Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 30 Mar, 2020

By Akash Jain

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

In our research paper titled, Profitability Screening in Australian Small Caps, we examined the effectiveness of a profitability screen on improving return as well as reducing volatility and drawdown for Australian small-cap stocks. Adhering to these principles, the S&P/ASX Small Ordinaries Select Index was launched on Dec. 21, 2018, to track profitable small-cap companies in Australia while minimizing index portfolio turnover and tracking error against the benchmark S&P/ASX Small Ordinaries.

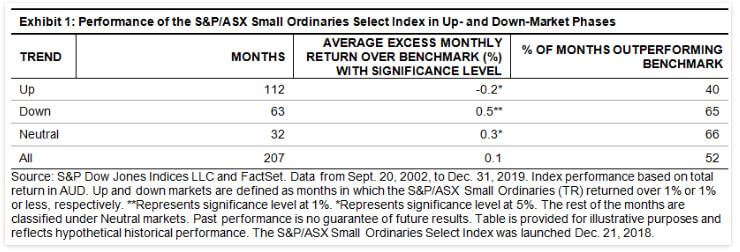

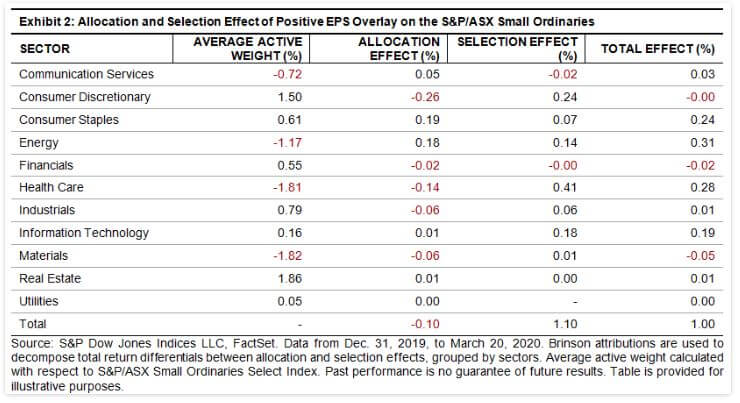

As highlighted in the research paper, the S&P/ASX Small Ordinaries Select Index tended to outperform the benchmark during down and neutral markets (see Exhibit 1). The defensive characteristic of the S&P/ASX Small Ordinaries Select Index was also seen in the recent market downturn. During the period from Dec. 31, 2019, to March 20, 2020, the underlying index fell 30.5%, whereas the select strategy fell by 29.5%, outperforming the benchmark by 100 bps. The outperformance of the S&P/ASX Small Ordinaries Select Index was largely driven by stock selection within sectors (see Exhibit 2). Stock selection in the majority of the sectors attributed positively to the S&P/ASX Small Ordinaries Select Index’s relative performance, where attribution from Health Care and Consumer Discretionary stocks were most pronounced. Nevertheless, the unintended sector bets had marginal negative attribution to the S&P/ASX Small Ordinaries Select Index’s return. The select version of the index carried the highest active sector exposures to Real Estate and Consumer Discretionary, while it was most underweight in Materials and Health Care. The overweight in the Consumer Discretionary sector hurt the S&P/ASX Small Ordinaries Select Index’s performance, but the active sector bets in Consumer Staples and Energy attributed most positively to its return.

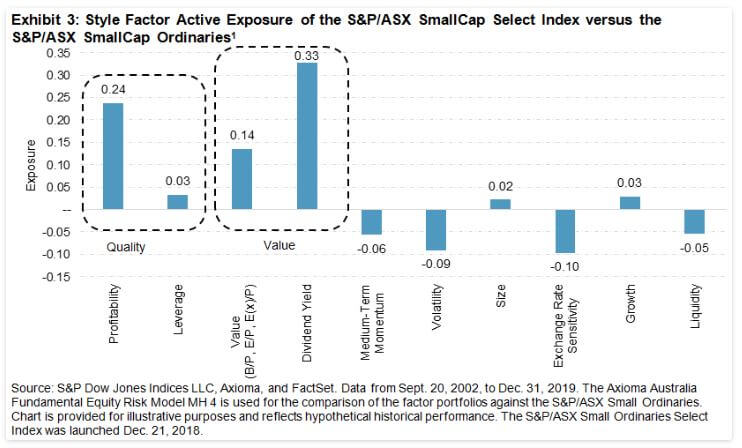

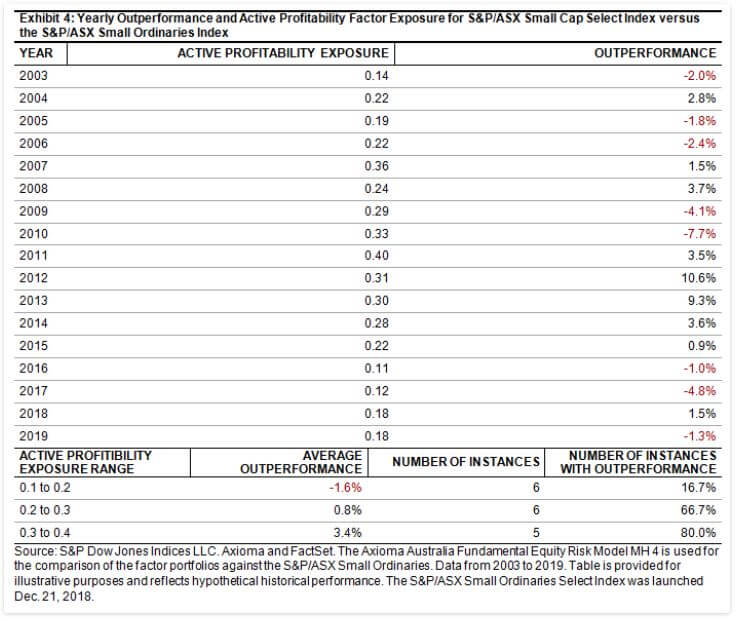

In the research paper, we also mentioned the S&P/ASX Small Ordinaries Select Index had a higher profitability active factor exposure than the S&P/ASX Small Ordinaries Index historically. In addition, the S&P/ASX Small Ordinaries Select Index offered higher dividend yields compared with the benchmark, as profitable companies are better positioned to maintain sustainable dividends. Exhibit 3 shows the active factor exposures averaged over the 17-year period since 2002 to 2019. Stock selection based on trailing EPS effectively captured positive profitability exposure for the S&P/ASX Small Ordinaries Select Index every year. As market conditions changed, so did the profitability active factor exposure. We observed in years when the profitability factor exposure was higher, the S&P/ASX Small Ordinaries Select Index tended to have better outperformance, indicating profitability was a determinant factor in driving outperformance of the select index (see Exhibit 4).

1 d’Assier, Olivier. “When Size Matters.” Axioma. Pp 12.