Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 1 Oct, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

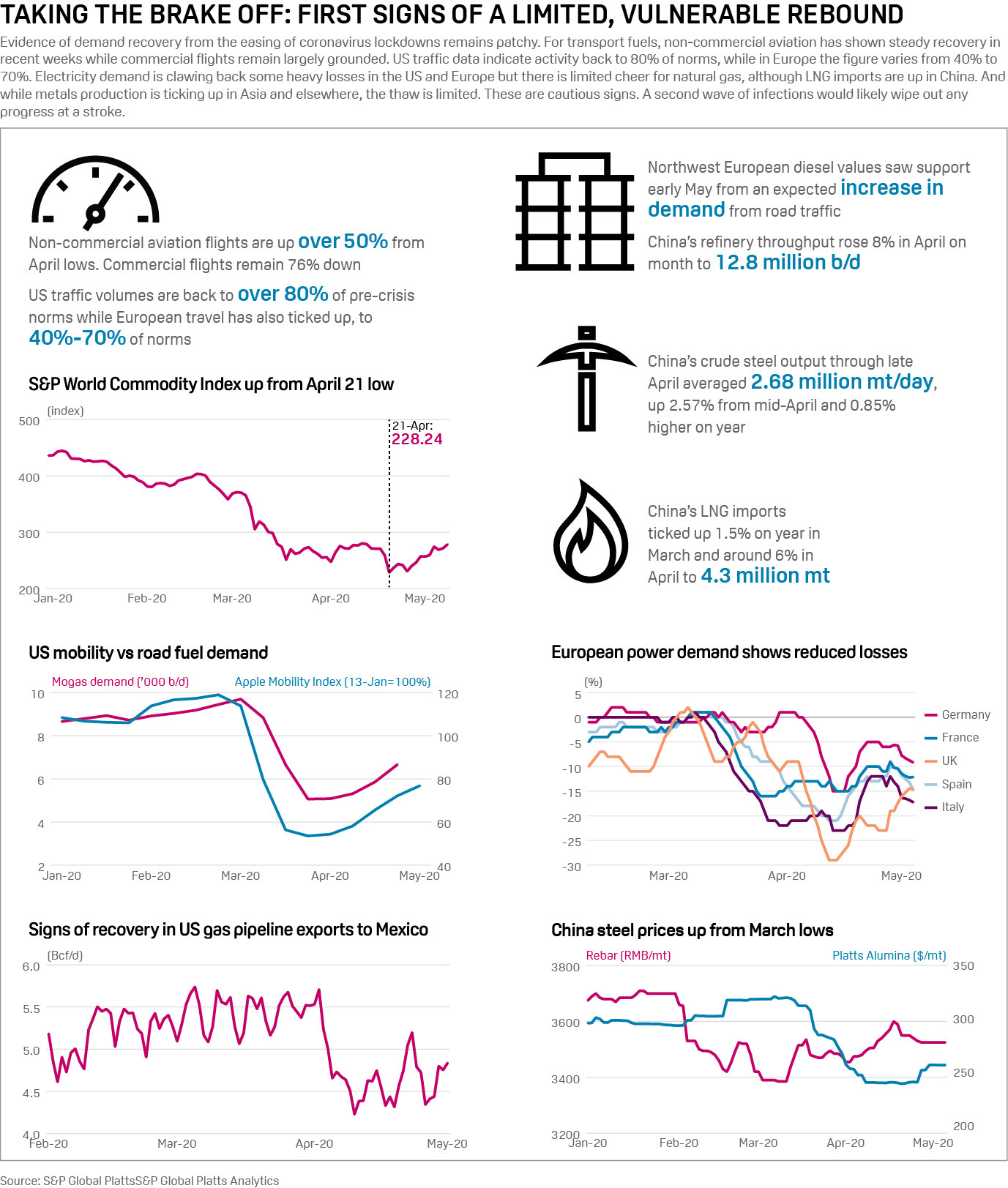

Evidence of diverging economic recoveries is starting to surface around the world, with many larger, developed countries faring better than their smaller, emerging counterparts.

“While there is a tremendous variance of recovery prospects across different corporate sectors, we continue to believe it will take until well into 2022 or, in some cases, 2023 and beyond for many sectors to recover credit metrics,” S&P Global Ratings said in its updated COVID-19 sector recovery expectations this week. “The return to pre-crisis levels of operations and credit metrics is unlikely to be smooth or swift, and will depend on how governments, businesses, and consumers behave.”

Across the Asia-Pacific region, the worst of the pandemic’s economic effects have passed, making for a “K-shaped” recovery, according to S&P Global Ratings’ APAC Credit Conditions Committee. The public health emergency remains a primary risk while economic activities in the region are gradually regaining traction.

The U.S. economy has shown signs of resilience, apparent in the fact that credit conditions are largely favorable for many nonfinancial corporate borrowers due to the Federal Reserve’s ample monetary policy, according to S&P Global Ratings. Still, risk is compounding for state and local governments as budget pressures build and revenues decline.

The unprecedented bond issuance that played a role in lifting U.S. companies’ cash holdings to record levels in the second quarter dwindled in the third quarter, according to S&P Global Market Intelligence. This appears to mark an end to the “dash for cash” propelled by the coronavirus crisis.

Meanwhile, the world’s biggest economy has rebounded better than many observers expected.

“Federal fiscal stimulus has spurred consumer spending, which accounts for about 70% of the U.S.’s $21 trillion GDP, and the housing market is strong, as historically low interest rates entice buyers. Moreover, waves of new COVID-19 outbreaks in some states haven’t hampered economic activity as much as we’d expected,” S&P Global Ratings’ Chief U.S. Economist Beth Ann Bovino said. “That said, there are signs that activity will slow as the country transitions to autumn, particularly as the U.S. enters flu season with no COVID-19 vaccine. And the recovery may face more hurdles now that extended federal unemployment benefits have expired and job gains have slowed.”

Elsewhere in North America, Canada’s economy is unlikely to return to pre-pandemic levels before 2022, according to S&P Global Ratings’ Senior Economist Satyam Panday, who forecasts a 5.6% contraction for the country this year.

“Assuming any subsequent waves of infection aren’t overwhelming, we continue to expect an economic recovery tested by several factors following a near-term bounce in aggregate demand and employment as lockdowns ease,” Mr. Panday said. “Lingering scars in the form of virus fears, bankruptcies, and social distancing will limit capacity utilization and growth for one-third of the economy. The unusual nature of this service-centric shock makes the recovery more uncertain than usual.”

Latin America’s challenges regarding economic growth won’t subside when the pandemic is contained in the region, according to S&P Global Ratings’ Latin America Senior Economist Elijah Oliveros-Rosen.

“We now see the region contracting 8.5% this year and expanding 4.5% in 2021, versus down 7.7% and up 3.9%, respectively, in our previous quarterly update,” Mr. Oliveros-Rosen said. “An important downside risk to growth across the region will be the potential for bouts of social instability with implications to investment due to the outsized impact of the pandemic downturn on lower-income households in an already polarized political environment in most Latin American countries.”

Emerging markets face similar uncertainties and are likely to endure a fragile, uneven recovery. S&P Global Ratings now forecasts growth across such emerging markets, excluding China, to decline 6.4% this year, with a 6.2% rebound next year.

“Credit conditions in emerging markets continue showing a gradual improvement stemming from supportive financing conditions, the gradual economic recovery, and the likelihood that a COVID-19 vaccine will be available soon,” S&P Global Ratings’ Emerging Markets Regional Credit Conditions Chair Jose M. Perez-Gorozpe said. “A key developing risk is the phase out of credit forbearance and fiscal stimulus. As these measures are lifted, some of the pandemic's consequences will surface, which could especially stress banks given a potentially rapid deterioration of asset quality, absent additional measures.”

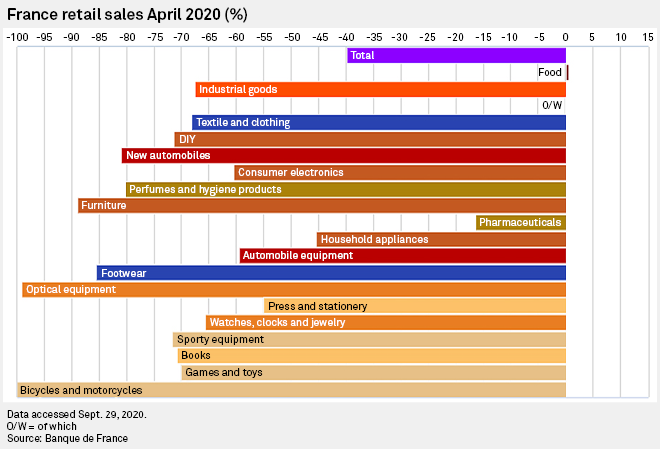

Notably, Europe has bounced back better than many other regions from the debilitating declines it suffered during lockdowns in the spring, but remaining risks include “a resurgence in the virus as winter approaches without a vaccine, the ongoing threat to solvency for companies with weak credit fundamentals, increasing global trade tensions, extended uncertainty inhibiting consumer demand, as well as increasing doubts about whether a U.K.-EU trade deal can be concluded before year-end,” S&P Global Ratings European Regional Credit Conditions Chair Paul Watters said.

Continuing private sector job losses show that the economic pain of the pandemic is nowhere close to healing at the onset of the fourth quarter.

Five major multinationals announced within the 24-hour period ended Sept. 30 that they will cut at least 70,000 jobs combined due to the current crisis’ constraints on their business. In the U.S., Walt Disney Co. said it will lay off 28,000 workers in its resort, experiences, and consumer products divisions, and auto insurer Allstate will terminate 3,800 employees. Wall Street will see Goldman Sachs reduce its workforce by 400 jobs. In the energy sector, the Michigan-headquartered chemical giant Dow said it will slash its global workforce by 6%, but didn’t disclose how many jobs that will entail, and Netherlands-based oil conglomerate Royal Dutch Shell will make redundant as many as 9,000 jobs within the next two years.

“We have to be a simpler, more streamlined, more competitive organization,” Shell CEO Ben van Beurden said in a Sept. 30 statement. “In many places, we have too many layers in the company: too many levels between me, as the CEO, and the operators and technicians at our locations.”

Today is Thursday, October 1, 2020, and here is today’s essential intelligence.

Turning Over a New Lease: COVID-19 Hastens Shift to New Retail Leasing Model

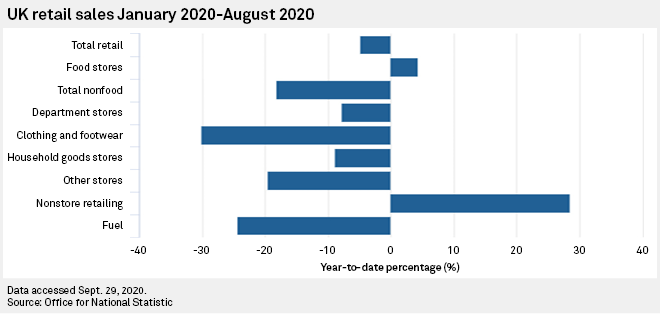

Retail property was once a simple business — how times have changed. The COVID-19 pandemic has overturned much of what retail landlords and their tenants have long taken for granted. Turnover leases — or percentage leases — have become increasingly common in many developed markets as the rapid growth of e-commerce, particularly in the U.S. and U.K., chipped away at the revenues of brick-and-mortar retailers, killing off many.

—Read the full article from S&P Global Market Intelligence

Chinese Developers Tread with Caution After Incomes Skid to a 3-year Low in H1

Major Chinese developers may choose to prioritize debt reduction over land purchases and expansion this year amid economic uncertainties due to the coronavirus pandemic that plunged their first-half earnings to a three-year low. Although property sales started to recover in the second quarter, the aggregate net income of the 10 property companies with the largest exposure in mainland China dropped 11.23% to 134.4 billion yuan in the January-to-June period, from 151.4 billion yuan a year ago.

—Read the full article from S&P Global Market Intelligence

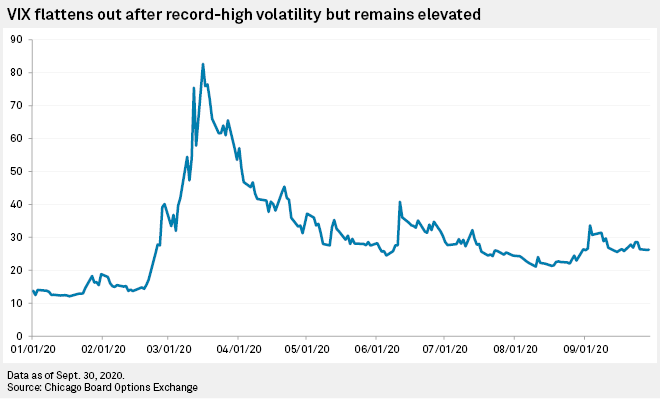

Stock Volatility Set to Remain Elevated Through U.S. Elections – Risk Monitor

Volatility is expected to be a feature in U.S. equities for the duration of the U.S. presidential campaign as investors weigh up the possibilities of a second term for President Donald Trump or a victory for Democrat nominee Joe Biden. The CBOE volatility index, or VIX, has been at historically high levels for much of the time since the coronavirus sent shockwaves through financial markets in March.

—Read the full article from S&P Global Market Intelligence

Listen: Fixed Income in 15 – Episode 12

On this episode of Fixed Income in 15, Joe Cass is joined by Gerard O’Reilly, co-CEO at Dimensional Fund Advisors and S&P Global Ratings Global Head of Research Alexandra Dimitrijevic. Discussion included a high level outlook for markets, credit default risks and the scale of rating downgrades thus far in 2020. There was also time for Alexandra and Gerard to discuss how they have adapted to working from home and the unique academic culture at Dimensional.

—Listen and subscribe to Fixed Income in 15, a podcast from S&P Global Ratings

COVID-19- and Oil Price-Related Public Rating Actions on Corporations, Sovereigns, and Project Finance to Date

Rating actions have declined considerably since the highs in late March and early April. In fact, the tally of negative actions related to the COVID-19 pandemic and the oil-price dislocation declined to 19 this week--roughly 7% the peak weekly amount. Most of the more recent negative rating actions have been downgrades, and most of these downgrades affected companies that had either negative outlooks or ratings on CreditWatch negative.

—Read the full article from S&P Ratings

North America Credit Markets Update –3Q 2020

The U.S. corporate credit market has largely stabilized. After credit spreads widened in late March to the widest seen since the Global Financial Crisis, spreads have both tightened and differentiated. Investment-grade credits saw a meaningful reduction in risk premium after actions by the Federal Reserve.

—Read the full article from S&P Ratings

Europe Credit Markets Update –3Q 2020

Spreads remain persistently higher than Pre-COVID levels, though considerably tighter than peaks. Swift and sizable fiscal and monetary stimulus gave investor confidence a needed boost. Despite this speculative-grade spreads are over 4x wider than investment-grade, up from 3.5x at the beginning of the year.

—Read the full article from S&P Ratings

Asia-Pacific Credit Markets Update –3Q 2020

Investment-grade debt maturities peak at $240.9 billion in 2022, and much of this debt is from financial services companies. Issuers of speculative-grade debt have longer to refinance because their maturities do not peak until 2024, when $22.2 billion matures.

—Read the full article from S&P Ratings

Shock and Ore: Surging Debt to Test Australian States

Public borrowing is set to soar in most advanced economies. In Australia, both the federal government and the states and territories will record unusually large cash deficits this year, with the possible exception of iron ore-rich Western Australia. Outstanding commercial term debt on issue by the states surged past A$330 billion around August 2020. This will reduce buffers at the 'AAA' and 'AA+' level.

—Read the full article from S&P Ratings

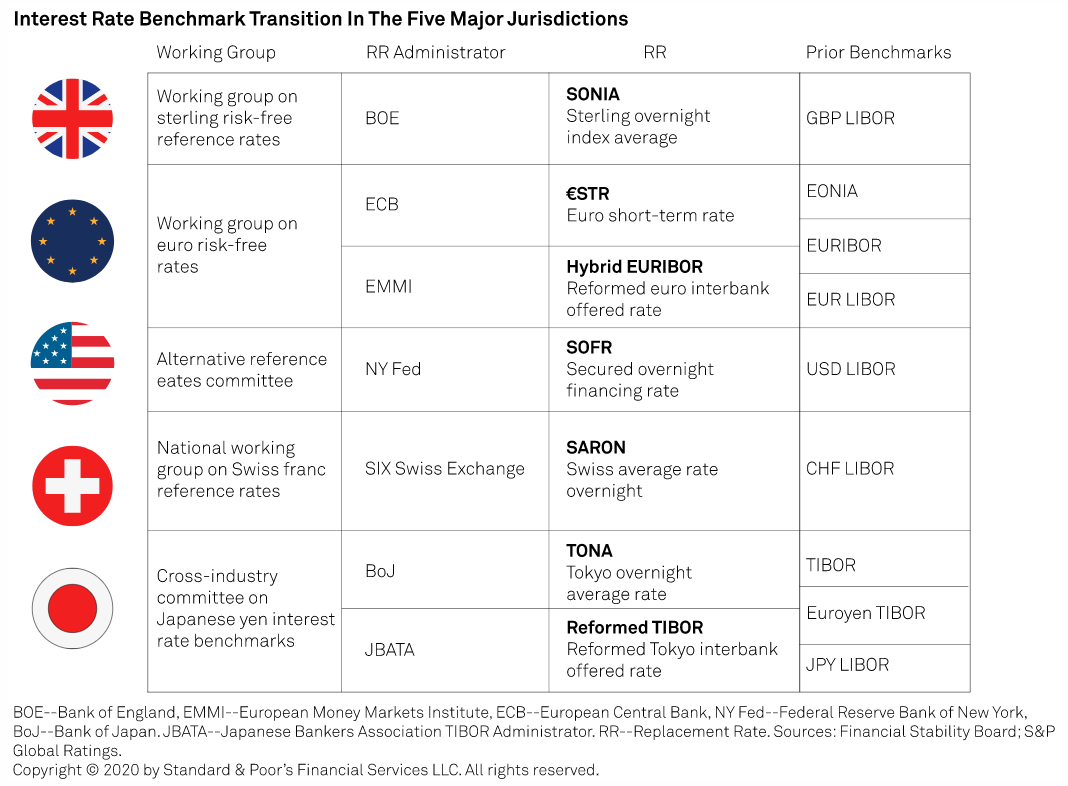

Losing LIBOR: Most European Banks are Unlikely to Face a Cliff Edge

S&P Global Ratings believes the planned introduction from Jan. 1, 2022, of new interest rate benchmarks regarded as transparent, risk free, and transaction based, will be a positive move for Europe's financial markets. Regulators, banks, clearinghouses, and other bodies are working together to find ways to minimize transition risks for market participants, so Ratings doesn’t anticipate widespread systemic disruptions.

—Read the full report from S&P Global Ratings

Shock and…Ordinary: European Bank Primary Issuance an 2020 so Far

The speed and scale of the monetary and fiscal policy response to COVID-19 sparked a material risk-on credit spread rally after March 2020 lows. The rapid and fulsome primary market reopening de-risked both a short-term liquidity shock and medium-term recapitalization requirement. Risk-weighted-asset inflation and regulatory changes on capital composition should stimulate additional subordinated issuance (Tier 2 and Additional Tier 1) to supplement Common Equity Tier 1 ratios, markets permitting.

—Read the full article from S&P Global Ratings

UAE Currency Exchange Sector set for Consolidation as Remittances Fall

Further consolidation is expected in the United Arab Emirates' remittances industry, the world's second largest, as declining volumes and a switch to digital transfers due to coronavirus-related movement restrictions endanger smaller exchange houses. Remittances from the Middle East and North Africa, which mainly comprise money sent home by migrant workers in the wealthy six-member Gulf Cooperation Council, are set to fall by 19.6% in 2020, the World Bank forecasts.

—Read the full article from S&P Global Market Intelligence

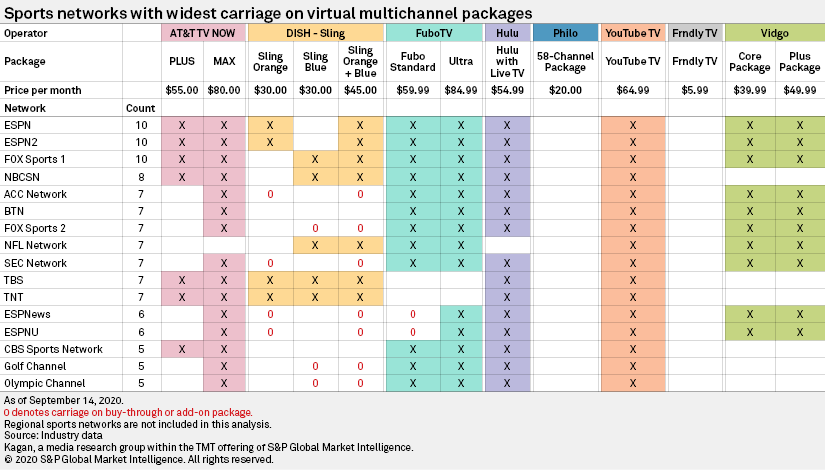

Virtual Multichannel Carriage: Sports Networks

Virtual multichannel services see sports networks as an important part of the bundle even though these channels continue to drive higher programming costs, which has led to frequent price hikes. Our analysis shows that sports networks with the highest license fees also enjoy the widest carriage on base packages offered by most skinny bundle operators.

—Read the full article from S&P Global Market Intelligence

Amazon Seeks Spot for Halo in Crowded Smartwatch, Fitness Tracker Market

As Amazon.com Inc. dives into the crowded market for biometric-monitoring wearables, the company is betting that its lower cost and unique features will draw customers — and add fuel to its healthcare efforts, experts say. The Amazon Halo band, unveiled Aug. 27, is a screenless fitness device that uses sensors to upload biometric data like heart rate and temperature. It can also track physical activity and sleep.

—Read the full article from S&P Global Market Intelligence

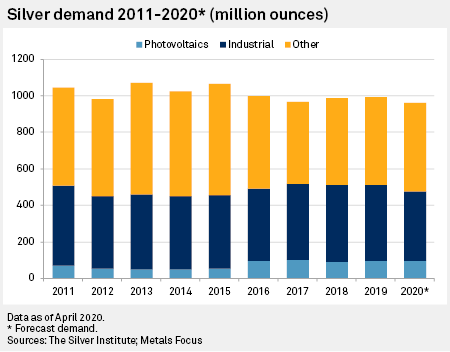

Solar-Driven Silver Demand set to Dim as Sector Innovates

Silver demand from the solar sector looks set to wane as manufacturers continue to find ways to use less of the highly conductive but relatively expensive metal in their solar cells, according to experts. "Out to 2024, we see volume drifting lower," said Philip Newman, a founding partner of research group Metals Focus, which produced a silver supply/demand report for the Silver Institute in April.

—Read the full article from S&P Global Market Intelligence

Tesla to Meet with Indigenous Activists as it Plots Future Supply Chain

Tesla Inc. will meet with a network of Russian Indigenous activists campaigning for the electric vehicle company to boycott nickel supplied by PJSC Norilsk Nickel Co., the world's largest producer of high-grade nickel, according to one of the activists involved with the campaign. Pavel Sulyandziga, president of Indigenous rights group Batani Foundation, told S&P Global Market Intelligence through an interpreter that advocates with the boycott campaign are scheduled to speak with Tesla representatives involved with corporate social responsibility on Oct. 7.

—Read the full article from S&P Global Market Intelligence

Glencore Trader Brocas says OEMs Seeking 5-10 Year Deals for Cobalt for EVs

Glencore, the biggest global cobalt producer, is trying to mitigate the risk of any big rally in prices or scarcity of supply caused by energy transition demand by discussing and entering long-term supply arrangements with OEMs, David Brocas, the company's lead trader of the minor metal, said Sept. 30. "Only if we get very long-term visibility on [customers'] needs for cobalt will we be able to dimension our production in the right way," Brocas told the virtual FT Commodities Global Summit.

—Read the full article from S&P Global Platts

EIA Forecasts 10% Decline in U.S. Annual Energy-Related CO2 Emissions in 2020, Lowest in Years

The Energy Information Administration has forecast a 10% annual decline in US energy-related carbon dioxide emissions in 2020 to below the 5 billion mt level for the first time since 1991. The decline is the result of less energy consumption related to COVID-19 mitigation efforts, the Sept. 24 "Current Issues and Trends" report said. The EIA also forecast a 4.8% CO2 emission increase in 2021, "as the economy recovers and energy use increases."

—Read the full article from S&P Global Platts

France's Total to Focus on LNG, Renewables in Major Clean Energy Drive

France's Total aims to grow its LNG and renewables business in the coming decade, while reducing its oil product sales, as it looks to transform itself into a broad, lower-carbon energy company. In a corporate strategy update Sept. 30, CEO Patrick Pouyanne said Total would though still focus on oil and gas production, using cashflow from that part of the business to help finance growth in its LNG and electricity businesses.

—Read the full article from S&P Global Platts

Aviation Group sets out Pathways to Halve Carbon Emissions by 2050

The global aviation industry can slash its CO2 emissions in half by 2050 and reach net-zero emissions about a decade later, aviation industry group the Air Transport Action Group said Sept. 29. The plan will rely on a significant shift away from fossil fuels, the introduction of radical new technology and continued improvements in operations by the sector, it said.

—Read the full article from S&P Global Platts

ESG Investment Trend Hurting Power Company Finances: GCPA Panelists

Investment in stocks that meet certain environment, social and governance standards and disinvestment in the broader market have caused power companies to be undervalued because of their link to coal, but those that successfully convert to renewables and cleaner natural gas can shine, according to observers.

—Read the full article from S&P Global Platts

The S&P/B3 Brazil ESG Index – Introducing Sustainable Investing in Brazil

The rapid growth and relevance of sustainable investing over the past years has made it a cornerstone in the investment selection process, so the presence of a broad ESG benchmark for the largest market in Latin America was necessary. Aimed toward ESG-oriented investors, S&P Dow Jones Indices launched on Aug. 31, 2020, the S&P/B3 Brazil ESG Index, an ESG-weighted index following a straight set of rules suitable for the Brazilian market, with a focus on sustainability and ESG principles similar to those of the S&P 500® ESG Index.

—Read the full article from S&P Dow Jones Indices

Gulf Arab Countries Speed Ahead with Renewables Projects Despite Fossil Fuels Boon

Gulf Arab countries are forging ahead with renewable projects despite an abundance of fossil fuels and the coronavirus pandemic. Record-low tariffs and plans to reduce dependence on crude oil and natural gas as feedstock for power and energy-intensive water desalination plants are the main factors behind the rapid development of renewables in the region.

—Read the full article from S&P Global Platts

Gas and Power Markets well Supplied but Nuclear a Worry - Q4 2020

European gas and power markets enter Q4 looking relatively well supplied but LNG, nuclear and wind variables could tighten supply in the event of a cold snap. EU gas storage levels are at 94% full while both Norwegian and LNG supplies are expected to rebound – but Europe could face competition from Asia for cargoes. And while European electricity demand is set to remain below norms into Q4, record low nuclear availability could trigger price spikes at times of low wind.

—Read the full article from S&P Global Platts

Shell Unveils Major Job Cuts as Q3 Oil and Gas Output Slips

Shell on Sept. 30 said both its LNG and crude production were down in the third quarter in an update to the market, which also detailed plans to cut up to 9,000 jobs by the end of 2022 as it adjusts to the COVID-19 price collapse. The company's upstream oil and gas production was down by 12-15% compared with a year earlier, in a range of 2.2 million-2.3 million boe/d, in part impacted by hurricanes in the US Gulf of Mexico. LNG output plunged by 8-12% to 7.9 million-8.3 million mt.

—Read the full article from S&P Global Platts

Global Commodity Traders Expect Bumper Year as Pandemic Shakes up Markets

Global commodity traders expect 2020 to rank as one of their strongest ever in terms of profitability after benefiting from "unprecedented volatility" and market dislocations due to the coronavirus pandemic. After posting record earnings from its oil and petroleum products division during the first half of the year, Singapore-based oil and metals trader Trafigura has been renewing and expanding its credit lines to take advantage of new trading opportunities, its chief financial officer Christophe Salmon said.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language