Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Jan, 2022

By Steven Baria

Citi to opt out of Mexican retail businesses

* Citigroup Inc. plans to exit the consumer, small-business and middle-market banking operations of Mexico-based Grupo Financiero Citibanamex SA de CV in line with the bank's strategy refresh efforts. The businesses Citi intends to exit accounted for about $3.5 billion in revenue, $1.2 billion in earnings before tax, $44 billion in assets and $4 billion in average allocated tangible common equity in the first three quarters of 2021.

* Some of the players reported to have interest in the Citibanamex assets include Spain's Banco Santander SA as well as Mexico's Grupo Financiero Inbursa SAB de CV, Grupo Financiero Banorte SAB de CV and retail and financial services conglomerate Grupo Elektra SAV de CV. While names of Canada's The Bank of Nova Scotia and Brazil's Itaú Unibanco Holding SA and Nu Holdings Ltd. have been floated, several reports countered that they are not interested in the deal.

* Citi's Mexican retail bank would be complementary to Santander's business in the country, but pursuing a deal may not be a good decision and could be financially challenging for the Spanish bank, according to UBS analysts.

* Citi's exit from its Mexican retail and small and medium-sized enterprises is credit negative for Citibanamex, as it "will sharply reduce the bank's operations and earnings diversification, including limiting its cheap retail funding capacity," according to Moody's. Mexico's finance ministry said it will watch the consequences of the exit closely, as it "raises delicate matters for the finance and regulatory authorities ... including a fundamental issue regarding concentration," the ministry said.

* A potential IPO for Citi's Mexican retail operations could also be in the works given the regulatory concerns that the deal entails, Bloomberg News reported, citing Itaú BBA analyst Arturo Langa.

* Mexico's President Andrés Manuel López Obrador said Citi's planned sale of Citibanamex is an opportunity for the bank to return to Mexican ownership. Mexico's Interior Minister Adán Augusto López said the government does not plan to make an offer for the transaction.

* Citi's surprise move to sell its large, profitable Mexico unit has analysts wondering whether management could take similarly bold action on its lagging U.S. retail business, according to a report from S&P Global Market Intelligence.

Strategic moves

* Brazil's Itaú will purchase 100% of digital broker Ideal Holding Financeira SA. Itaú will first buy 50.1% of Ideal through a primary capital contribution and then a secondary acquisition of shares totaling about 650 million reais. After five years, Itaú will exercise an option to buy the remaining 49.9% stake in Ideal.

* Brazilian financial technology company Ebanx SA plans to expand its Mexican presence in 2022 as it opens its first office in the country, according to CEO João del Valle. Transactions are expected to grow 105% this year.

In other news

* Renegotiated loans in Brazil have reached a historic high of 18.7 million contracts, equivalent to 1.1 trillion reais, during the pandemic, according to banking association Febraban. The agreements helped in controlling defaults in the banking system, which is at a historical low of 2.2% and below the rates recorded ahead of the pandemic, the association said.

* Banco de Crédito del Perú SA said it has developed a sustainability financing framework that sets up measures that the bank and affiliate Mibanco Banco de la Microempresa SA must observe to launch green or social instruments. The framework is in line with parent Credicorp Ltd.'s corporate sustainability strategy.

Featured this week on S&P Capital IQ Pro

* LatAm banks get stable 2022 outlook; risks abound: Latin American banks look solid moving into 2022 as economies return to pre-pandemic "normality," with rating agencies giving the sector a stable outlook despite a forecast of slower growth and higher interest rates.

* Brazil's banks to see better profitability, slower credit demand: Brazil's credit expansion will slow sharply amid a sluggish economy and rising rates, which will likely discourage loan growth but allow banks to rebuild profitability.

* LatAm bank indices end 2021 in a rut, though Mexico ekes out small gain: Latin American bank indexes tracked by S&P Global Market Intelligence were in a rout for the last quarter of 2021 as volatile global economic conditions hurt stock performance. However, the Mexican index bucked the trend in the remaining days of the year.

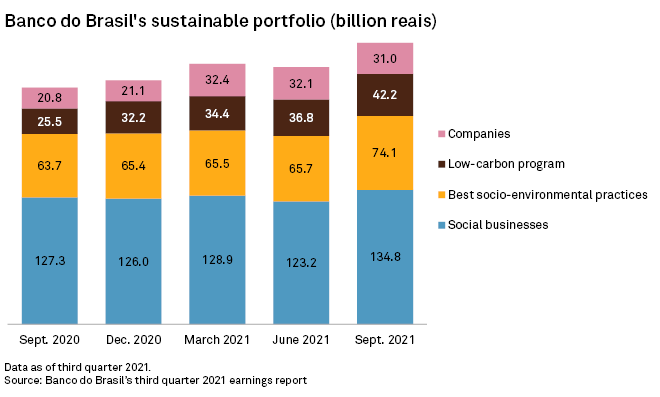

* Banco do Brasil issues 1st social bond as ESG wave seen to continue in 2022: Banco do Brasil SA's first-ever social bond issuance serves as a bellwether for Brazilian companies that would want to continue riding the environmental, social and governance wave this year.

* Fintech investments in a 'wonky' moment but will settle out: Shares of many top-notch fintechs, including Nu Holdings, also known as Nubank, have all taken a very significant hit over the last two to three months.

* Patience pays off for a veteran backer of Brazilian startups: Venture-backed companies in Latin America drew $14.8 billion in investments in 2021, as of Dec. 16, more than they received the past six years combined, according to research firm PitchBook Data Inc.