Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 19 Oct, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Of the long-term effects that the coronavirus pandemic, pushing women out of the workforce may be one of the direst. Women have historically shouldered a disproportionate amount of responsibility providing family care. As daycares, schools, nursing homes, and offices have closed or reduced their capacity during the current crisis, many female employees at U.S. companies could be forced to abandon their careers to care for children or aging relatives and loved ones.

Companies have responded by rapidly accelerating the expansion of their family-care benefits in the absence of federal mandates for such policies, according to new research from S&P Global and AARP entitled “Something’s Gotta Give.” Despite the pandemic generating greater flexibility around work schedules and work locations to support employees juggling family and career responsibilities, women could be set back significantly in the labor force.

While 58% of large U.S. companies that garner more than $1 billion of revenue offer paid parental leave, compared to 42% of smaller companies, only 10% of total companies offer 14 weeks or more—and only 19% of large companies offer a minimum of two weeks of paid secondary care leave for the person who is not leading the families’ childcare duties, according to research. The report is based on the results of an S&P Global/AARP survey of nearly 1,600 individuals who work for a firm with more than 1,000 employees, of which fifty-one percent of survey respondents were male and 49% were women. The research focused on parents with children aged five or younger who have stayed with the same company since their youngest child was born, and caregivers who provide unpaid care to a friend or relative aged 18 years or older.

More than half of parents and family caregivers are spending more time at home taking care of children or caring for adults since the pandemic began, according to the report.

The greater time spent on caregiving has increased people’s stress levels. Approximately 73% of family caregivers reported an increase in stress due to the pandemic's impact on their work-life responsibilities.

"The pandemic has highlighted an opportunity for the U.S. private sector to lead the way in adopting more flexible family leave policies, which we noted have a higher impact on women's participation in the labor force," Martina Cheung, President of S&P Global Market Intelligence, said in a statement. "Implementing flexible leave policies, as well as a culture that embraces work-life balance, is vital to support a more inclusive workforce and achieve collective economic benefits."

"One in six Americans were already juggling work and family caregiving responsibilities prior to COVID-19, and their unique challenges have only expanded as they try to keep themselves and their loved ones safe," Nancy LeaMond, AARP Executive Vice President and Chief Advocacy & Engagement Officer, said. "Supporting these dedicated employees with caregiver-friendly workplace policies will help foster a stable and healthy workforce, throughout the pandemic and beyond."

Today is Monday, October 19, 2020, and here is today’s essential intelligence.

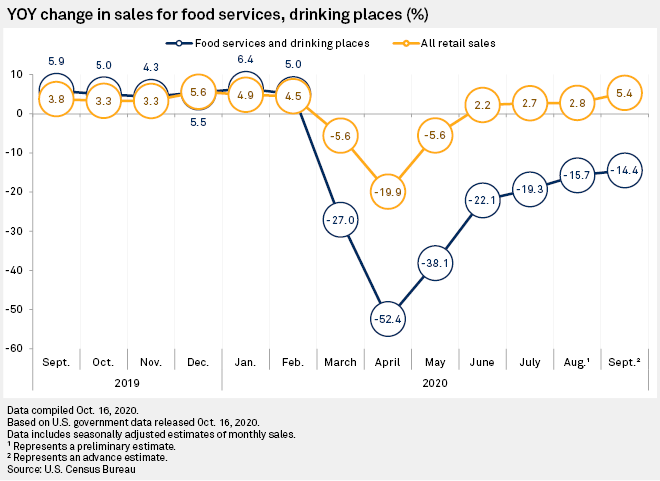

Dining out: Restaurant sales warm in September but lack heat of previous months

Sales at U.S. bars and restaurants in September continued to rebound from pandemic-induced drops earlier in the year, though the pace of growth remained slower than previous months. Food services and drinking places also added jobs at a muted pace in September, portending that a more drawn-out recovery could be in store for the restaurant industry. The restaurant industry has seen different sectors fare better than others as companies focus on how best to operate in a changing environment. Meanwhile, shares of most of the biggest publicly traded restaurants rose in the month ended Oct. 15.

—Read the full article from S&P Global Market Intelligence

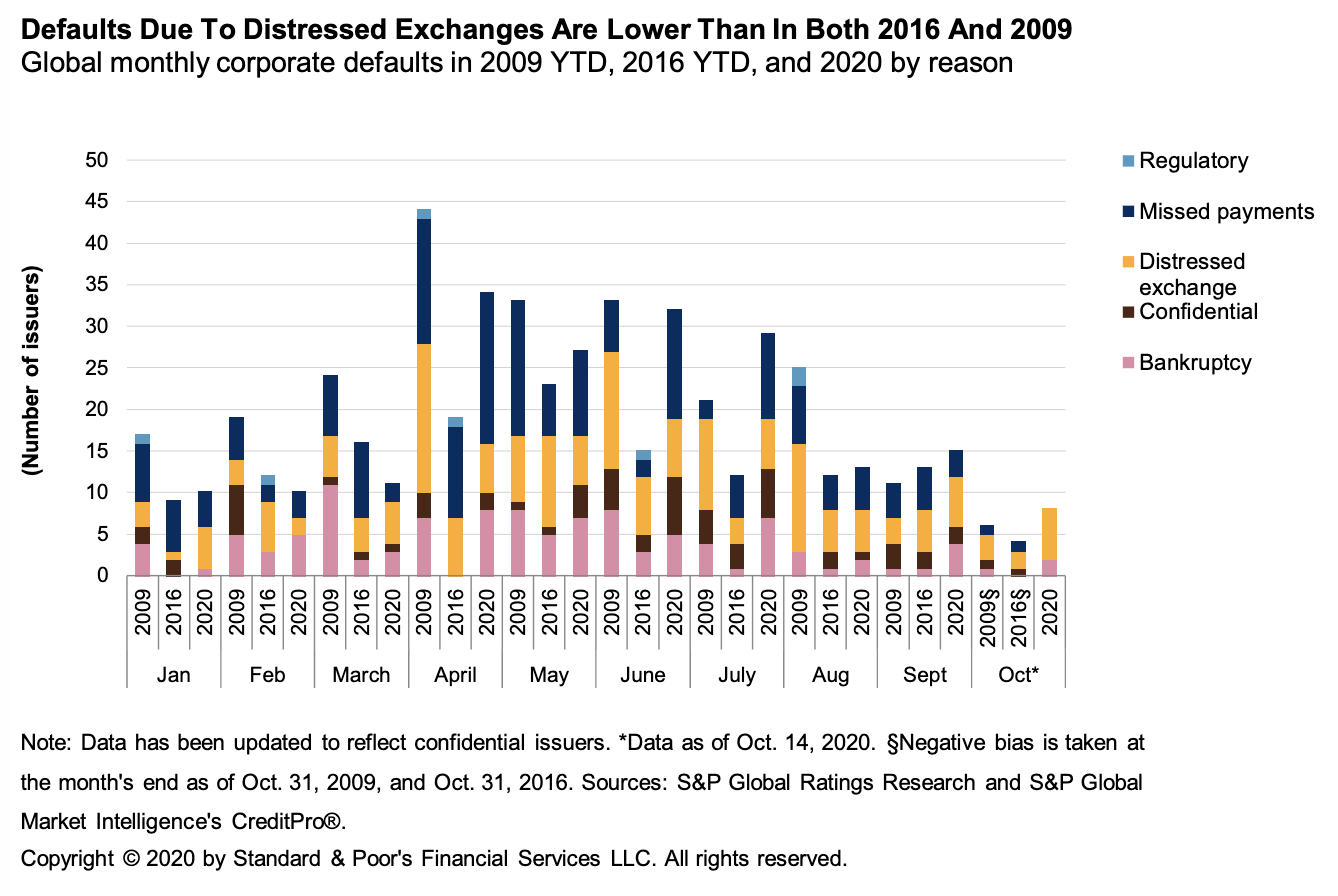

Default, Transition, and Recovery: Distressed Exchanges Boost Corporate Defaults In The Second Half Of 2020

The global corporate default tally has reached 189 so far in 2020, after five companies defaulted since S&P Global Ratings’ last report. While missed interest and principal payments lead corporate defaults so far in 2020, spread compression in the summer has helped refinancing opportunities in general, along with distressed exchanges, which have increased in recent weeks.

—Read the full report from S&P Global Ratings

Credit Trends: U.S. Corporate Downgrades Fell To Pre-Pandemic Levels In The Third Quarter

The number of U.S. corporate downgrades fell by 74% in the third quarter to 107, its lowest level since fourth-quarter 2018. The U.S. corporate upgrade tally rose to 43 in the quarter, matching third-quarter 2019's total, as economic growth rebounded. Downgrade risk as measured by negative bias (the percentage of issuer credit ratings with negative outlooks or on CreditWatch with negative implications) for U.S. speculative-grade companies fell by 5 percentage points to 47%. Weakness persists at the lowest rating levels as we expect the recovery for many sectors to last into 2023: Companies rated 'B-' and lower accounted for 53% of downgrades in the quarter, and companies rated 'CCC+' and below have a negative bias of 89%.

—Read the full report from S&P Global Ratings

October retail market: US sales jump; bankruptcies pause after record highs

U.S. retail sales rose for the fifth month in September, smashing expectations for the month, though experts caution that the pace of recovery could level off in the coming weeks. Meanwhile, no retailers entered bankruptcy proceedings in late September through mid-October in stark contrast to a year that has already seen more filings than any since 2010, according to an S&P Global Market Intelligence analysis.

—Read the full article from S&P Global Market Intelligence

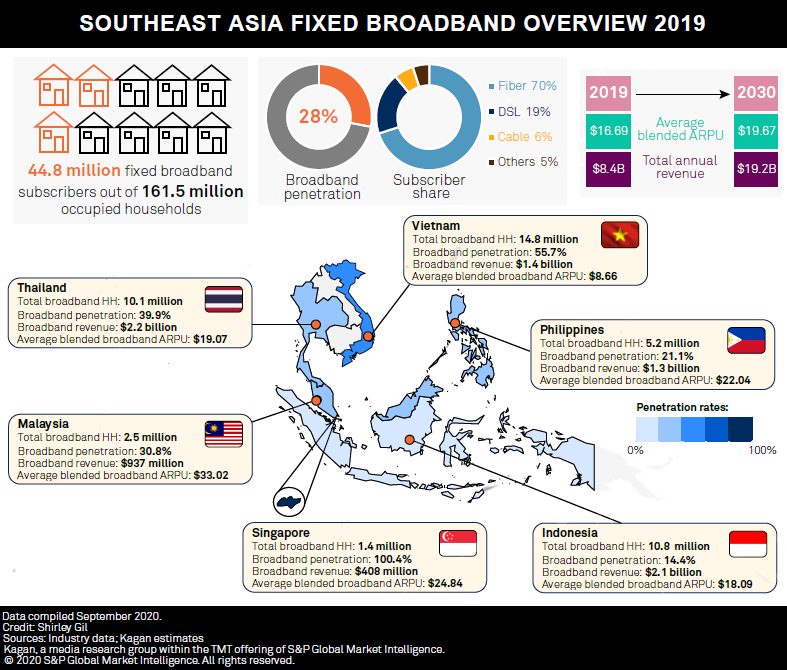

Gradual yet steady broadband growth awaits emerging markets in Southeast Asia

Government initiatives, fiber build-outs and migration as well as faster broadband speeds at lower costs have been the main drivers of Southeast Asia's broadband growth, which reached an estimated 44.8 million broadband households in 2019. Kagan estimates the region generated $8.39 billion in broadband revenue and had an average blended average revenue per user of $16.69 in 2019. However, limited infrastructure in far-flung areas and low purchasing power has kept broadband penetration low, covering a mere 27.7% of 161.5 million households in Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam.

—Read the full article from S&P Global Market Intelligence

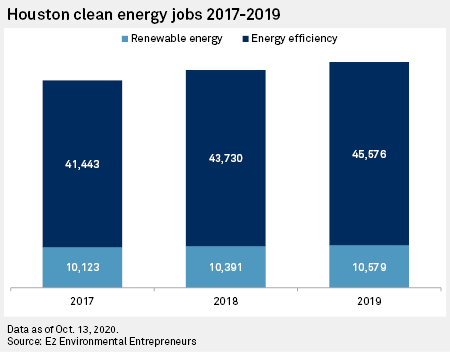

Houston, America's fossil fuel capital, braces for the energy transition

Perhaps more than any major city in America, Houston faces fundamental questions about its economy and its future in the global energy transition. Some 4,600 energy companies, including more than a dozen Fortune 500 companies, serve as the foundation of the city's economy.

—Read the full article from S&P Global Market Intelligence

Eversource strategy chief sees role for green hydrogen, geothermal in Northeast

Decarbonizing New England's natural gas grid will require a portfolio of solutions that likely includes green hydrogen and geothermal energy rather than systemwide electrification, according to Roger Kranenburg, vice president for energy strategy and policy at Eversource Energy. Kranenburg sees electrification of heating playing some role in achieving Massachusetts' goal of reducing greenhouse gas emissions by 80% from 1990 levels by 2050. However, Kranenburg sees Eversource evolving into a "regional energy company" that delivers a range of low-carbon energy to end users, and the right solution might not always be electrification.

—Read the full article from S&P Global Market Intelligence

Satellite monitors will soon leave methane emissions 'nowhere to hide'

Advances in satellite-based monitoring of methane emissions will mean far more scrutiny of the oil and gas industry by policymakers and investors, according to a new study out of Columbia University's Center on Global Energy Policy. Methane, the main component of natural gas, is a potent greenhouse gas and the second-biggest contributor to climate change behind carbon dioxide. But the difficulty of accurately detecting the oil and gas sector's methane emissions has been a critical challenge for the industry and regulators.

—Read the full article from S&P Global Market Intelligence

CFTC completes rule on position limits with more tweaks for energy sector

The US Commodity Futures Trading Commission voted 3-2 to finalize a regulation setting federal speculative position limits on physical commodity derivatives, further adjusting the regulation to answer concerns of energy interests. The final version expands upon the exemptions to the limits in order to better encompass hedging practices used by commercial end users including energy companies.

—Read the full article from S&P Global Platts

Listen: How CFTC climate risk warnings could impact US energy sector

US oil and gas producers were already facing a tough investment climate by the time this spring's price crash and demand plunge decimated capital spending plans. Layered on top of this near-term crisis is a much bigger, longer-term threat: climate change. A recent Commodity Futures Trading Commission report argues climate change could pose a major risk to the stability of the US financial system. It backs an economy-wide carbon price and recommends that banks pilot the use of stress tests -- both of which could have big impacts on the US energy sector. Capitol Crude spoke with Kyle Danish, a partner at Van Ness Feldman and a nonresident senior associate at the Center for Strategic and International Studies about the report and its potential impacts for the US oil, natural gas and power sectors. Stick around after the interview for the Market Minute, a look at near-term oil market drivers with Platts senior editor Jordan Blum.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Platts

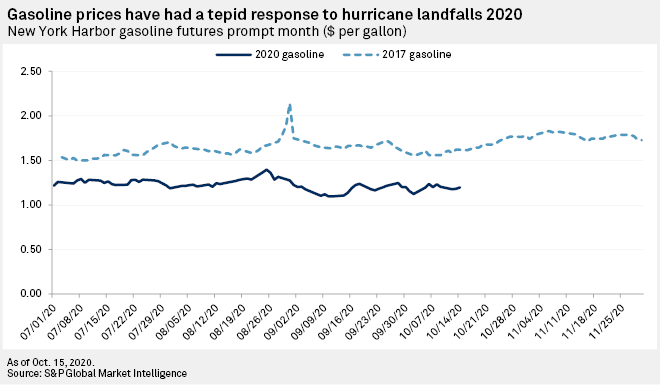

Analysts sound profit warning after hurricanes fail to lift gasoline prices

Atlantic basin tropical storms that would normally send gasoline prices soaring have had relatively little effect on a U.S. petroleum market still in the throes of a pandemic, demonstrating the magnitude of the supply glut that could linger through the end of the year. "We worry that another round of negative EPS revisions may be in store given how margins are shaping up so far in [the fourth quarter]," Tudor Pickering Holt & Co. analysts wrote Oct. 13. Since the beginning of October, they said, average U.S. Gulf Coast gasoline cracks, an indicative measure of the profitability of refining crude oil into gasoline, are up 45.3% from the $6.64-per-barrel third-quarter average. But they warned that those profits tend to fade as winter approaches "especially … when rough weather crimps demand."

—Read the full article from S&P Global Market Intelligence

Coronavirus fallout spurs M&A across US oil and gas sector

Soft oil prices, strained balance sheets and a lack of support from outside funding sources have left many US independent oil and gas companies close to bankruptcy. For some, joining forces may be a way to stay solvent. Most independent producers entered 2020 on unstable footing. The oil price crash and collapse in demand as a result of the COVID-19 pandemic drastically worsened their predicament, and a slow economic recovery has left many facing massive financial and operational cuts well into 2021.

—Read the full article from S&P Global Platts

Global PVC supply squeeze reaches Latin America on feedstock shortages

Orbia, the largest polyvinyl chloride producer in Latin America, will reduce rates at its PVC plants in Mexico and Colombia "in the coming weeks" because of a squeeze in upstream vinyl chloride monomer supply, according to a customer letter from its Vestolit PVC subsidiary seen Oct. 16 by S&P Global Platts. The letter said a supplier had notified Vestolit that "due to unexpected external failures they have been experiencing operational outages in their production plants." In addition, the company's main supplier has a VCM turnaround slated for November, Veslolit said in the letter, dated Oct. 6. Orbia did not respond to a request for comment.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language