Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 12 Mar, 2020

By Fei Mei Chan

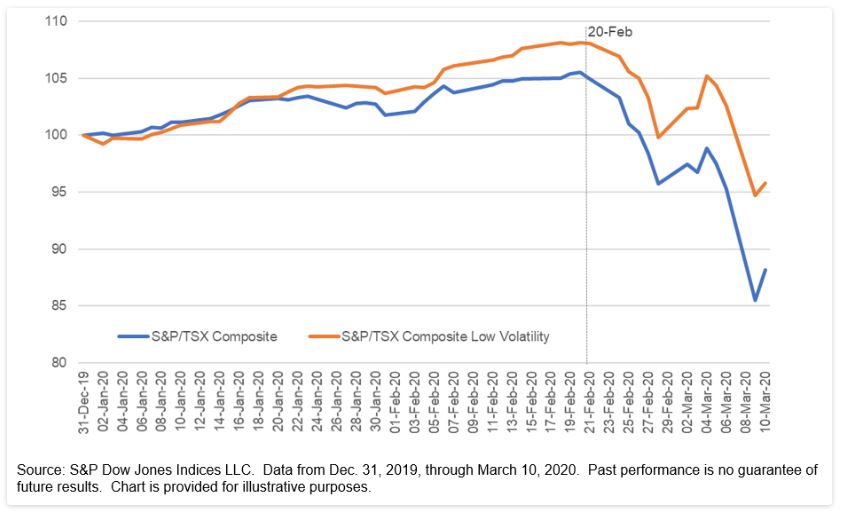

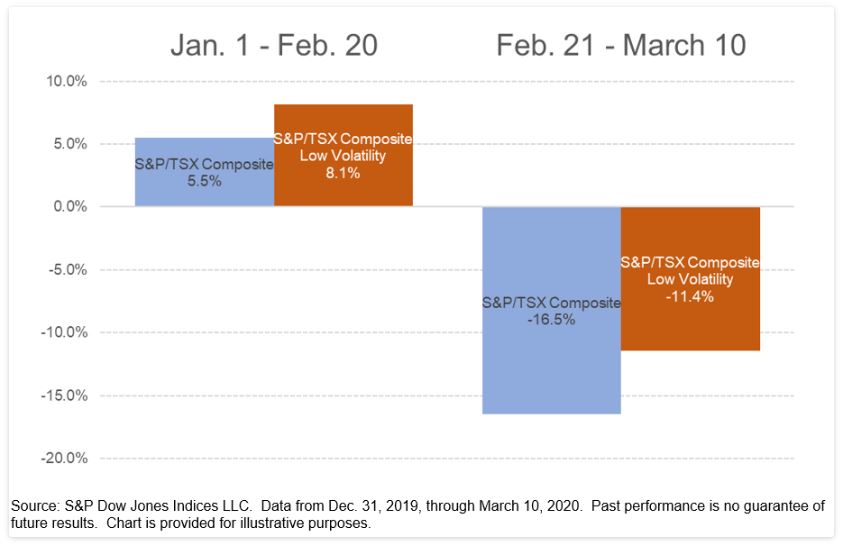

It remains to be seen what the full economic impact of the COVID-19 virus will be, but it is already clear that no equity market has escaped unscathed. (In fact, most of them have been scathed rather badly.) The Canadian equity market was humming along in 2020 through February 20, 2020, with the S&P/TSX Composite climbing 5.5% in almost two months. Since then, things have taken a decided turn for the worse, as the index dived 16.5%. Overall, the index is down 11.9% year to date through March 10.

It’s not surprising to see that the S&P/TSX Composite Low Volatility Index has managed to weather the stormy environment well. That’s what it was designed to do, by offering a shield in the bad times while still participating in the good times. Low Vol will typically go up less when the market is rising and go down less when the market is falling.

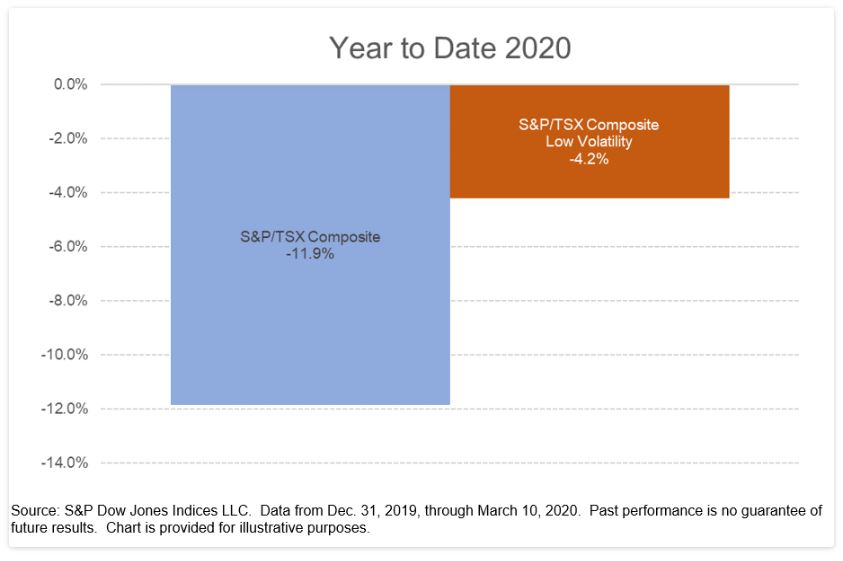

Since the February 20th peak, the low volatility index fell 11.4% compared to the 16.5% decline of the TSX Composite. This is expected; Low Vol should decline less than the market. But it also uncharacteristically outperformed when the market was doing well, up 8.1% compared to 5.5% for the parent index. This allowed Low Vol to gain an extra cushion for its performance year to date, outperforming the S&P/TSX Composite by an impressive 7.6% (S&P/TSX Composite: -11.9%, S&P/TSX Composite Low Volatility: -4.2%). This phenomenon isn’t limited to the Canadian market, the strategy offered a similar protection in U.S. equity markets as well.