Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Jun, 2021

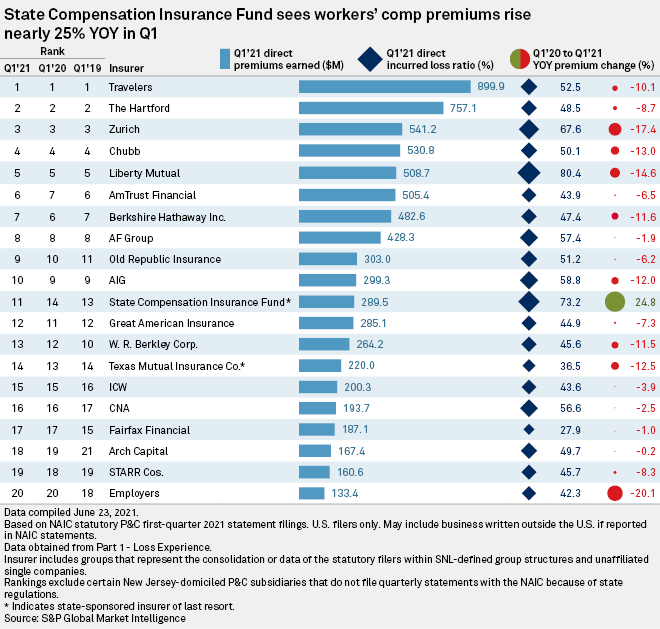

U.S. workers' compensation direct premiums earned were down 7.7% year over year to $12.01 billion in the first quarter, according to S&P Global Market Intelligence analysis.

Of the top 20 U.S. workers' compensation underwriters, only State Compensation Insurance Fund logged a year-over-year increase in direct premiums earned at 24.8% in the first quarter.

The state-backed fund's net premiums earned totaled $286 million, 25.3% higher than a year earlier, mainly due to a $45 million reduction in estimated audit premium a year ago and none this year, according to State Insurance Fund's first-quarter report.

The Travelers Cos. Inc. held on to its position as the top workers' compensation insurer in the U.S. despite a 10.1% dip in premiums earned. The company's premiums earned declined to $899.9 million from $1.00 billion on a yearly basis, while the direct incurred loss ratio decreased year over year to 52.5% from 93.8%. Lower net written premiums in Travelers' workers' compensation product line due to the impact of COVID-19 and related economic conditions on payrolls affected the company's gross and net written premiums in the first quarter, according to its Form 10-Q filing.

The Hartford Financial Services Group Inc., which retained the second-place spot in the first quarter, saw premiums earned slip 8.7% to $757.1 million. The Hartford attributed the year-over-year decline in workers' compensation premium to lower payrolls caused by the ongoing economic effects of the pandemic.

Zurich Insurance Group AG rounded out the top three with direct premiums earned of $541.2 million, down 17.4% from the same quarter last year.

The industry's loss ratio in the first quarter was 52.1%, the second-highest ratio observed since 2018 but down from 54.8% a year earlier. Fairfax Financial Holdings Ltd.'s loss ratio of 27.9% was the lowest among the top 20 insurers.