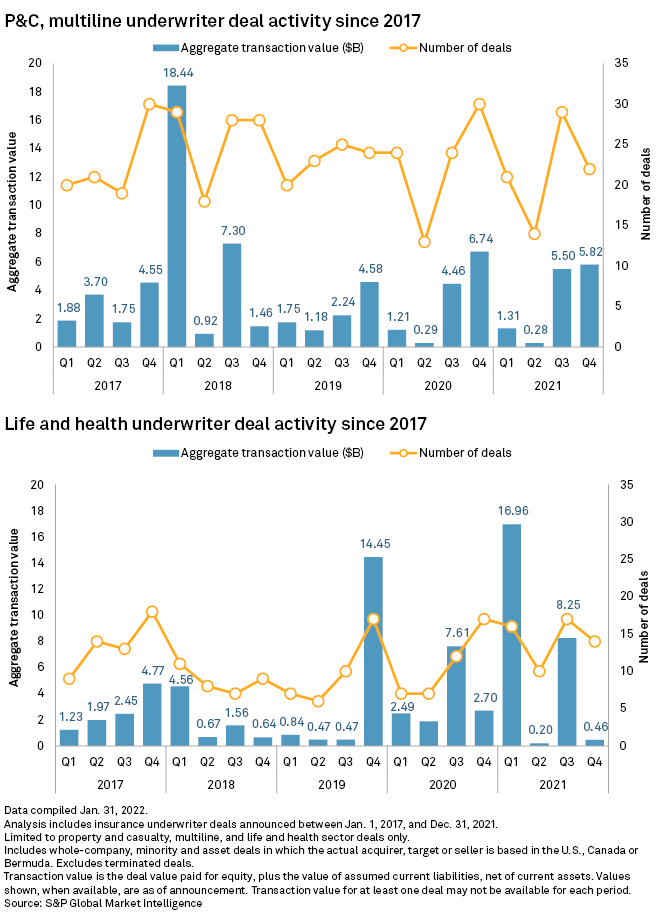

Transaction volume in the property and casualty and multiline sectors was down year over year in the last quarter of 2021 to 22 deals from 30 in the prior-year period, and the combined value slid to $5.82 billion from $6.74 billion in the prior year.

Managed care chipped in three transactions in the quarter, versus six a year earlier.

The life and health space logged 14 transactions, down from 17 in the fourth quarter of 2020, and the combined value fell to $460 million from $2.70 billion.

Weighty deals involving Chubb, PartnerRe

One of the biggest deals announced during the period was Chubb Ltd.'s acquisition of life and nonlife insurance companies that house the personal accident, supplemental health and life insurance business of Cigna Corp. across six markets in Asia-Pacific and in Turkey for $5.75 billion in cash.

Piper Sandler analyst Paul Newsome sees the transaction as part of a general expected increase in M&A as increased profits from the hard market are deployed into deals.