Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Nov, 2022

By Alex Graf and Gaby Villaluz

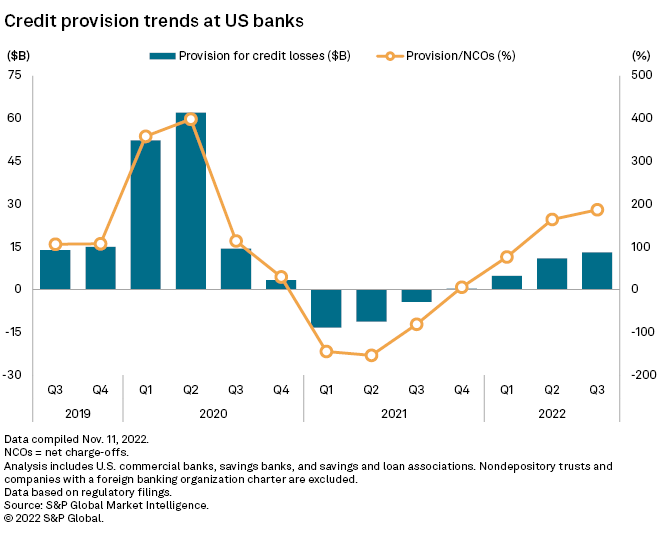

Provisions for expected credit losses at U.S. banks have risen for the sixth consecutive quarter.

The industry recorded total positive provisions of $13.05 billion in the third quarter, up from positive provisions of $10.95 billion a quarter earlier, according to S&P Global Market Intelligence data. The upward trend began in the second quarter of 2021 and has persisted as inflation, rising interest rates, geopolitical turmoil and the growing prospect of a recession have increased economic uncertainty.

* Download a template to compare a bank's financials to industry aggregate totals.

* View U.S. industry data for commercial banks, savings banks and savings and loan associations.

* Download a template to calculate deposit and loan beta and growth rates.

Mixed provisioning trend

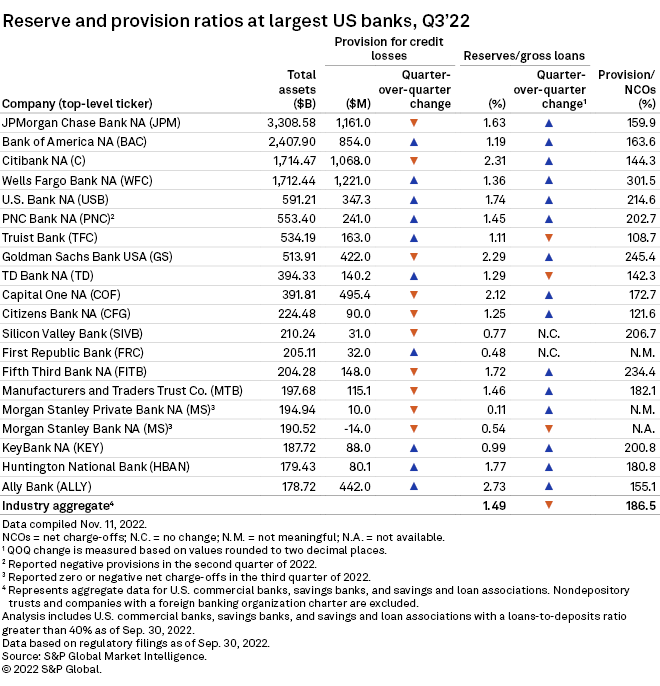

Provision for credit loss trends among the top 20 largest U.S. banks were a mixed bag in the third quarter with half reporting quarter-over-quarter increases and the other half reporting sequential declines.

JPMorgan Chase & Co., the largest U.S. bank based on total assets as of Sept. 30, reported a third-quarter provision of $1.16 billion, down more than 5% from $1.23 billion in the linked quarter. However, the company's ratio of reserves as a percentage of gross loans increased quarter over quarter.

If economic conditions sour, or the bank believes the chances of adverse events are on the rise, the bank's reserves will probably rise, Chairman and CEO Jamie Dimon said on the company's most recent quarterly earnings call.

Dimon estimated that if U.S. unemployment were to rise to 5% or 6% during a recession, the bank could increase reserves by $5 billion or $6 billion over the course of a couple of quarters.

"Easy to handle, not a big deal," Dimon said. "It just does affect capital a little bit."

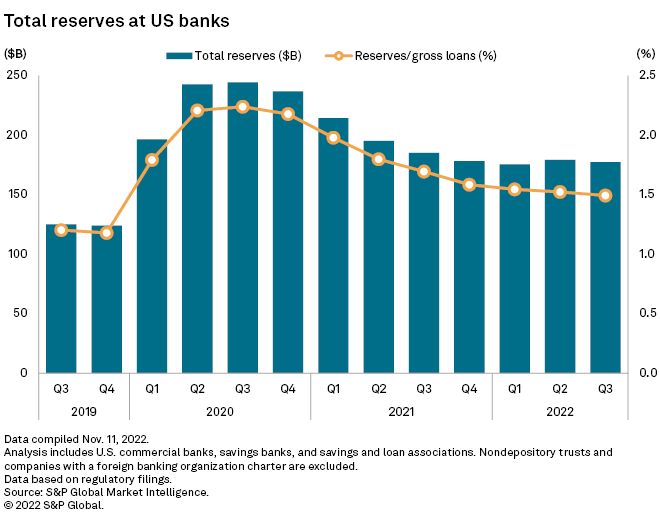

Total reserves inch down

Fifteen of the 20 largest banks in the U.S. reported quarter-over-quarter increases to their reserves as a percentage of gross loans at Sept. 30, while three reported decreases and two reported no change.

Total reserves at U.S. banks fell slightly in the period, following a small rise in the second quarter that broke the long-term trend of declines dating back to the end of 2020. The industry booked $177.39 billion in total reserves in the third quarter, down from $179.20 billion in the linked quarter. Reserves as a percentage of total gross loans declined slightly to 1.49% from 1.52%.