Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 15 Oct, 2020

By Koel Ghosh

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

The year 2020 has been unique, with the COVID-19 pandemic bringing unprecedented changes to economic activity that no one was fully prepared for, as well as record levels of volatility in financial markets. But such disruption not only creates innovation, it also gives opportunities to contrarian options and allows new themes to emerge dominant.

India has always been a country with a “home bias” in its investment strategies—meaning that Indian investors have generally preferred local securities to global. This is understandable; high yields in the fixed income markets and strong performance from equities, as well as a faith that India would deliver world-beating economic growth, kept investors glued to the local markets. However, the market’s reaction to the events of 2020 have provided a counterpoint to the accepted wisdom, when opportunities beyond domestic borders emerged as the clear winners.

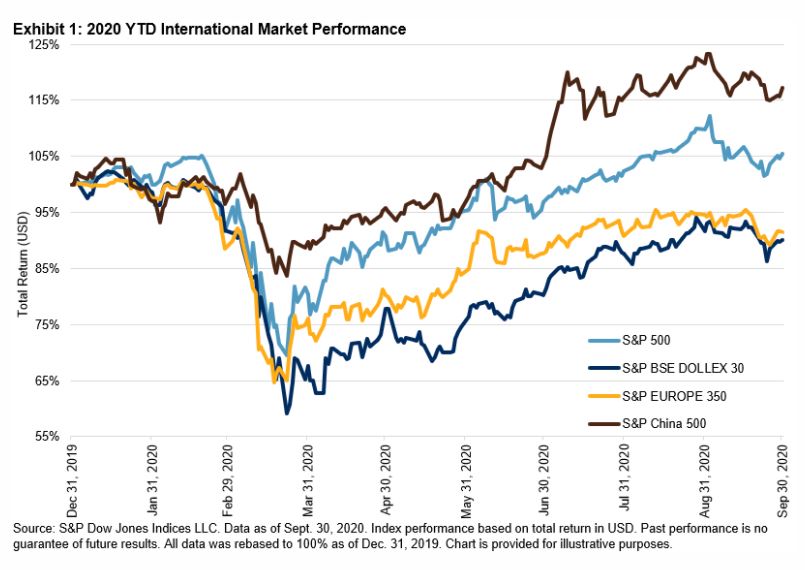

Exhibit 1 compares the YTD trends in the S&P BSE SENSEX with a range of global indices calculated by S&P DJI, including our benchmarks for the U.S., Europe, and China. As the chart makes clear, 2020 has been a year in which global diversification could have helped Indian investors. Note that the S&P BSE DOLLEX 30 is the U.S. dollar equivalent of the Indian rupee-denominated S&P BSE SENSEX; for purposes of comparison, the performance of all indices is shown in U.S. dollars.

Whenever we compare performance, analyzing different time periods helps understand how the trends played out for a particular investment strategy or rather, in this case, the indices representing the country markets. The case for international diversification for Indian investors also holds up well in the long term, particularly for the world’s largest stock market: the S&P 500’s performance, whether over 1, 3, 5, or 10 years, was distinctly superior.

The global opportunity set offers a wide range of sectors and companies—within them, the likes of Microsoft, Apple, Amazon, and Facebook, that have benefited from the move toward virtual workplaces, virtual shopping, and higher spending on communications and technology. Using the S&P Global BMI, Exhibit 3 highlights the performance of certain global equity sectors and industries that showed both substantial gains and declines this year, illustrating the strength of the market’s trends. While airlines and energy companies have seen steep declines across the world, the soaring shares of global software, IT, and internet companies have offered refuge to those who had made an allocation.

International diversification provides local investors the chance to take part in such global trends and participate in the opportunities that arise from advancing technology and global changes in corporate and consumer behavior. Furthermore, in times of turmoil, broader diversification could enable market participants to weather the bad times, along with making the most of the good times.

The extraordinary events of 2020 have so far emphasized the potential of global equities to Indian investors, but are they seeing the opportunity? Offering perspective, S&P Dow Jones Indices’ series of global benchmarks can help frame the landscape of international investing.

Note: Thanks to Tim Edwards for a series of conversations that generated ideas for this blog and for providing some of the accompanying data.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Content Type

Segment

Language