Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Oct, 2022

By Brian Scheid and Annie Sabater

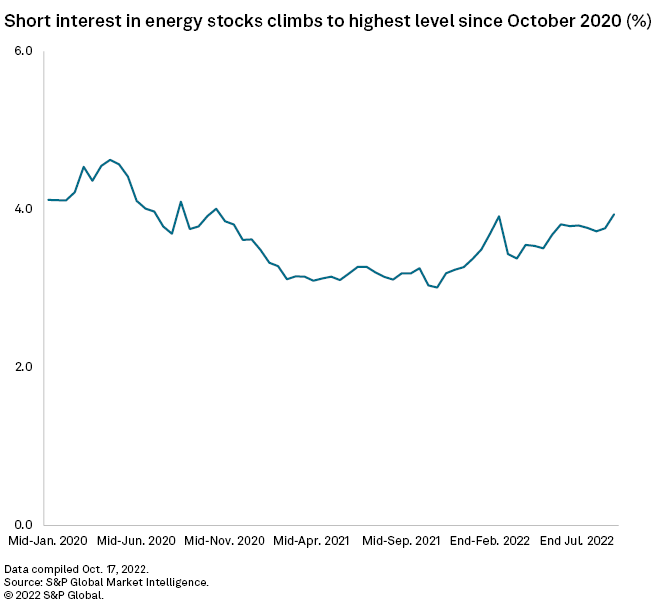

Short interest in U.S. energy stocks has climbed to the highest level in nearly two years, a sign that sellers may believe demand will be hit by soaring oil and gas prices and a potential recession.

At the end of September, short interest in the U.S. energy sector was at 3.9%, the highest level since the end of October 2020, when it was at 4%, according to the latest S&P Global Market Intelligence data.

Short interest measures the percentage of outstanding shares of a certain company held by short sellers, who make money when a stock's price falls by selling borrowed shares and buying them later at a lower price.

Overall, short interest in the S&P 500 was at 2.3% at the end of September. Short interest in the large-cap index has averaged 2.2% since the start of the year.

Energy posts only gain in 2022

The energy sector, which is the only S&P 500 sector seeing gains so far this year, was the third-most shorted sector at the end of September, behind the inflation-battered consumer discretionary sector and healthcare.

Most-shorted energy industries

In the energy sector, oil and gas refining and marketing stocks were the most shorted with short interest of 6.5%. Oil and gas drilling stocks were the second-most shorted with 6.3% short interest.

Most-shorted energy stocks

Vertex Energy Inc., a specialty refinery of alternative feedstocks, was the most shorted energy stock with short interest of 28% at the end of September. Gevo Inc., a renewable fuels company, was the second-most shorted energy stock with short interest of 21.5%.

Across all sectors

Bed Bath & Beyond Inc. was the most-shorted U.S. stock overall with short interest of 38.2% at the end of September.