Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Nov, 2021

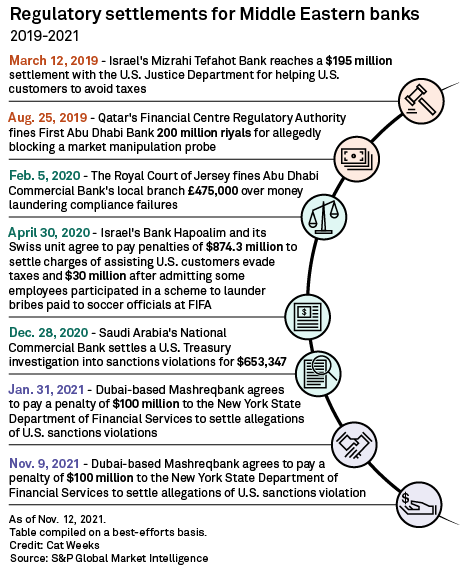

Legacy issues related to U.S. sanctions compliance have continued to dog banks across the globe, with Mashreqbank PSC becoming the latest lender in the Middle East

The fifth-largest bank in the United Arab Emirates

Mashreqbank is accused of illegally processing, through its London branch, about $4.09 billion of payments tied to Sudan between January 2005 and February 2009. Sudan came under U.S. sanctions in 1997 for supporting international terrorism and human rights abuses. It was removed from the U.S. list of state sponsors of terrorism in December 2020.

The Dubai-based bank said the U.S. authorities recognized its cooperation and commitment to building an effective and sustainable compliance program.

"Mashreq is committed to complying with all laws and regulations governing our industry and fully cooperated with these government regulators on this matter," it said.

The Office of Foreign Assets Control has issued 36 bank fines ranging from $12,500 to $8.9 billion between 2010 and 2019 for sanctions violations, data from financial market information provider Refinitiv showed.

Mashreqbank did not mention in its financial report for the nine months to September-end whether or not it had provisioned for the fine, while reporting general and administrative expenses of 1.91 billion dirhams for the period, up from 1.88 billion dirhams a year ago. The bank's profit attributable to owners of the parent was 265.1 million dirhams, down on a yearly basis from 352.0 million dirhams. Third-quarter attributable profit was 179.7 million dirhams, compared to a year-ago loss of 183.1 million dirhams.

Other news

* Israel

* Israel

* The Bank of Israel

* The Abu Dhabi Securities Exchange, along with the emirate's Department of Economic Development, submitted a proposal to the UAE

* Moody's revised to stable from negative the outlook on the long-term deposit ratings of nine Saudi Arabian

* Kuwait

* The Egyptian

* Lebanon

* CEOs of banks in Tanzania

Abdelghani Henni contributed to this article.