Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

16 Jan, 2020

By John Welling

The S&P China 500 advanced 12.9% in Q4 2019, an indication that investors shrugged off U.S.-China trade tensions and signs of a slowing economy. The performance was a reversal from losses during the prior two quarters, which had followed an outstanding 23.6% surge in Q1 2019. The full-year result was a welcome contrast to the dismal end to 2018, when trade concerns appear to have peaked.

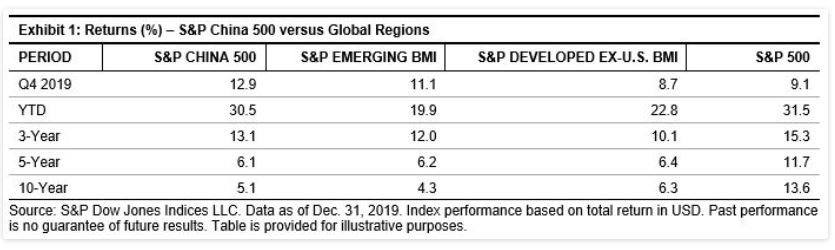

Chinese stocks generally outpaced emerging and developed equity benchmarks during Q4 2019, as the S&P Emerging BMI gained 11.1% and the S&P Developed ex-U.S. BMI stood at 9.3%. Tallied against the full array of global indices on an annual basis, only the U.S.-based S&P 500® managed to beat the Chinese benchmark in 2019 (and only by a slim margin; see Exhibit 1).

Broadly speaking, onshore-listed China A-shares gained an advantage over offshore stocks throughout 2019; the S&P Access China A gained 34.7% while the S&P China Broad BMI, which includes A-shares at a limited weight, gained a lesser 22.0%. As expected, the S&P China 500 posted performance in the middle of most major China equity benchmarks, given its diversified composition across all Chinese share classes and sectors.

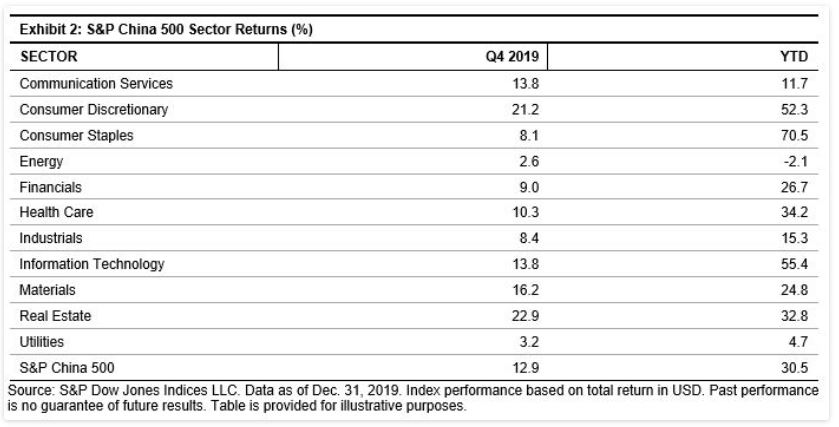

All 11 sectors performed positively during Q4 2019, while 10 of these logged YTD gains. Consumer Staples—led by Kweichou Moutai (up 97.6% YTD)—and Information Technology were sector leaders for the year, with gains of 70.5% and 55.4%, respectively. Energy was the sole sector to miss YTD gains, concluding 2019 with a 6.9% loss.

Financials and Consumer Discretionary (pushed higher by Alibaba, up 54.7% YTD)—the two largest sectors of the S&P China 500 by weight—contributed the most to positive performance in 2019. Combined with Communication Services, the next largest, these sectors represented over half of the index’s annual gains, highlighting the knock-on effects of an increasingly robust consumer-based economy.

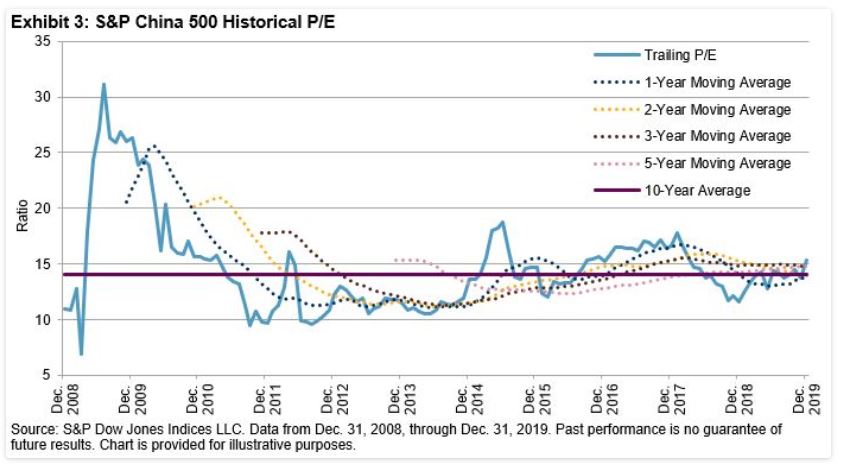

The S&P China 500 trailing P/E moved higher in Q4 to 15.4x, surpassing the 10-year average P/E ratio of 14.0x, as well as rolling 1-, 3-, and 5-year figures, driven largely by substantial price appreciation. Meanwhile, the index’s forward P/E advanced somewhat less drastically from 12.4x in the prior quarter to 13.8x in Q4 2019, reflecting positive increases in earnings expectations.

Despite the recent increase in index valuations, metrics of broader emerging market indices were well within range, as the S&P Emerging BMI trailing P/E stood at 16.6x at the end of Q4 2019. The S&P China 500 dividend yield, meanwhile, decreased from 2.20% to 2.01% on a quarterly basis.