Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Nov, 2022

By David Hayes and Zuhaib Gull

McLean, Va.-based FJ Capital Management LLC reduced its total common stock exposure by 17.5% in the third quarter to $827.9 million, as the firm continued selling positions, and the overall market dropped, according to the firm's most recent Form 13F filing.

FJ Capital was formed in 2007 by Martin Friedman and Andrew Jose and primarily focuses on "underfollowed" community banks.

This article is part of a series on large institutional investors active in the U.S. financial sector. All institutional investment managers active in the U.S. with over $100 million in investments in Form 13F securities must file quarterly statements detailing their positions.

Top holdings, put exposure trimmed

FJ cut its exposure to four of its former top five holdings in the third quarter. The hedge fund manager's position in Eastern Bankshares Inc. increased to $36.7 million as of Sept. 30, up from $35.8 million at the end of June, making the Boston-based bank its single-largest position, up from No. 4 a quarter earlier. Dallas-based Veritex Holdings Inc. fell to the No. 2 spot after FJ lowered its share position by almost 23% in the third quarter and Veritex's share price dropped 9.1%.

By comparison, the S&P U.S. BMI Banks index posted a negative 2.4% return in the third quarter and the S&P 500 dropped 4.9%, according to S&P Global Market Intelligence data.

Meanwhile, Oak Ridge, N.J.-based Lakeland Bancorp Inc. and Beaumont, Texas-based CBTX Inc. both fell completely out of FJ's top 20 after the fund manager trimmed its position in each bank by about 72% in the third quarter.

On Sept. 27, Lakeland announced that it would be acquired by Jersey City, N.J.-based Provident Financial Services Inc. for approximately $1.3 billion, while CBTX's merger of equals with Allegiance Bancshares Inc. closed Sept. 30, forming the new company, Stellar Bancorp Inc.

FJ did not report a position in Provident Financial Services or Allegiance Bancshares at the end of September.

|

* |

The hedge fund manager maintained a put position on the SPDR S&P Regional Banking ETF during the third quarter, however, the notional value of its position fell about $30 million to $8.3 million as of September. The shares underlying the put position fell by over half to 34,000 from 87,000 at the end of June.

First Bancshares vaults into top 5

FJ drastically increased its stake in Hattiesburg, Miss.-based First Bancshares Inc. to $32.6 million as of Sept. 30, up from just $3.7 million at June 30. The bank has had a very active 2022, announcing two whole-bank transactions.

First Bancshares' acquisition of Fort Walton Beach, Fla.-based Beach Bancorp Inc. closed Aug. 1, less than four months after it was first announced. Once its acquisition of Jonesboro, Ga.-based Heritage Southeast Bancorporation Inc. closes, First Bancshares will likely have over $8 billion in assets, up from $6.08 billion at the end of 2021.

Exits

During the third quarter, FJ Capital fully exited 18 positions that were worth a combined $101.8 million as of June 30. The fund manager's largest exit was a $28.7 million stake in Rosemont, Ill.-based Wintrust Financial Corp., which had been its 11th-largest common stock position overall at the end of June.

FJ also sold out of a $15.6 million investment in Phoenix-based Western Alliance Bancorp. and a $14.6 million investment in New York-based Metropolitan Bank Holding Corp.

Entries

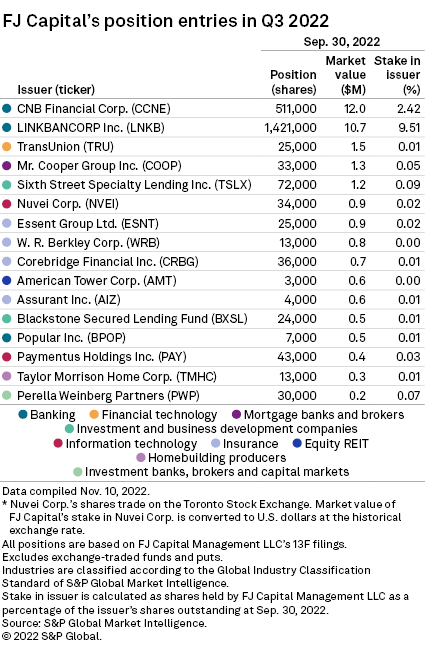

The fund manager also disclosed 16 new common stock positions worth a combined $33.2 million at the end of September. FJ's largest initiation was a $12.0 million stake in CNB Financial Corp., followed by a $10.7 million position in LINKBANCORP Inc.

Both of the Pennsylvania-based community banks completed common equity offerings in September.