Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 2 Sep, 2020

By S&P Global

The race for a COVID-19 vaccine could accelerate the pace of change in the healthcare sector, while also raising red flags about the legitimacy of some treatments being touted by public figures.

“Notwithstanding certain risks, the economic and societal benefit of a COVID-19 vaccine would be enormous. This could improve the [pharmaceutical] industry's reputation and beyond the direct benefit of saving people's lives, include some indirect benefits. Communities could go back to normal, economies could recover more quickly, and jobs would be created,” S&P Global Ratings said in a report this week.

On Sept. 1, a panel of U.S. National Institute of Health experts condemned the Food and Drug Administration’s support of convalescent plasma therapy as an effective treatment for hospitalized coronavirus patients. Convalescent plasma therapy is a process of providing antibodies from recovered patients into the bloodstreams of those who are ill.

“There are currently no data from well-controlled, adequately powered randomized clinical trials that demonstrate the efficacy and safety of convalescent plasma for the treatment of COVID-19,” the NIH said in a statement. “The long-term risks of treatment with COVID-19 convalescent plasma and whether its use attenuates the immune response to SARS-CoV-2, making patients more susceptible to reinfection, have not been evaluated. Convalescent plasma should not be considered standard of care for the treatment of patients with COVID-19.”

After the FDA granted an emergency authorization for convalescent plasma therapy on Aug. 23, Commissioner Dr. Stephan Hahn, Health Secretary Alex Azar, and President Donald Trump incorrectly claimed that such an approach could save 35% of people from dying from the virus—a figure that scientists and health experts noted was extremely inflated. Dr. Hahn apologized on Twitter, saying on Aug. 25 that “the criticism is entirely justified" and that he should have said "that the data show a relative risk reduction not an absolute risk reduction."

“Right now, the FDA has less credibility than it’s ever had in my lifetime,” Harvard University professor of global health Ashish Jha told the Financial Times on Aug. 31. “Stephen Hahn has got to do something to try and restore that credibility. If he doesn’t, I imagine he will face a mass exodus.”

The Trump Administration previously touted hydroxychloroquine, a drug approved to treat malaria, for COVID-19 patients. Citing evidence of increased heart problems and worsening of coronavirus symptoms, the FDA cautioned against the use of hydroxychloroquine in July. Still, the drug has acclaimed a controversial status as other world leaders, including Brazilian President Jair Bolsonaro, have championed its effectiveness during the pandemic despite the advice of healthcare professionals.

The market for a COVID-19 vaccine will involve multiple players, rather than one singular so-called winner. Companies will struggle to meet the demand of vaccinating billions of individuals with differing patient profiles, according to S&P Global Ratings.

In the U.S., “a successful vaccine could improve the pharma industry's reputation and lead to a more balanced debate about U.S. drug price reform,” S&P Global Ratings said in an Aug. 31 report. “Rising drug prices remain a key issue affecting the [pharmaceutical] industry's social license to operate, and politicians are still using drug reform as a key platform, especially in light of the upcoming presidential election.”

The numbers of Americans contacting their healthcare providers through telemedicine and using cloud-connected medical devices have ballooned during the pandemic—signally a more permanent shift to digital healthcare over in-person consultations. Revenue across telemedicine and home internet of things healthcare is expected to expand to $2.40 billion in 2024, from $628.3 million last year, according to S&P Global Market Intelligence.

Globally, “accessibility is as much a strategic as an ethical question, and governments will have to become more active stakeholders in infectious disease management,” S&P Global Ratings said, acknowledging that countries’ investment and pre-purchasing of vaccinations may lead to a surge of nationalism that creates supply obstacles for biopharmaceutical companies and a lack of coordination regarding who is first prioritized for the treatment. “Ultimately, there needs to be a containment strategy. This will inevitably require more global coordination and accessibility by all nations, as well as how to deal with anti-vaxxers.”

Today is Wednesday, September 2, 2020, and here is today’s essential intelligence.

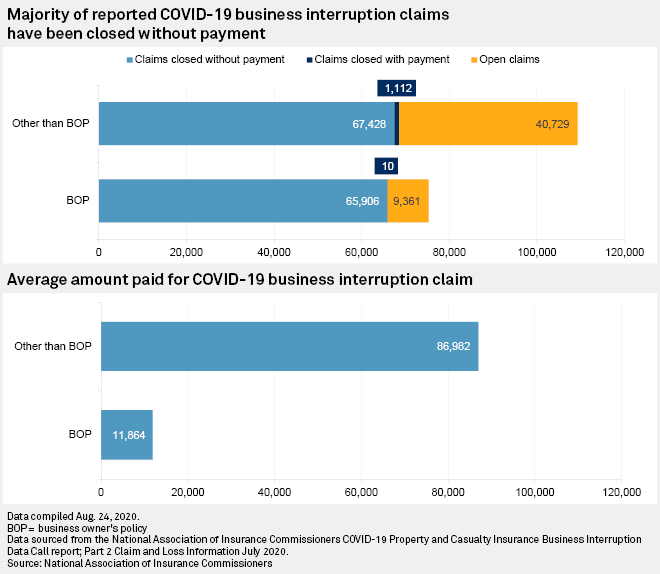

Case Count Tops 1,000 As Litigation Against Insurers Over COVID-19 Takes Shape

A federal judge's ruling in Missouri represents one of the first victories of note for policyholders as litigation over business interruption insurance continues to pile up across the U.S. But with only a handful of opinions issued on the matter so far, it is clear that legal battles over whether pandemic-related losses are covered are still in the very early days of winding their ways through court. U.S. District Judge Stephen Bough of the Western District of Missouri on Aug. 12 threw out a motion to dismiss a case against Cincinnati Financial Corp., ruling that the plaintiffs "adequately alleged a direct physical loss," since coronavirus particles attached to property and damaged it by making it unsafe and unusable. The decision will allow a group of restaurants and hair salons to move forward with their case and sue the insurance carrier for losses.

—Read the full article from S&P Global Market Intelligence

Capitol Hill Seeks To Grill US FDA, CDC Chiefs About COVID-19 Political Pressure

House and Senate lawmakers want U.S. Food and Drug Administration Commissioner Stephen Hahn to testify about whether his agency is being politically pressured to quickly approve a COVID-19 vaccine and other products before they have demonstrated safety and efficacy. Senate Democrats also want U.S. Centers for Disease Control and Prevention Director Robert Redfield to come to Capitol Hill. A number of lawmakers and scientific and public health experts have raised concerns about the FDA's independence after President Donald Trump and other members of his administration publicly criticized the agency and said they expected regulators to approve a vaccine before the end of the year — even as early as the Nov. 3 election.

—Read the full article from S&P Global Market Intelligence

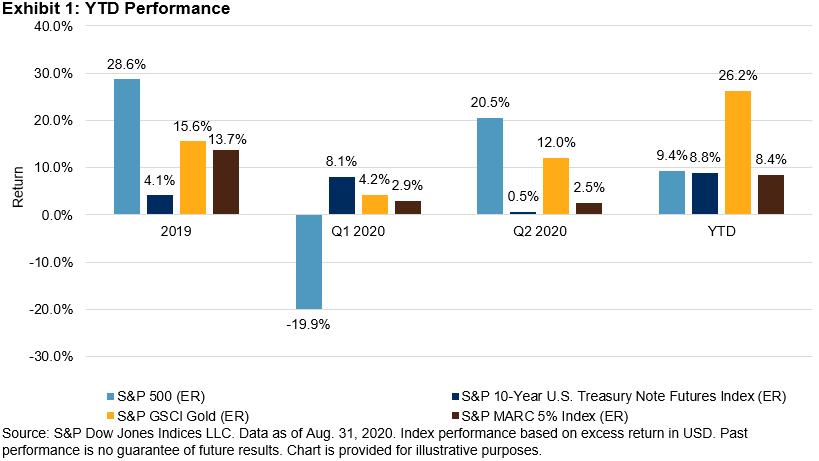

Gold and U.S. Treasuries Helped the S&P MARC 5% Index Performance YTD

Despite substantial market volatility and significant drawdowns in the first quarter of 2020, the S&P MARC 5% Index ended the quarter in positive territory. With markets staging impressive rebounds, S&P Indices take a renewed look at the performance of the S&P MARC 5% Index on a YTD basis.

—Read the full article from S&P Dow Jones Indices

Cyclones and Cyclicals

Most constituents of the S&P GSCI posted positive performance in August. The headline S&P GSCI rose 4.59% on the back of increased inflation expectations and bullish market sentiment brought on by the S&P 500® reaching new highs. The performance attribution across sectors was evenly distributed. Inflation hedging may have been one of the key drivers in commodities outperformance this month, following changes to the U.S. Federal Reserve inflation target, which allows inflation to run above 2% and gives the Fed more leeway to cut its interest rate in the event of an economic shock. Commodities tend to perform well in inflationary environments.

—Read the full article from S&P Dow Jones Indices

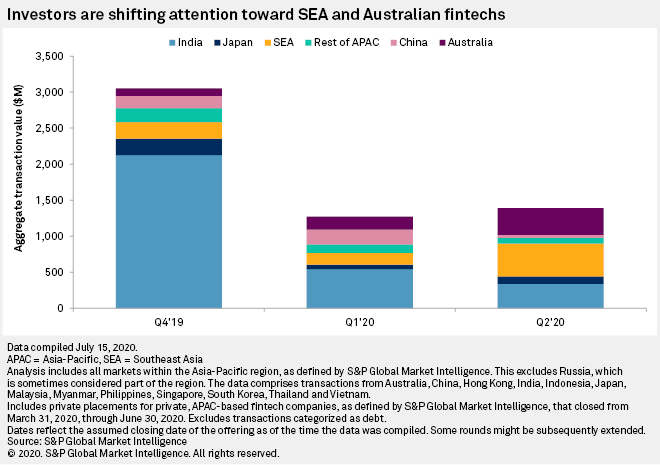

Investments in Southeast Asian, Australian Fintechs Propped up Funding in Q2

Investments in private financial technology companies in Asia-Pacific grew 9.1% to $1.4 billion in the second quarter, though deal activity remained flat, with 107 transactions in both quarters. Payment companies continued to draw in the most venture capital out of the six industry segments tracked by S&P Global Market Intelligence and, geographically speaking, investors cast their sights on Southeast Asia and Australia.

—Read the full article from S&P Global Market Intelligence

Smaller Chinese Banks Face Rising Default Risk Despite Recovering Economy

Mid-sized and small Chinese banks set aside more cash as loan loss provisions than they earned as net profit in the first half of 2020, highlighting a rising default risk for locally focused and less-capitalized lenders despite a recovering economy, analysts say. For the six months ended June 30, the combined loan impairment losses of 20 mid-sized and small Chinese commercial banks listed in Hong Kong totaled 67.82 billion yuan, 42% more than their combined net profit of 47.74 billion yuan, according to calculations by S&P Global Market Intelligence. In the same period last year, these lenders set aside 58.41 billion yuan as buffer against expected loan losses, 19% more than their combined earnings of 49.26 billion yuan.

—Read the full article from S&P Global Market Intelligence

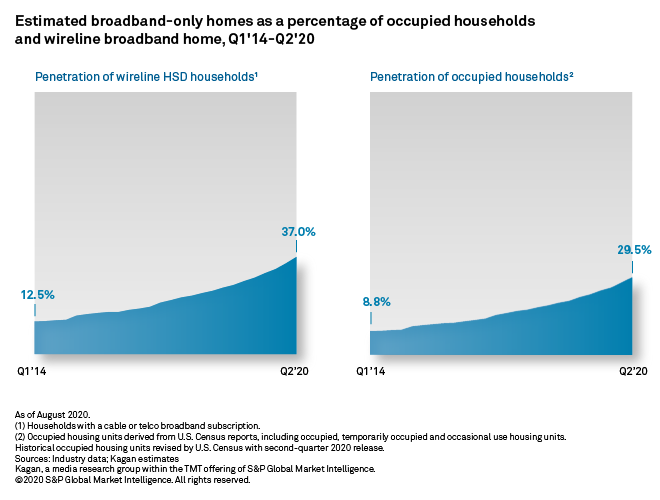

Broadband-Only Homes Near 30% of U.S. Households in Q2'20

Broadband-only homes' year-to-date net gains more than doubled on a record jump in the second quarter. This puts the segment on track to meet S&P Global Market Intelligence’s 2020 target as the multiplication of high-profile over-the-top services expand consumer choices and facilitate cord cutting amid budget tightening in the COVID-19 era. Perhaps unsurprisingly in the context of a global pandemic and its economic impact, which has led to tens of millions of Americans filing for unemployment benefits since the March national emergency, the three months ended June 30 marked the segment's second straight quarter in 8%-plus territory.

—Read the full article from S&P Global Market Intelligence

AT&T Better Off Without DIRECTV, But Deal Would Be A Tough Sell – Analysts

AT&T Inc.'s DIRECTV business has shed millions of video subscribers in recent years, and reports suggest that AT&T is now ready to shed DIRECTV. Citing people familiar with the matter, The Wall Street Journal reported that AT&T is considering selling some or all of its satellite TV business, having already held early-stage talks with several potential private-equity buyers such as Apollo Global Management Inc. and Platinum Equity. Speculation has also swirled for years that DIRECTV could combine with fellow satellite operator DISH Network Corp.

—Read the full article from S&P Global Market Intelligence

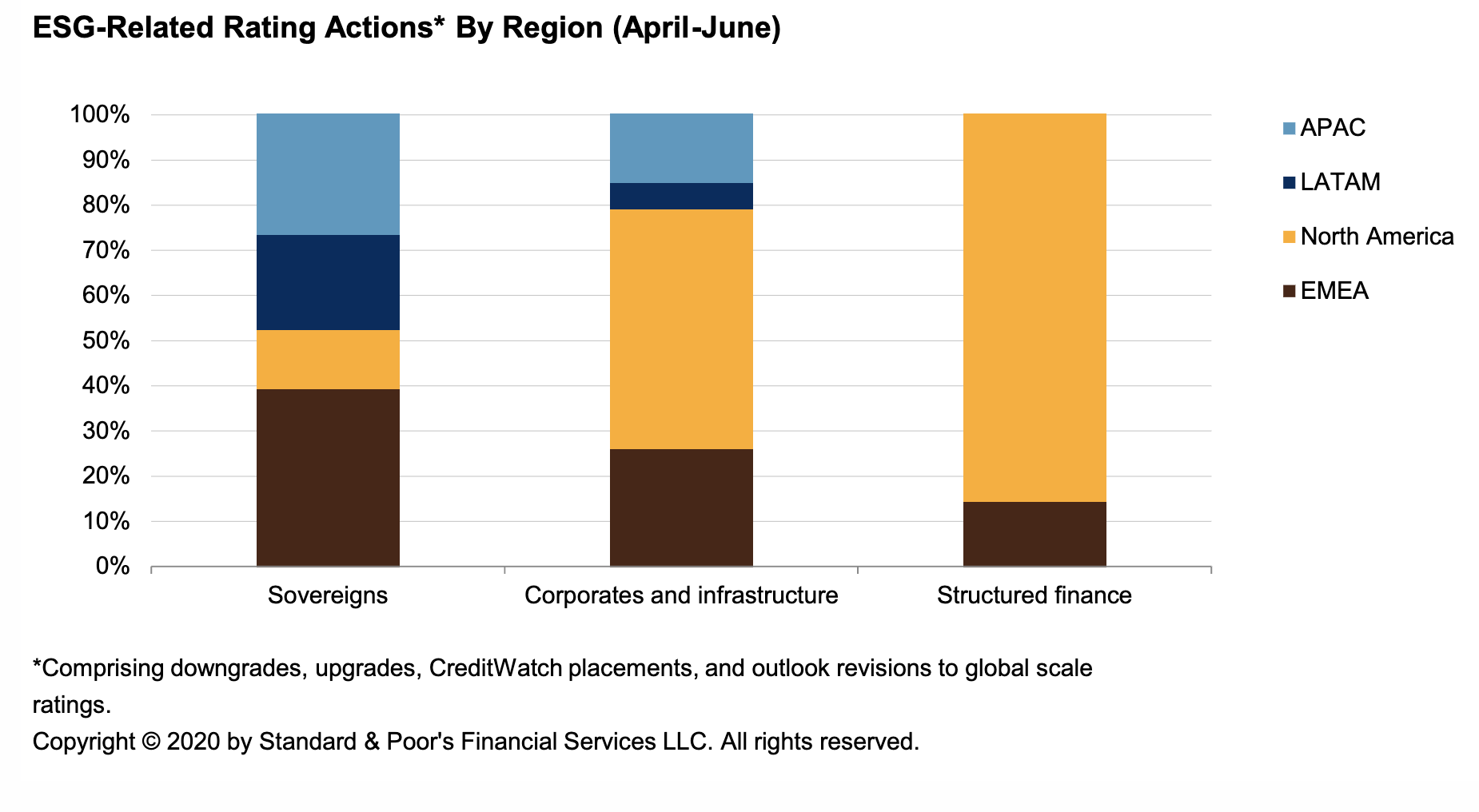

The ESG Pulse: The Search For A Vaccine

Not surprisingly, the bulk of ESG-related rating actions in June continued to stem from the COVID-19 pandemic, though there were a number related to governance factors. There have been some signs of business restoration in parts of the U.S., as well as in other countries that experienced a COVID surge earlier in the year and where the number of new cases is now tapering off.

—Read the full report from S&P Global Ratings

Nextera's Robo Retains Status As Highest-Paid Utility CEO In 2019

NextEra Energy Inc. Chairman, President and CEO James Robo retained the top spot among the 10 highest-paid utility executives in 2019. Nearly all but one of the highest-paid chief executives in the U.S. utilities industry reported a boost in compensation in 2019, according to an S&P Global Market Intelligence analysis of the year. Robo received total adjusted compensation of $21.0 million in 2019, including $11.7 million in stock awards, for an overall 2.3% increase from $20.5 million in 2018. NextEra also had the highest CEO to median employee pay ratio of 168-to-1, the analysis shows. The median employee's annual total compensation in 2019 was $129,735, the company reported in its proxy statement.

—Read the full article from S&P Global Market Intelligence

COVID-19 Crisis Could Yet Hamper Energy Transition: Norway's Energy Minister

Speaking during Norway's online ONS conference, Bru, who became petroleum and energy minister in Western Europe's largest oil producing state in January, said it was too early to conclude whether or not the COVID-19 crisis would speed a transition to a lower-carbon world. She defended Norway's granting of temporary tax breaks to oil and gas companies in response to the crisis, saying such companies were needed in the energy transition effort, for example in offshore wind, and that moving too fast to curb oil and gas could be counter-productive.

—Read the full article from S&P Global Platts

Colorado Looks To Incorporate Environmental Justice Into New Oil, Gas Rules

As Colorado implements and defines a slate of new rules affecting the states' oil and natural gas industries, officials are also looking to tackle "environmental justice" issues, forcing companies seeking well permits to take into account the proximity and number of minority and low-income residents living nearby, which would make it the first major oil-producing state to do so.

—Read the full article from S&P Global Platts

Watch: Market Movers Asia, Aug 31- Sept 4: Transport Fuels Demand Outlook Remains Weak; Japan's Energy Policy in Focus

The highlights in Asia this week, with S&P Global Platts Associate Editor for Asia LNG Masanori Odaka: Japan's renewable energy and decarbonization policies to remain in place despite Prime Minister Shinzo Abe's resignation, Surge in new coronavirus cases dampens transport fuels demand recovery, Japan's gasoline and gasoil demand in August lowest in decades, Asia spot LNG prices seek direction ahead of winter peak season, and Hurricane concerns in the US brew mixed sentiments in Asian petrochemical markets.

—Watch and share this Market Movers video from S&P Global Platts

NewOcean To Scale Back Oil Business As COVID-19, Low Oil Prices Dent Prospects

Hong Kong-listed NewOcean Energy Holdings Limited said Aug. 31 that the coronavirus pandemic and the slump in global oil prices had adversely affected its business segments including its oil bunkering activities in Singapore and Hong Kong, forcing the company to scale down its operations. The company's segments include oil/chemical products business, sales and distribution of LPG, sales of electronic products as well as sales and distribution of natural gas.

—Read the full article from S&P Global Platts

Analysis: Rebounding Offshore Gas Production, Weaker Demand Reverse Henry Hub Cash Rally

Henry Hub cash prices were down sharply Aug. 31 as offshore and Gulf Coast gas production previously shuttered by Hurricane Laura continued to come back online, pressuring the regional supply-demand balance. In intraday trading, the benchmark price tumbled over 20 cents to $2.25/MMBtu. On Aug. 24, as Laura, a massive Category 4 storm, ravaged the Louisiana Gulf Coast, a precipitous drop in offshore gas production lifted prices to their highest in nine months at $2.52/MMBtu, S&P Global Platts data shows.

—Read the full article from S&P Global Platts

Analysis: Rebounding Offshore Gas Production, Weaker Demand Reverse Henry Hub Cash Rally

Henry Hub cash prices were down sharply Aug. 31 as offshore and Gulf Coast gas production previously shuttered by Hurricane Laura continued to come back online, pressuring the regional supply-demand balance. In intraday trading, the benchmark price tumbled over 20 cents to $2.25/MMBtu. On Aug. 24, as Laura, a massive Category 4 storm, ravaged the Louisiana Gulf Coast, a precipitous drop in offshore gas production lifted prices to their highest in nine months at $2.52/MMBtu, S&P Global Platts data shows

—Read the full article from S&P Global Platts

BP’s Summer Surprise Shines Spotlight On Stranded Oil, Gas Assets: Fuel For Thought

BP’s bold August strategy move for a faster pivot to cleaner energy shows the extent to which Big Oil has been forced to consider the financial consequences of climate change on fossil fuels.

The major’s much-vaunted shift to become an integrated energy company (IEC) and face the energy transition head-on took some by surprise. The industry’s push into renewable energy, electrification and ever more ambitious pledges to pursue net-zero emission targets has been a slow but steady work in progress. But the COVID-19 pandemic has accelerated fears that oil demand could soon be in terminal decline, and industry moves to cut long-term price forecasts have been a wake-up call.

—Read the full article from S&P Global Platts

Listen: A Region Of Promise And Uncertainty: A Dive Into Eastern Mediterranean Natural Gas And LNG Markets

Ira Joseph, head of gas and power for S&P Global Platts Analytics, and Ryan Ouwerkerk, manager of Americas natural gas pricing for S&P Global Platts, are joined by Samer Mosis, Platts team lead, EMEA LNG, to discuss a range of short- and long-term dynamics impacting the Eastern Mediterranean and Middle Eastern gas markets, from Tuna-1 to the future of Leviathan, Egyptian LNG and Cypriot markets.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language