Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 20 Sep, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Widening Network of Trade Positions Vietnam for Growth

On Sept. 10, President Joe Biden landed in Hanoi, Vietnam, with the goal of creating a stronger bilateral trade relationship between the Southeast Asian country and the US. During the visit, Biden and Vietnam's general secretary, Nguyen Phu Trong, signed the new Comprehensive Economic Partnership agreement that governs the development of the Vietnamese semiconductor, critical mineral and rare earth industries. The agreement forms part of a patchwork of trade agreements that is transforming the fast-growing Vietnamese economy into a hub of international supply chains. S&P Global Market Intelligence Chief Economist for Asia-Pacific Rajiv Biswas reviewed the current state of growth and trade in Vietnam in the article “Vietnam strengthens economic ties with US during President Biden's visit.”

Vietnam’s export-driven economy has enjoyed significant growth over the past five years. Despite the disruptions caused to global trade during the COVID-19 pandemic, Vietnam’s GDP grew 2.9% in 2020 and 2.6% in 2021. Last year was a bounce-back year for global trade, and Vietnam’s GDP grew 8%. In 2023, Vietnam’s volume of exports lags 2022’s record-setting pace, but the economy is still growing at 3.7%. Vietnam’s growth is a product of the country’s lower manufacturing wages compared to some other Asian exporters, its well-educated workforce and increased foreign direct investment. As many large multinationals seek to diversify their supply chains, Vietnam has emerged as a popular manufacturing hub.

Beyond the new agreement that Trong signed with the US, Vietnam is a member of the ASEAN Free Trade Area, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, the EU-Vietnam Free Trade Agreement and the forthcoming Regional Comprehensive Economic Partnership free trade agreement. These trade agreements place Vietnam within a network of Asia-Pacific and Southeast Asian countries and maintain the country’s strong bilateral agreements with major export markets such as the US, EU and China.

The growth in Vietnam’s economy has attracted investors to its banking sector. Mergers and acquisitions are likely to increase as large regional banks look to boost their exposure to Vietnam’s stable economic growth.

"Acquiring a strategic stake in the Vietnam banks provides an opportunity for foreign investors to participate in the growth and tap the country’s favorable demographics via retail lending, particularly via digital channels," said Ivan Tan, an analyst at S&P Global Ratings.

The only potential dark cloud on the horizon for Vietnam is a contracting property sector. Vietnamese property developers have pursued debt-fueled growth to meet the demand from investors. Investors accounted for about 86% of total property purchased in Vietnam over 2020–2022, while about 45% of total buyers were from overseas. New regulatory policies instituted by the Vietnamese government may undermine the credit quality of Vietnam developers, according to S&P Global Ratings. With residential property sales falling, Vietnamese banks may suffer some spillover effects, although the impact is likely to be manageable.

Today is Wednesday, September 20, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

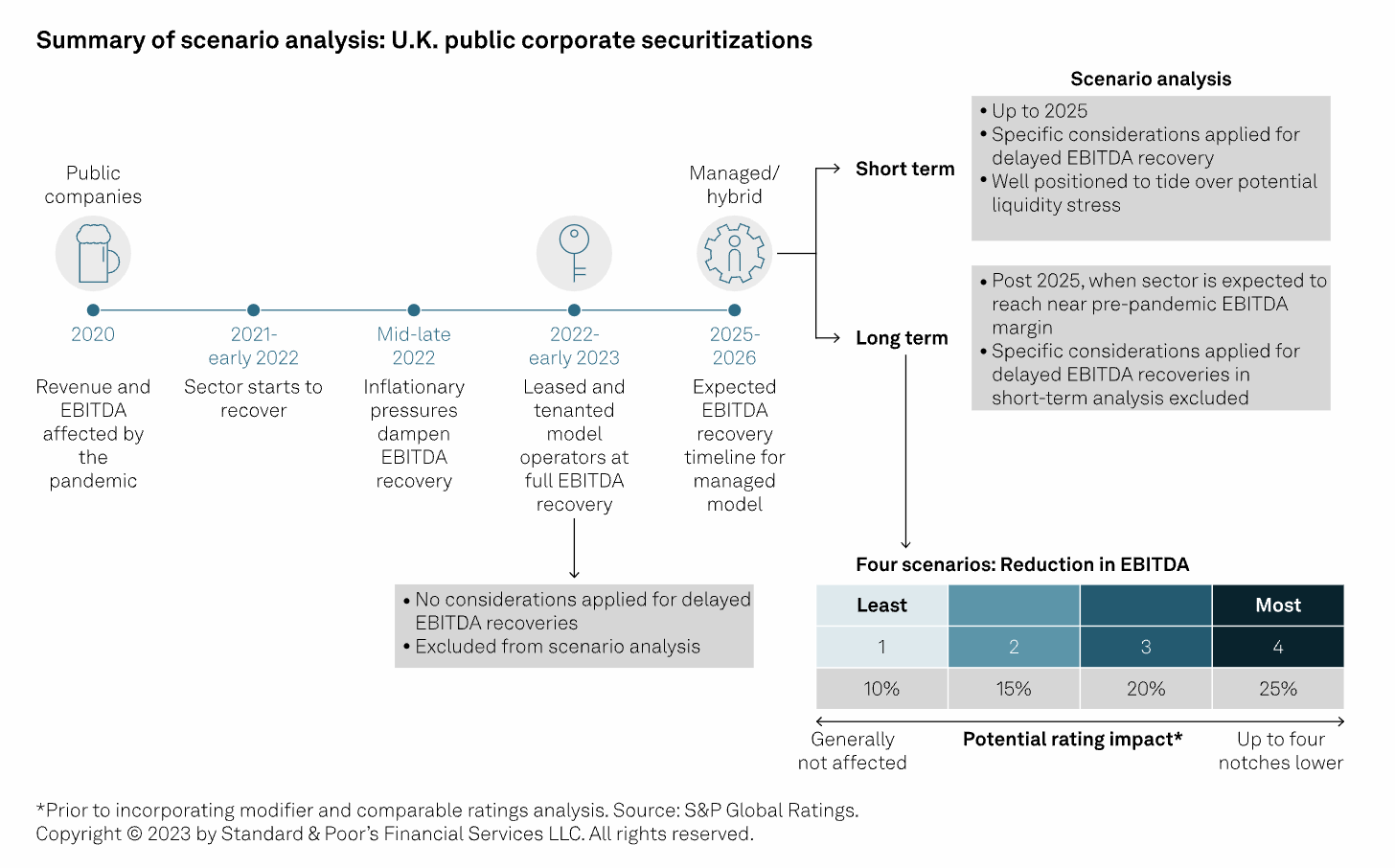

Scenario Analysis: Will Lower EBITDA Recovery Leave UK Pub Corporate Securitizations In The Cellar?

The UK pub sector faced unprecedented stress during the pandemic, followed by a sharp increase in labor, energy and food costs. Together with rising cost of living pressures affecting UK households, the pressure on the topline will also add to the weakness in profitability. The nature of the business model impacts also has a bearing on operating performance and profitability. The EBITDA margins of leased and tenanted operating models have rapidly recovered to pre-pandemic levels, while fully managed or hybrid models will recover more slowly.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Listen: Ep40: Rohit Sipahimalani On Private Credit, Generative AI And The Rise Of India

Rohit Sipahimalani, CIO at Temasek, and Martina Cheung, President of S&P Global Ratings, join host Joe Cass on this episode of Fixed Income in 15. The discussion centered around disruptive investment areas, macro-outlooks, private credit, the impact of Generative AI and the rise of India.

—Listen and subscribe to Fixed Income in 15, a podcast from S&P Global Ratings

Access more insights on capital markets >

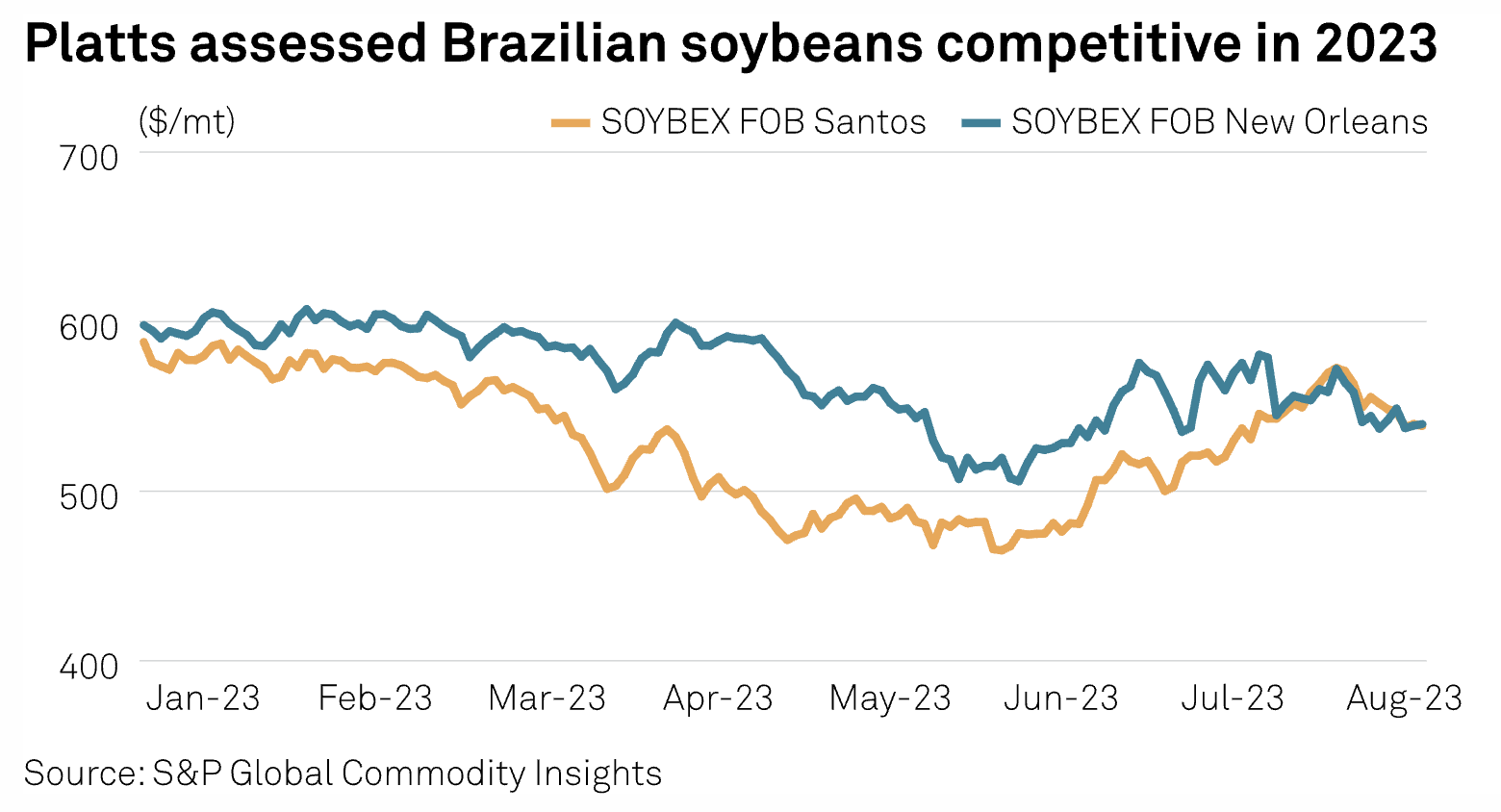

Brazil's Sep 1-18 Soybean Exports Surge 36% On Year To 3.5 Mil Mt

Brazil's soybean exports so far in September have surpassed the shipped volumes in the same period a year earlier amid strong trade momentum, commodity analysts said, likely supporting basis prices. According to the latest data from Brazil's foreign trade department, Secex, the country shipped out 3.5 million mt of soybeans over Sept. 1-18, up 36% on the year. On the back of ample domestic supplies and competitive pricing, along with robust demand from China, the South American country has been shipping out the yellow oilseed in large volumes in 2023, market analysts said.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Carbon Credits Seek To Regain Credibility Amid Growing Scrutiny

Voluntary carbon markets are facing a critical moment in their short history. Questions about the integrity and effectiveness of many carbon projects have led to a sharp fall in prices and liquidity. However, a series of quality and transparency initiatives are being adopted to restore confidence in offsets. S&P Global Commodity Insights' experts Eklavya Gupte, Dana Agrotti and Silvia Favasuli discuss the road to recovery for the VCM as it seeks to rebuild credibility and trust.

—Listen and subscribe to Platts Future Energy, a podcast from S&P Global Commodity Insights

Access more insights on sustainability >

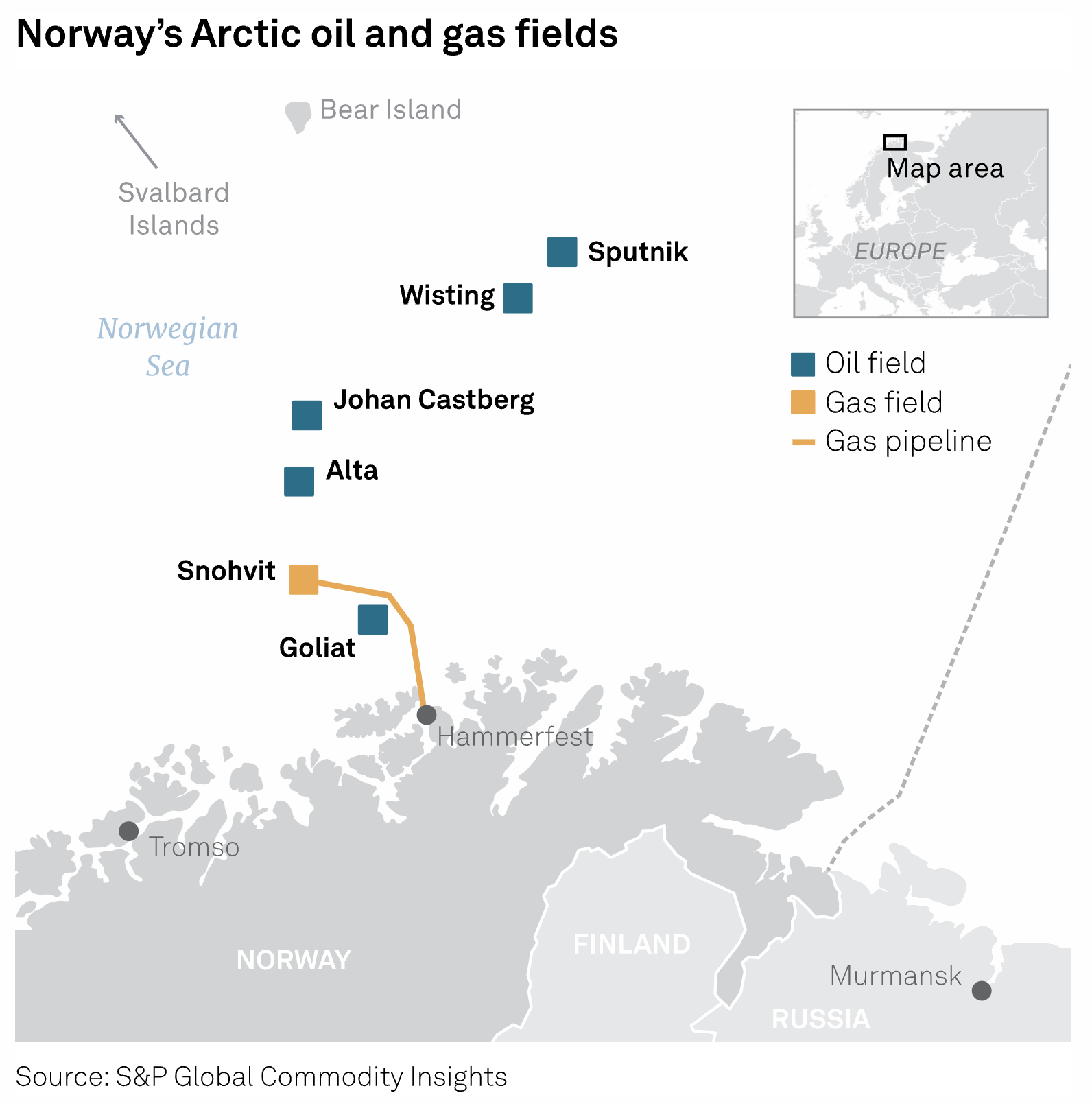

Equinor Signals Further Capex Blowout For Flagship Barents Sea Crude Project

Norway's state-controlled Equinor on Sept. 19 signaled the latest in a series of increases in capital expenditure forecasts for its flagship Barents Sea oil project Johan Castberg, up 40% from the original plan, but said startup was on track for Q4 2024, in line with an earlier revised schedule. Castberg is the second oil field to be developed in the Norwegian Barents Sea after Goliat, a field operated by Var Energi, majority owned by Italy's Eni.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

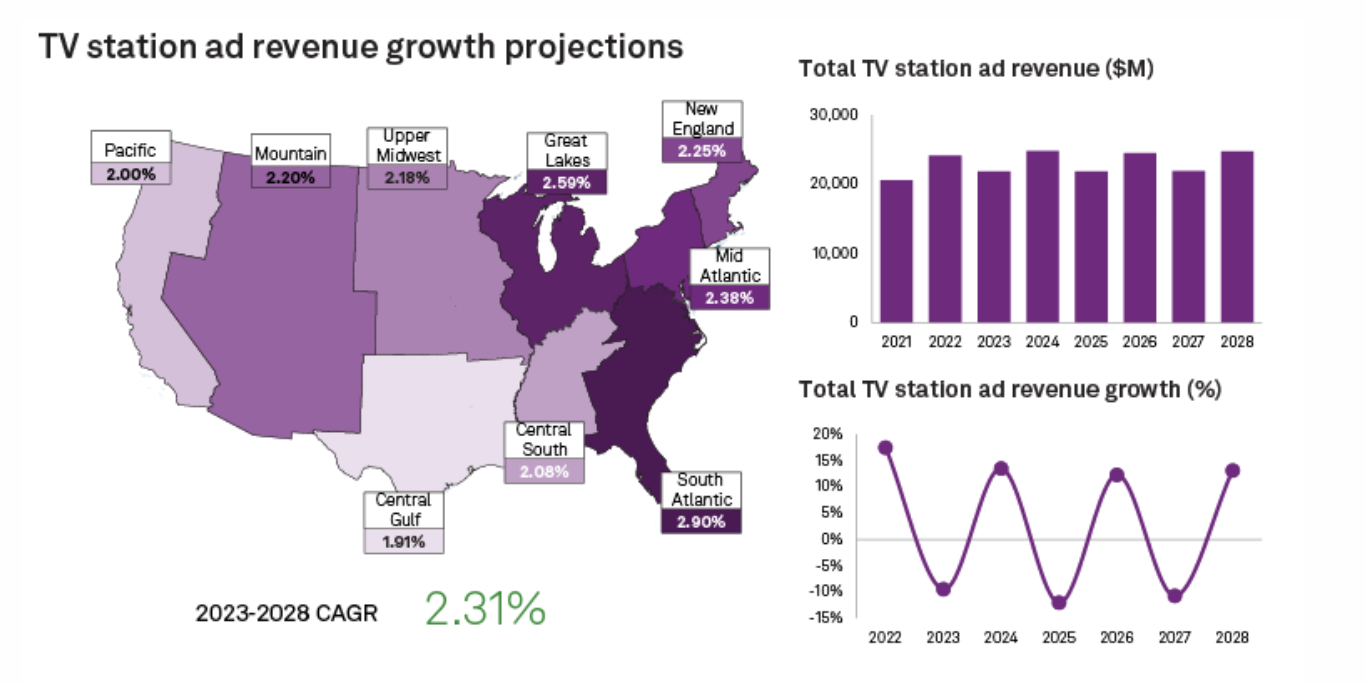

Radio/TV Station Annual Outlook 2023

The US broadcast station industry is expected to reach $33.83 billion in total advertising revenue in 2023, down 7.0% from $36.39 billion in 2022. Core ad categories including automotive, retail and travel categories, have mostly rebounded from pandemic-level declines although showing signs of softness as a result of high interest rates and inflationary pressures while pharmaceuticals, telecoms and professional services are still relatively strong in terms of ad spending.

—Read the article from S&P Global Market Intelligence

Content Type

Theme

Location

Language