Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Apr, 2021

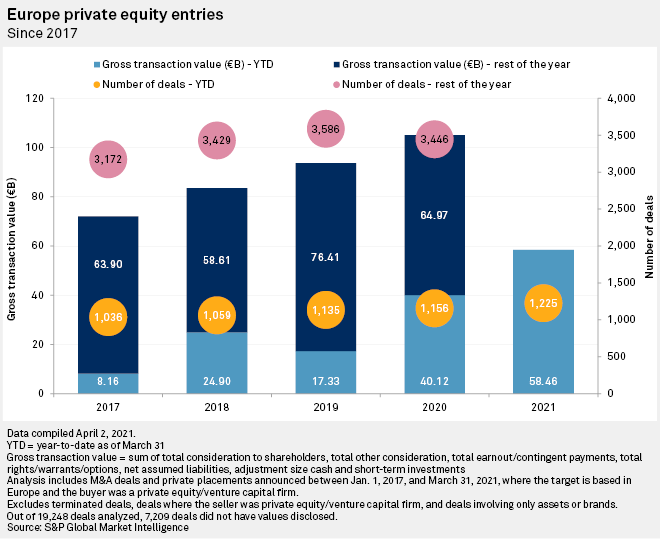

Private equity and venture capital entry deal volume in Europe climbed in the 2021 first quarter amid improving market conditions a year into the COVID-19 pandemic, data from S&P Global Market Intelligence showed.

Entry deal volume totaled 1,225 in the three months to March 31, up 6.0% from the 1,156 tallied in the same period in 2020. Gross transaction value grew 45.7% year over year to €58.46 billion, an increase from €40.12 billion.

Private equity firms returned to deal-making after central banks in Europe and the U.S. injected trillions of capital into the financial system, which in turn lowered borrowing costs and boosted investor confidence, Bain & Co. said in its Global Private Equity Report 2021.

Private equity investors have an overwhelmingly bullish outlook for the industry in 2021 owing to the high amount of available dry powder and the low interest rate environment. Just under two-thirds, 62%, of Europe-based private equity players expect deal-making conditions to improve during the year, while 32% believe investment activity will remain the same, according to S&P Global Market Intelligence's 2021 Global Private Equity Outlook.

Private equity firms in the U.K. had $184.5 billion in dry powder, or committed capital yet to be invested, while firms elsewhere in Europe had $160 billion, according to Preqin data as of April 7.

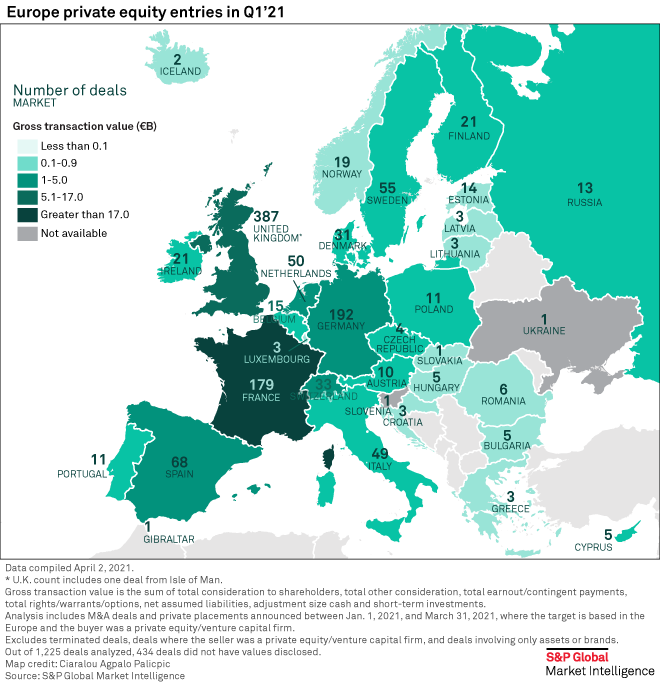

The acquisition of Suez SA by Ardian and Global Infrastructure Management LLC for a gross transaction value of €30.47 billion, and the €3.88 billion buyout of Lonza Specialty Ingredients by Cinven Ltd. and Bain Capital Private Equity LP were among the largest deals announced in the three months to March 31.

The U.K. accounted for the largest number of deals in Europe in the first quarter at 387, worth an aggregate €11.14 billion. France saw the largest combined gross transaction value at €33.01 billion across 179 deals.

Closed PE funds decline, but raised capital swells

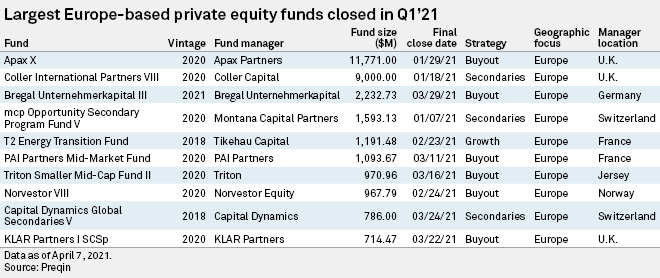

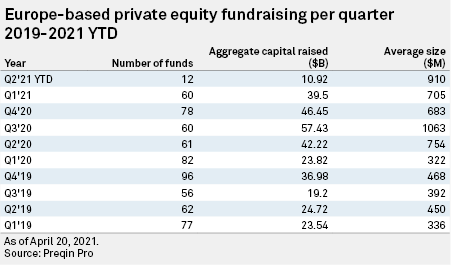

The number of private equity funds closed in the first quarter fell to 60 from 82 vehicles in the first three months of 2020, according to Preqin Pro data. Aggregate capital raised increased to $39.5 billion from $23.82 billion year over year. The average fund size swelled to $705 million from $322 million in the comparative year-ago period.

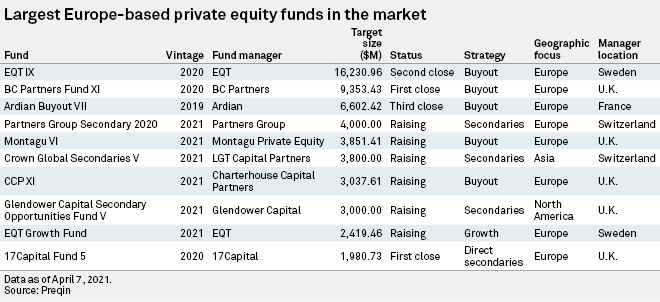

Apax Partners LLP's Apax X fund was the largest Europe-based vehicle closed in the quarter, securing $11.77 billion. With a target size of €14.75 billion, EQT Partners AB's EQT IX platform was the largest European private equity fund in the market as of April 7.