Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Feb, 2021

By Chris Rogers

Casual-footwear maker Crocs Inc. reported revenue growth of 56.5% year over year in the fourth quarter of 2020. That includes a 35.7% rise in sales in the Americas and was helped by a surge in digital sales and a product mix that leans toward homewear during the coronavirus pandemic. The company forecasts growth in the first quarter of between 40% and 50% year over year as similar trends continue.

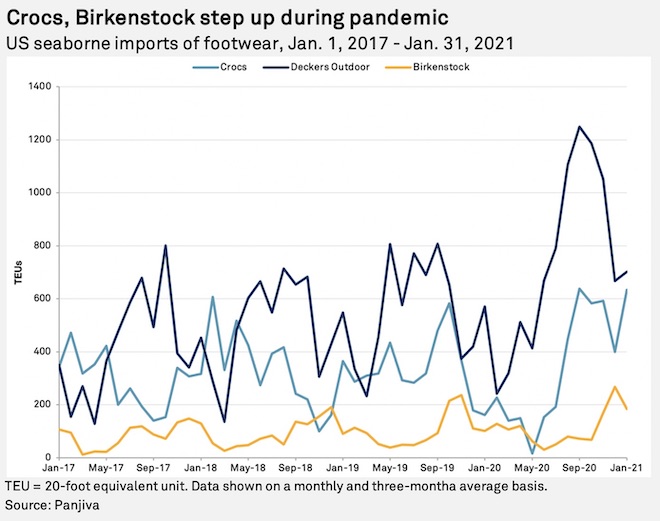

Panjiva's data shows that U.S. seaborne imports linked to Crocs climbed 39.5% year over year in the fourth quarter of 2020 and may have jumped as much as 293% year over year in January.

The latter compares to an unusually low figure a year earlier but nonetheless represents an unusual peak in shipments for the company. In turn, that may reflect delayed deliveries linked to congestion seen across the logistics industry, as outlined in Panjiva's research of Feb. 15.

Indeed, Crocs CFO Anne Mehlman has said that the company is "seeing great pressure on inbound largely just due to the supply chain right." Meanwhile, CEO Andrew Rees has noted that "global logistics here in the first quarter are really challenging," in the context of the company's growth objective.

Crocs' performance has far outstripped the wider footwear segment, reflecting reduced demand for workwear and schoolwear. Other niche, casualwear brands have also done well. Imports linked to sandal-maker Birkenstock GmbH & Co. KG dipped 10.2% year over year in the fourth quarter of 2020, but that included a 142.7% surge in December before a further 82.5% expansion in January.

Shipments of footwear linked to Deckers Outdoor Corp., which includes the Ugg brand as well as sporting goods such as Hoka, climbed 100.9% in the fourth quarter of 2020 before slowing to a 23.2% increase in January.

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.