Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Jan, 2021

By Sanne Wass

Dutch bank ING Groep NV aims to take its commodity trade finance business "back to basics," providing more traditional transactional financing while reducing corporate exposures to midsize traders, according to Maarten Koning, the bank's new global head of trade and commodity finance.

"I expect this to be not an ING trend, but an industry trend," Koning told S&P Global Market Intelligence, saying he was "bullish" about the outlook for the business. ING is one of the leading banks in financing the trade of commodities such as oil, metals and agricultural products.

The bank's new focus also includes more warehouse checks, better collateral management agreements, more audits of borrowing bases and investment in technology platforms to reduce the risk of fraud, he said.

Losses within its commodity financing business last year had triggered some "soul searching" at ING, which has now resulted in the change in strategy, Koning said. He was himself appointed to the role in December as part of a reorganization that saw ING bring its structured commodity finance units in Geneva and Asia into the trade and commodity finance division.

Other large commodity trade finance banks have also been reviewing or scaling back their lending to commodities trade. ABN Amro Bank NV, for one, announced in August that its activities in this space would be "discontinued completely."

Société Générale SA, meanwhile, decided to close its trade commodity finance unit in Singapore following the collapse of trading firm Hin Leong Trading (Pte.) Ltd., while BNP Paribas SA is shutting down its Swiss commodity trade finance team after suspending new deals in Europe, the Middle East and Africa, according to Bloomberg News. The news outlet further reported this week that Rabobank would close its trade and commodity finance operations in London, Shanghai and Sydney.

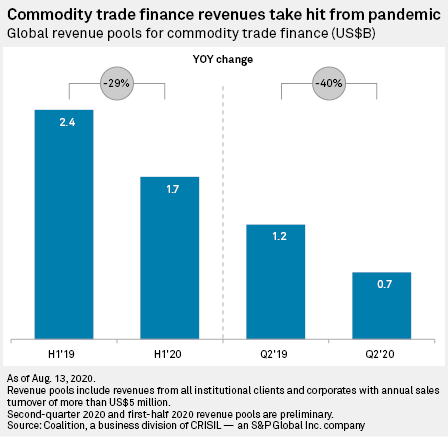

Banks have faced pressure on margins within commodity trade finance for years, but the global pandemic seemed to have been the final straw for many, after a number of high-profile bankruptcies among commodity traders, many of which were linked to allegations of fraud, caused significant losses for lenders.

ING has been reported to be among the creditors to Singapore-based commodities traders Agritrade and ZenRock, which both collapsed in the first half of 2020.

'Back to basics'

Trade finance has historically been considered one of the safest forms of businesses for banks, as the financing has traditionally been linked to specific trades that are secured against the commodities or goods as collateral, keeping default rates low.

But over the years, competitive pressure from large commodity traders and changing capital requirements with the implementation of Basel III, and so-called Basel IV, have prompted banks to increasingly replace the transactional trade finance with unsecured, corporate credit lines to commodity traders based on their balance sheets and credit rating, while having a "lighter and lighter monitoring and control of the transactions and security packages," said John MacNamara, previously Deutsche Bank's global head of structured commodity trade finance and now an independent commodity specialist, in an interview.

This has left banks increasingly vulnerable to credit risks and fraud, and was a contributor to the wave of losses faced by banks last year.

Koning said ING aims to now bring its focus back to collateralized transactional trade finance, and he suspects that other lenders will do the same.

He said his department has already done "some portfolio pruning," waving goodbye to some clients either due to its tightened risk appetite or new commercial metrics. This includes in Latin America, where ING took the strategic decision to close its activities completely.

The Dutch lender will also prioritize better verification of the secured assets as well as investing in technology solutions that can help banks to monitor if assets have already been financed by other banks, he added. ING is currently invested in Komgo, Vakt and MineHub, all of which are based on blockchain technology and seek to solve some of the commodity trade and finance industry's challenges.

New capital needed

Other banks' decisions to scale back their commodity trade finance business is "of course" creating new opportunities for ING, Koning said, but he added that "we do not want to solve the problem of all the banks leaving."

"We will pick and choose the transactions that are the most attractive," he said.

Other banks and nontraditional capital providers will need to step in, he added. Institutional investors, for example, could provide liquidity to the market either by buying trade finance assets from banks, or investing directly in assets through specialized funds.

Koning said he had already seen client demand for commodity trade finance increase in the first three weeks of 2021 as commodity prices have been going up. As this demand rises further, he expects ING will sell more assets to investors, stressing that ING's own portfolio is "not going to grow very significantly."

Deutsche Bank AG is one example of a European lender that has said it is looking to grow its commodity trade finance business and "selectively" take market share where possible, according to Daniel Schmand, the German bank's global head of trade finance and lending.