Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 12 Oct, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Big Tech has found itself the object of unwelcome scrutiny on both sides of the Atlantic. These large, primarily U.S.-based companies have long drawn the ire of European regulators, who consider the companies’ all-encompassing platforms to be anti-competitive and potentially monopolistic. But U.S. regulators are now also casting a critical eye at Amazon, Facebook, Apple, and Google.

The U.S. House of Representatives published a 449-page report on Oct. 6 claiming that these four companies have abused their market power. The report, which emerged from the Democrat-controlled antitrust subcommittee, recommended that U.S. antitrust law be rewritten to limit the power of these firms.

According to the report, “they (Facebook, Amazon, Apple, and Google) not only wield tremendous power, but they also abuse it by charging exorbitant fees, imposing oppressive contract terms, and extracting valuable data from the people and businesses that rely on them.” The House report recommends that the companies be forced to restructure so that different lines of business be kept under different management, if not sold off altogether.

“Antitrust statutes reflect a time when markets were relatively stable because technology was relatively stable,” the Brookings Institution said in a recent report, published in support of more regulation for Big Tech. “Today, the rapid pace of digital technology means companies can move rapidly to advantage themselves by exploiting consumers and eliminating potential competition.”

Although S&P Global Market Intelligence reported that aggressive action is unlikely given the current partisan division in Washington, the threat of antitrust reforms may encourage more restraint from the Big Tech firms.

"I think they're going to be more cautious in their approach in acquiring firms and certain types of conduct," John Yun, former acting deputy assistant director in the economics bureau in the antitrust division at the FTC, told S&P Global Market Intelligence after the House report was released. "That could be a good thing if they're right on the edge of what is anticompetitive … or it could be, a little bit chilling of innovation in that what they were doing is perfectly legitimate and they were actually creating value for consumers and advertisers.”

Washington is widely seen as playing catch-up to Brussels when it comes to regulation of Big Tech and antitrust enforcement. The European Commission is known to be preparing an aggressive package of legislation known as the the Digital Services Act intended to curtail the behavior of companies that control platforms considered indispensable to businesses and consumers. According to reports, the list of companies considered to be “gatekeepers” of this type is composed primarily of U.S.-based companies. This fact has already attracted the attention of U.S. trade representatives of the Trump Adminstration and could result in additional tariffs on European goods in the U.S.

While President Trump has been occasionally critical of Big Tech companies, especially Amazon and Facebook, his tax policies and opposition to antitrust enforcement have allowed these companies to achieve record profits with minimal oversight. Meanwhile Mr. Trump’s Democratic opponent, former Vice President Joe Biden, has proposed a 15% minimum tax rate for U.S. companies which some analysts believe represents a greater threat to these companies than enhanced antitrust legislation.

Despite these differences, people and political action committess associated with Big Tech firms have proven far more likely to donate to Mr. Biden’s campaign than Mr. Trump’s. Alphabet, Amazon, Microsoft, Facebook, and Google all appear among former Vice President’s top 10 donor contributors. Meanwhile, donations from Big Tech to Republican politicians are far lower, even when compared with previous election cycles.

Today is Monday, October 12, 2020, and here is today’s essential intelligence.

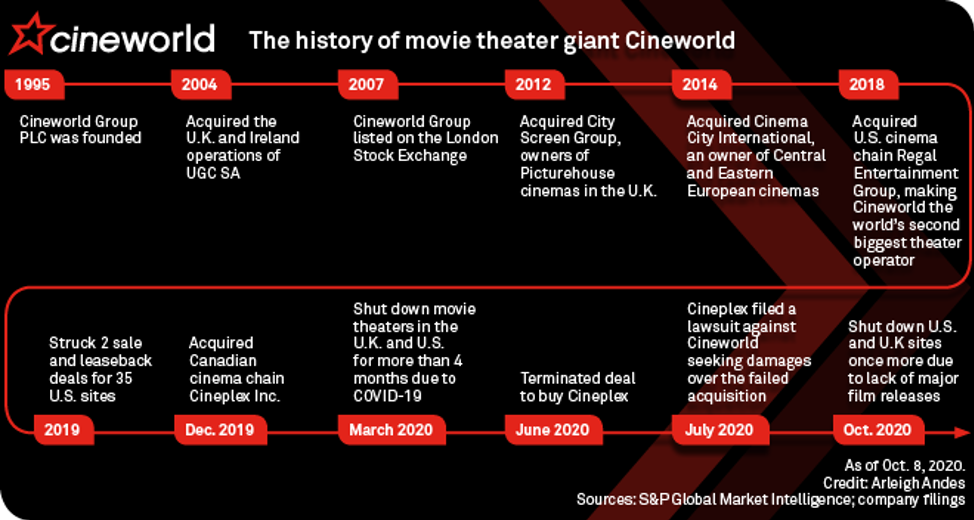

Cineworld Must Dig Deep To Survive Closures, Avoid Bankruptcy – Analysts

Regal cinemas owner Cineworld Group PLC may require up to $500 million in additional liquidity to survive its latest round of closures and avoid bankruptcy, according to analysts. The world's second largest movie theater chain behind AMC Entertainment Holdings Inc. shut venues in its core U.S. and U.K. markets on Oct. 8. The decision affects 668 sites, including 546 Regal sites in the U.S., that together account for 88% of the exhibitor's global footprint. Cineworld's share price halved on the news.

—Read the full article from S&P Global Market Intelligence

Assessing Gold’s Ascent

What’s driving demand for gold this year? S&P DJI’s Jim Wiederhold and CME Group’s Blu Putnam explore what’s pushing gold prices up and how investors are putting the precious metal to work in portfolios.

—Watch and share this video from S&P Dow Jones Indices

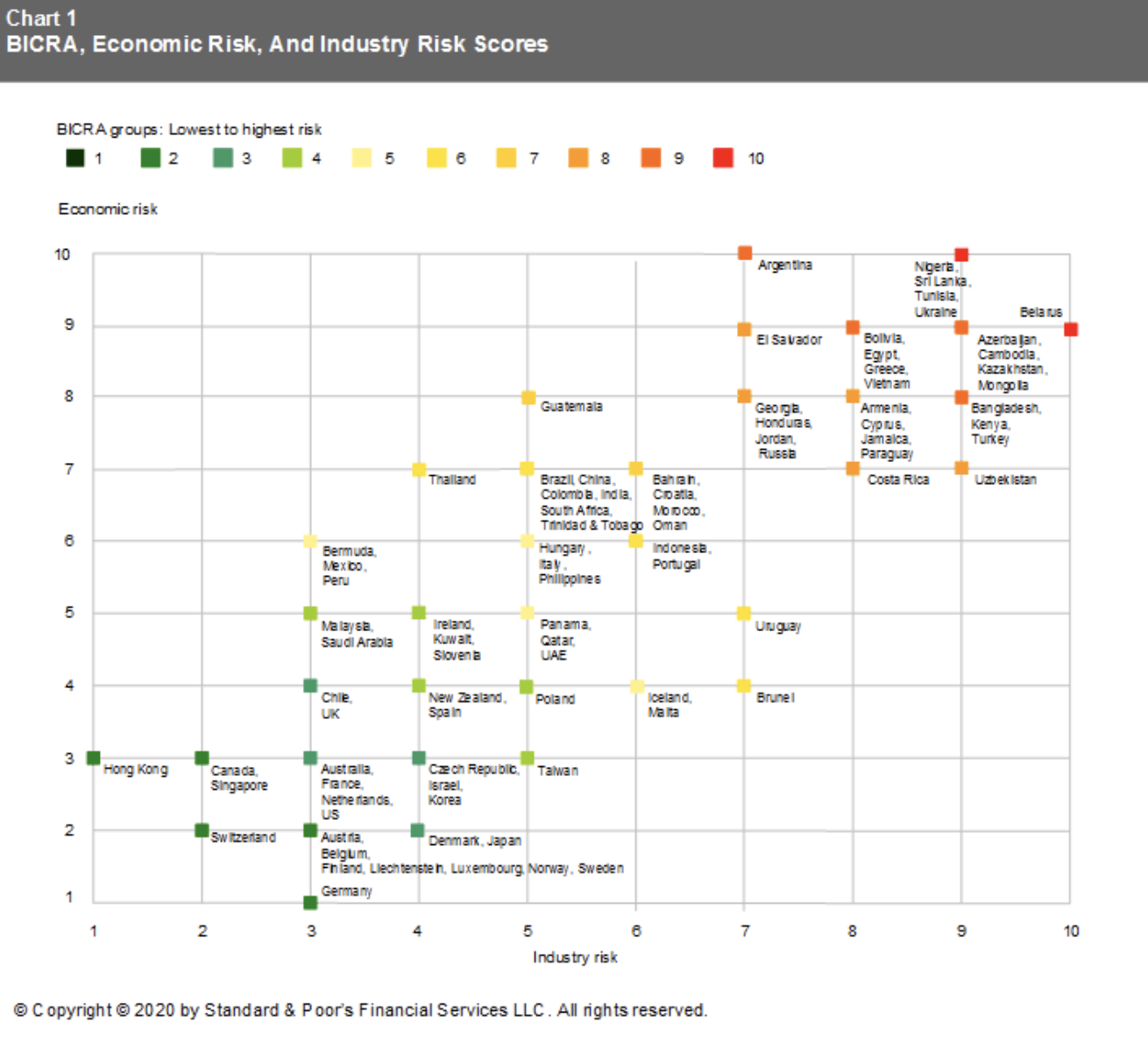

Banking Industry Country Risk Assessment Update: September 2020

This article presents updates to S&P Global Ratings' views on the 87 banking systems that it currently reviews under its Banking Industry Country Risk Assessment (BICRA) methodology (see the chart above and the tables that are included). This article also present government support assessments, as well as economic and industry risk trends, for those banking systems.

—Read the full report from S&P Global Ratings

PE Firms Must Be Prepared To Face Challenges Across Each Fund Vintage

Private equity firms must be prepared to face challenges "every 10 years" and across every fund vintage, Gilles Collombin, partner at mid-market firm Charterhouse Capital Partners LLP told listeners at the virtual British Pvt. Equity and Venture Capital Association Ltd summit Oct. 7. The global financial crisis was "painful for everybody," and the asset class began changing and adding value creation teams, moving away from the focus on the "L of leveraged buyout, a lot of leverage," he said.

—Read the full article from S&P Global Market Intelligence

$400M Fine Reinforces View Of Citi's Expensive Stay In Regulatory Doghouse

Regulators announced enforcement actions and a $400 million fine against Citigroup Inc., putting an initial price tag on the bank's effort to respond to renewed pressure to fix its risk management and internal controls. Analysts expect the bill to mount in the coming periods. The bank had already highlighted $1 billion in extra spending on its infrastructure and controls that it planned for this year, following a mistaken disbursement of $900 million to Revlon Inc. creditors as the administrator of a loan to the cosmetics company. CFO Mark Mason said controls and infrastructure are management's top priority in a company presentation made shortly after a media report that the departure of CEO Michael Corbat had been hastened by regulators preparing the consent orders.

—Read the full article from S&P Global Market Intelligence

China Payments Giants May Face Limited Risk, Tweak Growth Plans As U.S. Mulls Ban

Ant Group Co. Ltd. and Tencent Holdings Ltd. are likely to face a limited earnings impact as Washington is reportedly exploring restrictions on their mobile payments platforms in the U.S., although the Chinese companies' overseas expansion strategies may lean more toward Southeast Asia and other emerging markets going forward.

—Read the full article from S&P Global Market Intelligence

COVID-19 Accelerating Purpose And Responsibility Trend In Private Equity

Purpose, responsibility and transparency have been on the private equity agenda for a number of years, but the trend is accelerating during the COVID-19 pandemic, according to Anna Grotberg, associate partner at EY- Parthenon. “We’ve had increasing demand from LPs in terms of transparency and accountability, particularly around ESG and ESG policies," she told delegates at the virtual British Pvt. Equity and Venture Capital Association Ltd. Summit on Oct.7.

—Read the full article from S&P Global Market Intelligence

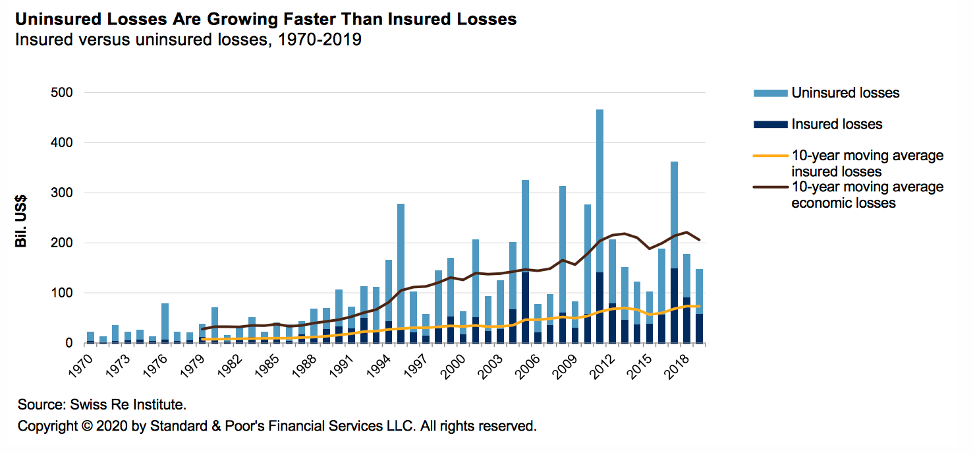

COVID-19 Highlights Global Insurance Protection Gap On Climate Change

As the COVID-19 pandemic spread from region to region, it has drawn attention to a hitherto unnoticed protection gap in insured and noninsured property/casualty (P/C) risks. The problem is global, and even affected mature economies, where insurance penetration (insurance premium as a percentage of GDP) is typically high. In June 2020, the International Monetary Fund indicated global economic losses from COVID-19 of about $12 trillion over 2020-2021 while Munich Re estimates insured property/casualty losses at $30 billion-$107 billion for 2020. Moreover, S&P Global Ratings expects global GDP to fall by more than 2.5% in 2020.

—Read the full report from S&P Global Ratings

Emerging Markets' Steel Demand To Buoy Coking Coal Amid Confused ESG Concern

Coking coal executives have warned about conflated environmental perceptions between thermal and coking coal, as COVID-19 recovery stimulus measures are buoying Pembroke Resources Pty Ltd.'s confidence as it gears up for construction on its A$1 billion Olive Downs' project in central Queensland. Private equity-backed Pembroke announced on Sept. 29 it had received mining leases, the last major approvals needed to start the 12- to 18-month mine construction phase for the 838 million-tonne JORC resource Olive Downs project, slated to start production at 4.5 million tonnes per year before eventually ramping up to 15 Mt/y over time.

—Read the full article from S&P Global Market Intelligence

Duke Energy Targets Net-Zero Methane Emissions At Gas Utilities By 2030

Duke Energy Corp. aims to achieve net zero methane emissions from its gas utility business by 2030, an ambitious deadline that vaults the Charlotte, N.C.-based company ahead of many of its peers on the issue of tackling fugitive methane. The company announced the target on Oct. 9, roughly a year after Duke said it would attempt to hit net-zero emissions across its entire business by 2050. To meet the goal, the company plans to embrace new technologies, step up damage reduction and leak survey initiatives, fine tune operations, and address remaining emissions through methane offsets through things like renewable natural gas, or RNG.

—Read the full article from S&P Global Market Intelligence

IEA's Lower Emissions Steel Plans Center On New Tech, Carbon Capture

The International Energy Agency expects the steel industry to depend more on technological enhancements, scrap recycling and carbon capture and storage to cut emissions by 50% amid ambitious climate goals, with significant coal use persisting through 2050 even with growth in hydrogen.

—Read the full article from S&P Global Platts

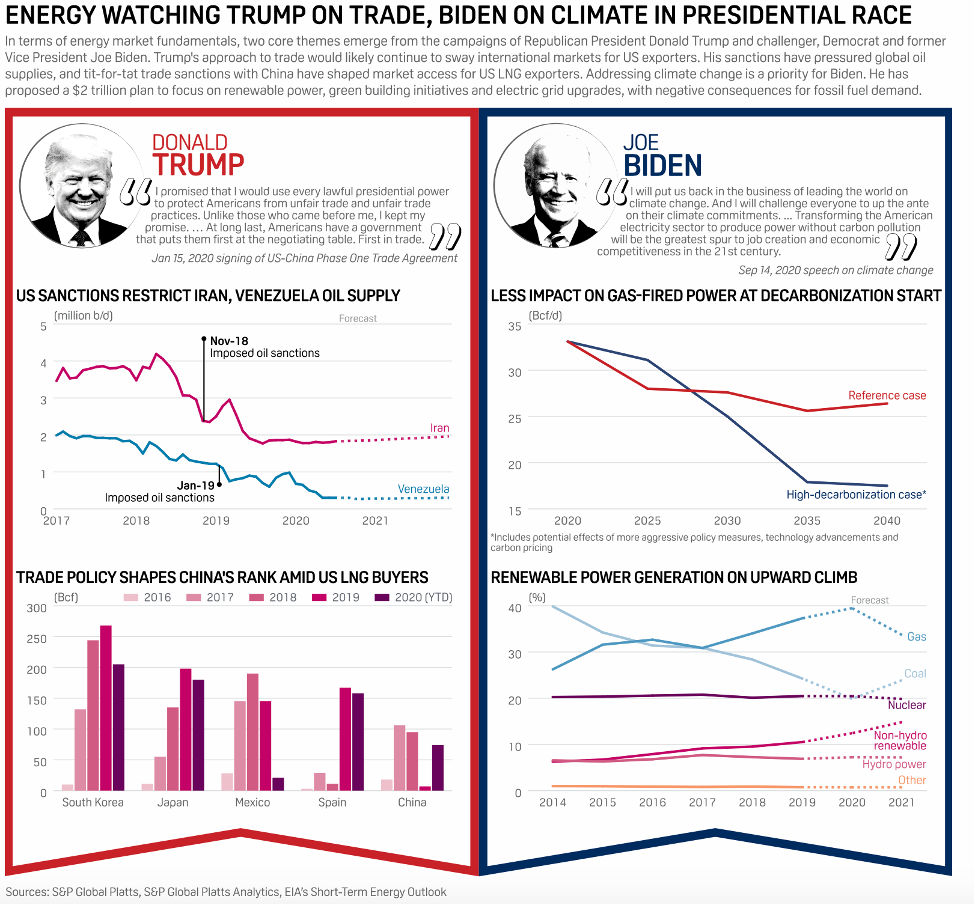

U.S. ELECTIONS: Wide Range Of Energy Market Impacts At Play In Race For White House

Stakes are high across the US energy and commodities sectors as President Donald Trump and former Vice President Joe Biden volley to shape energy, climate and trade policy for the next four years. Biden has called for a swift pivot to clean energy while Trump makes the case for the country's abundant fossil fuel resources.

—Read the full article from S&P Global Platts

U.S. ELECTION: Biden Win Could Spark Revision, Phase-Out Of Section 232 Steel, Aluminum Tariffs

The implementation of the Section 232 steel and aluminum tariffs under President Donald Trump could be revised or phased out under a new administration if Democratic contender Joe Biden wins the US presidential election in November, but any changes to the trade program would not be immediate, according to trade experts.

—Read the full article from S&P Global Platts

OPEC+ Improves Compliance In Sep But Catch-Up Cuts Remain Scant: Platts Survey

OPEC and its allies sharpened their output quota compliance to 99% in September, led by the Gulf states, but discipline from Russia and some African producers continued to slip, the latest S&P Global Platts survey found. Compensation cuts by 13 producers that had previously violated their quota levels remain scant, putting pressure on the alliance to do more to prop up an oil market still reeling from the impact of the coronavirus.

—Read the full article from S&P Global Platts

Analysis: Festive season adds to Indian petrochemicals sector recovery as economic activities resume

An Indian petrochemicals sector recovery, post reopening of the economy from COVID-19 lockdowns, has received a boost from festive demand and the offset of seasonal monsoons. Products like polypropylene, polyethylene, solvent-MX, acetic acid, vinyl acetate monomer, acrylonitrile, and styrene have seen an uptick in demand from July onward as economic activities resumed, and further in September, owing mainly to the start of festive season and the end of monsoons.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language