Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Mar, 2021

By Eric Oak

Adidas AG on March 10 reported fourth-quarter 2020 revenues that dipped 5.0% year over year, proving slightly better than the 6.3% decline expected by analysts, according to S&P Capital IQ figures. The company was "negatively impacted by the coronavirus," according to CEO Kasper Rorsted, though it has implemented a significant cost-cutting plan. More recently, the company may have been helped by a resurgence in U.S. retail activity, as noted in Panjiva's Feb. 17 research.

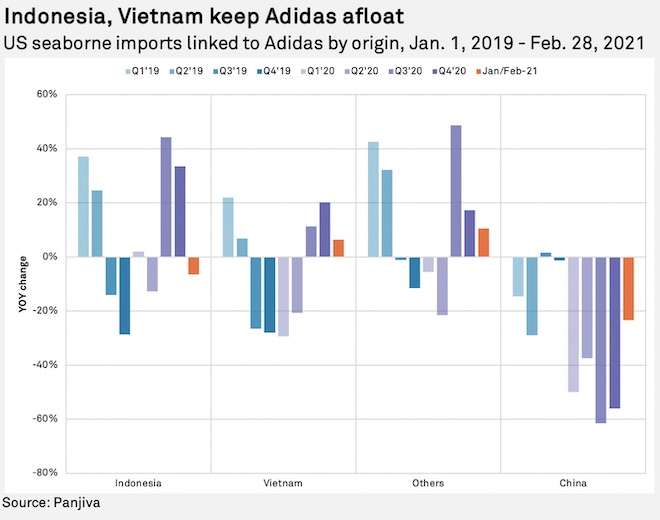

The company's supply chain activity growth has slowed. Panjiva's data shows that U.S. seaborne imports linked to the company climbed 3.0% in January and February combined after a 9.9% increase in the fourth quarter of 2020.

Adidas has also had to deal with a series of supply chain challenges. The company previously had to deal with section 301 duties on imports of certain types of shoes from China. That has led it to reduce the proportion of imports to the U.S. linked to China by 56.0% year over year in the fourth quarter of 2020 and by a further 23.3% in January and February combined.

Adidas' experience with tariffs may have taught it to respond to supply chain shocks, with Head of Global Operations Martin Shankland noting the need for "a responsive supply chain that can react to changes in demand in a controlled and agile manner." While Adidas has been able to reduce its lead times, it has struggled to become more agile as it "still follow[s] the early order timelines of wholesale," according to Shankland.

The company is also restructuring its distribution operations through a new "own the game" strategy looking to expand e-commerce activities as a result of changing consumer preferences.

Adidas' reduced exposure to China has been achieved by running up its imports from Indonesia and Vietnam, with increases of 33.5% and 20.3%, respectively, in the fourth quarter of 2020. Meanwhile, shipments from Indonesia dipped in January and February.

The next challenge for the company may lie in reducing its dependence on Myanmar, where the military coup has led to significant economic upheaval. The country provided 2.9% of Adidas' U.S. imports in 2020.

Eric Oak is a researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.