Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Feb, 2021

By Calvin Trice and Jason Woleben

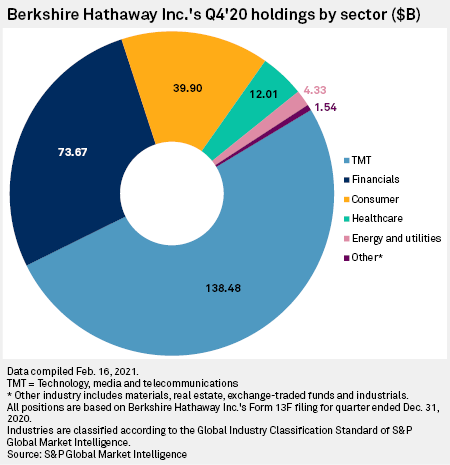

Berkshire Hathaway Inc. bought stocks in Verizon Communications Inc. and Chevron Corp. and dropped its remaining equity ownership in some of the country's largest banks, continuing its investment exit of the sector.

Warren Buffett, Berkshire's chairman, president and CEO, added to the company's holdings an $8.62 billion position in Verizon and $4.10 billion worth of Chevron shares during the fourth quarter of 2020.

Buffett sold off the conglomerate's remaining stakes in PNC Financial Services Group Inc., M&T Bank Corp. and JPMorgan Chase & Co., while slashing further equity investment in Wells Fargo & Co.

He also reversed the investment course on the relatively modest position Berkshire purchased in Pfizer Inc. during the third quarter of 2020. The filing indicates the company exited its $136.2 million stake in Pfizer in the 2020 fourth quarter, which saw the pharmaceutical giant take the global lead with partner BioNTech SE in developing a vaccine for COVID-19.

Berkshire, however, did not abandon the pharma sector during the fourth quarter of 2020. The conglomerate added to the slightly larger positions it took up in AbbVie Inc., Bristol-Myers Squibb Co. and Merck & Co. Inc. during the previous quarter, according to the company's latest form 13-F.

The conglomerate also took up an initial position in Marsh & McLennan Cos. Inc., starting with a $499.3 million investment. Berkshire more than doubled its share count in T-Mobile US Inc. to increase the equity value to $706.9 million. The company trimmed its stake in Apple Inc. and cut more than a quarter of its holdings in Suncor Energy Inc., while upping its position in The Kroger Co. by more than a third to a value of $1.07 billion.