Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Oct, 2022

By Zeeshan Murtaza and Dylan Thomas

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Europe's energy sector is seeing a rapid rise in private equity and venture capital investments as the continent grapples with an energy crisis stemming from Russia's invasion of Ukraine.

Investments in both traditional and renewable energy companies this year have already blown past 2021's full-year totals, S&P Global Market Intelligence data shows. Transactions involving oil, gas and coal companies added up to $5.36 billion between Jan. 1 and Sept. 26, nearly 84% higher than in all of last year. Deals involving renewable businesses over that same period totaled $5.51 billion, nearly nine times the full-year 2021 total.

Meanwhile, the throttling of Russian natural gas flows is challenging Europe's ability to meet energy demands, and concern is growing with the approach of winter and home-heating season. The continent is searching for a long-term replacement for Russian gas shipments before rising energy costs threaten its industrial sector.

European energy companies were already shifting toward renewables and away from fossil fuels before the crisis hit.

Read more about how the shift to renewables is creating buying opportunities for private equity.

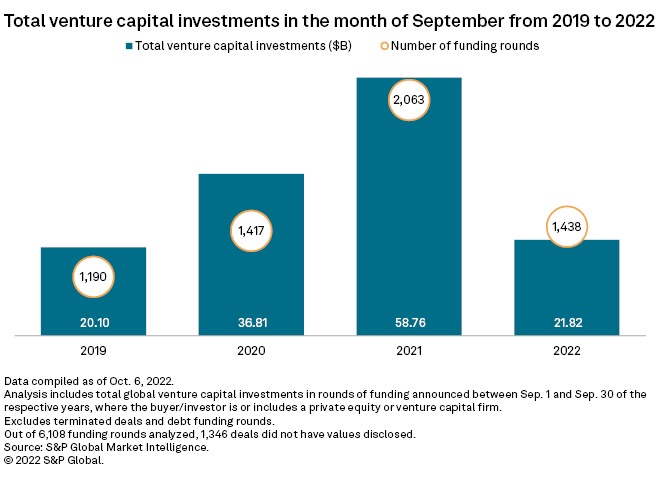

CHART OF THE WEEK: VC funding rounds down again in September

⮞ Global venture capital investment in September fell nearly 63% year over year to $21.82 billion.

⮞ Funding rounds were also down to 1,438 for the month, a greater than 30% decline from September 2021.

⮞ The largest share of the venture capital funding deployed in September went to businesses in the technology, media and telecommunications sector, which vacuumed up 44.5% of the total in September.

DEALS AND FUNDRAISING

* An investor group closed the purchase of Nielsen Holdings PLC for about $16 billion in cash, including debt. The group included Elliott Investment Management LP affiliate Evergreen Coast Capital Corp. and Brookfield Business Partners LP. The audience measurement, data and analytics company halted trading of its stock on the NYSE on Oct. 12.

* Thoma Bravo LP is buying ForgeRock Inc., a digital identity solutions company, for about $2.3 billion. The all-cash deal could close during the first half of 2023.

* Blackstone Inc. contributed $500 million to its new global life insurance and annuity consolidation business with Resolution Life Group Holdings LP. The partners intend to raise a total of $3 billion in new capital for the business.

* Hy24 closed its Clean H2 Infra Fund, which focuses on low-carbon hydrogen, with €2 billion in capital commitments. Hy24 is a joint venture between Ardian and FiveT Hydrogen.

ELSEWHERE IN THE INDUSTRY

* Actis LLP closed the sale of independent renewables developer Atlas Renewable Energy to Global Infrastructure Management LLC.

* Warburg Pincus LLC, through an affiliate of its managed private equity funds, agreed to acquire a majority interest in Vistaar Finance. WestBridge Capital Partners LLC, Elevar Equity LLC, Omidyar Network Services LLC and Saama Capital are selling their stakes in the Indian lender.

* Investment vehicles advised by Acathia Capital GmbH boosted their joint stake in Swedish life insurer Futur Pension Försäkrings to about 50% from 30%.

* TPG Capital LP and Clayton Dubilier & Rice LLC wrapped up their acquisition of animal-health technology and services company Covetrus Inc.

* Palatine Private Equity LLP, through its Impact Fund, invested in U.K.-based digital healthcare services company Redmoor Health Ltd.

* Egyptian healthcare technology company Vezeeta closed a round of funding led by Gulf Capital, with participation from VNV Global.

* Rheumatology platform Center for Rheumatology secured an investment from Veronis Suhler Stevenson, or VSS Capital Partners.