Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 8 Nov, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Booming with investment, the offshore wind industry is on the rise as countries ramp up their renewable energy resources to reach net-zero emissions in the coming decades.

While still accounting for a small proportion of the world’s energy and electricity mix, global installed offshore wind is likely to grow by six times, to 180 gigawatts by 2030, according to S&P Global Ratings. Europe is the global leader in the renewable technology, followed closely by China and with activity in the U.S. picking up.

Investors are flocking to offshore wind despite its being uneconomical now, amid the likelihood that costs will dramatically decline when the industry scales upwards, the lesser resource risk characteristics that offshore capacity holds compared to onshore wind generation, and the expectation of future tax credit support, according to S&P Global Ratings.

“Despite a generally good track record so far, we continue to see construction and operating risks as high, including erosion of offshore wind installations, weather-related effects on wind developers’ internal return rate, and supply chain disruptions,” S&P Global Ratings said in a recent report. “The challenge is finding the right balance between allocating sufficient resources to achieve internal sustainable targets while accelerating growth. We are focusing on five ESG factors, notably the shortage of skilled labor, sustainability of supply chains, contribution to the circular economy, health and safety, and community engagement.”

Today is Monday, November 8, 2021, and here is today’s essential intelligence.

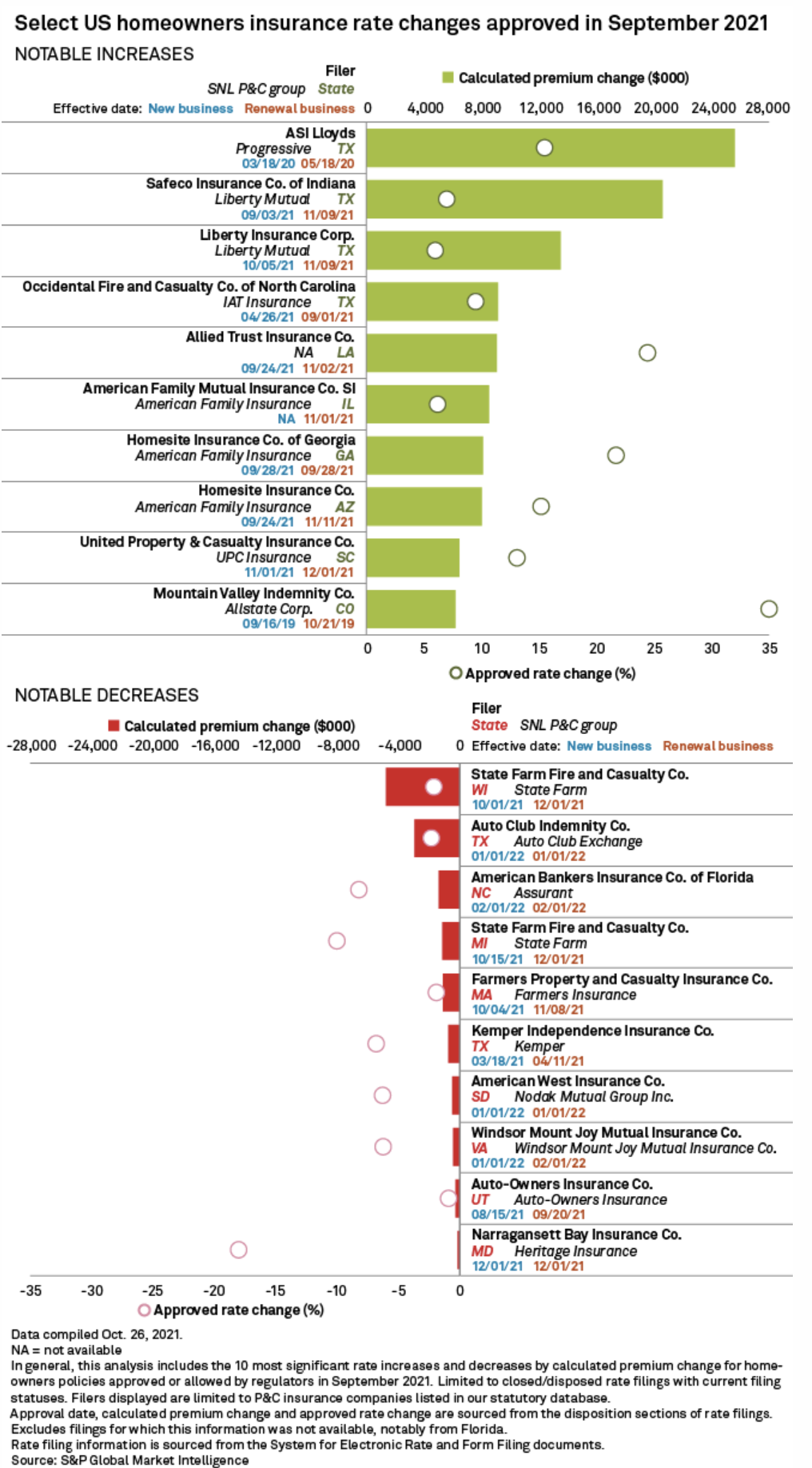

Liberty Mutual, Progressive Hike Homeowners Rates In September

Liberty Mutual Holding Co. Inc. could see the largest rise in homeowners premiums from rate increases approved in September. Liberty Mutual subsidiaries received a total of 30 homeowners rate-hike approvals from regulators in 13 states during the month, which could boost its written premiums by an aggregate $58.2 million.

—Read the full article from S&P Global Market Intelligence

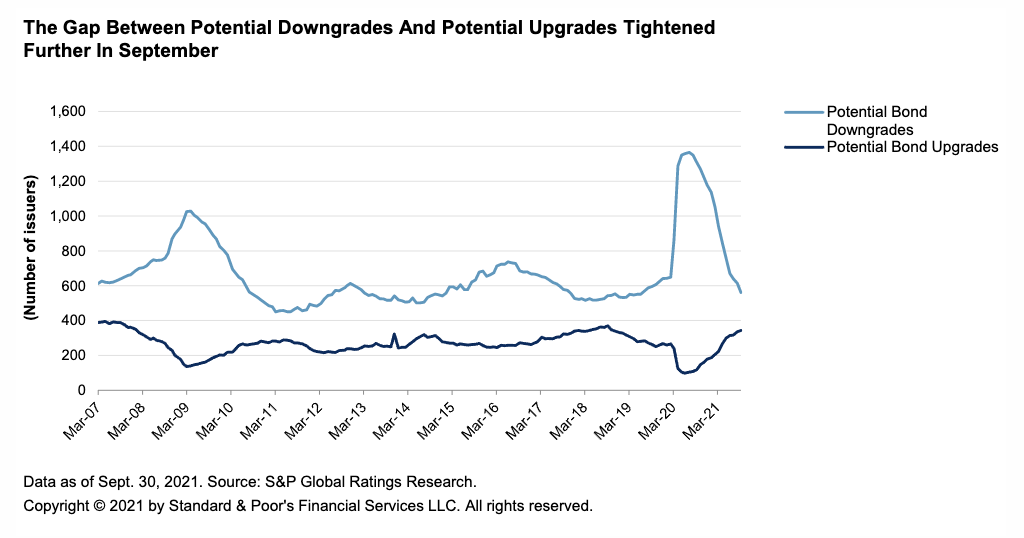

Credit Trends: Gap Between Potential Downgrades And Potential Upgrades Is At The Lowest Level Since February 2019

The number of potential downgrades has decreased for the 14th month in a row with a net decrease of 53, down to 561. Potential upgrades saw a net increase of 9, up to 344, meaning the gap between potential downgrades and potential upgrades is at the lowest level since February 2019.

—Read the full report from S&P Global Ratings

SF Credit Brief: U.S. CMBS Delinquency Rate Trend Continued With A 67 Bps Decline In October

U.S. CMBS overall delinquency rate decreased 67 bps month-over-month to 3.7% in October. Seriously delinquent loans (60-plus-days delinquent) remained high at 93.1% of delinquencies. By balance, delinquency rates decreased for lodging (168 bps), retail (148 bps), industrial (14 bps), office (12 bps), and multifamily (8 bps).

—Read the full report from S&P Global Ratings

Canadian Credit Card Quality Index: Monthly Performance—September 2021

The CCQI is a monthly performance index that aggregates performance information of securitized credit card receivables in the following key risk areas: receivables outstanding, yield, payment rate, charge-off rate, delinquencies, base rate, and excess spread rate.

—Read the full report from S&P Global Ratings

Less Than 50% Of Discovery+ Subs Are Also HBO Max Customers

When Discovery Inc. closes its acquisition of AT&T Inc.'s Warner Media LLC next year, Discovery Inc. President and CEO David Zaslav said the resultant Warner Bros. Discovery "will appeal broadly to all demographics, young and old with strong male and female genres."

—Read the full article from S&P Global Market Intelligence

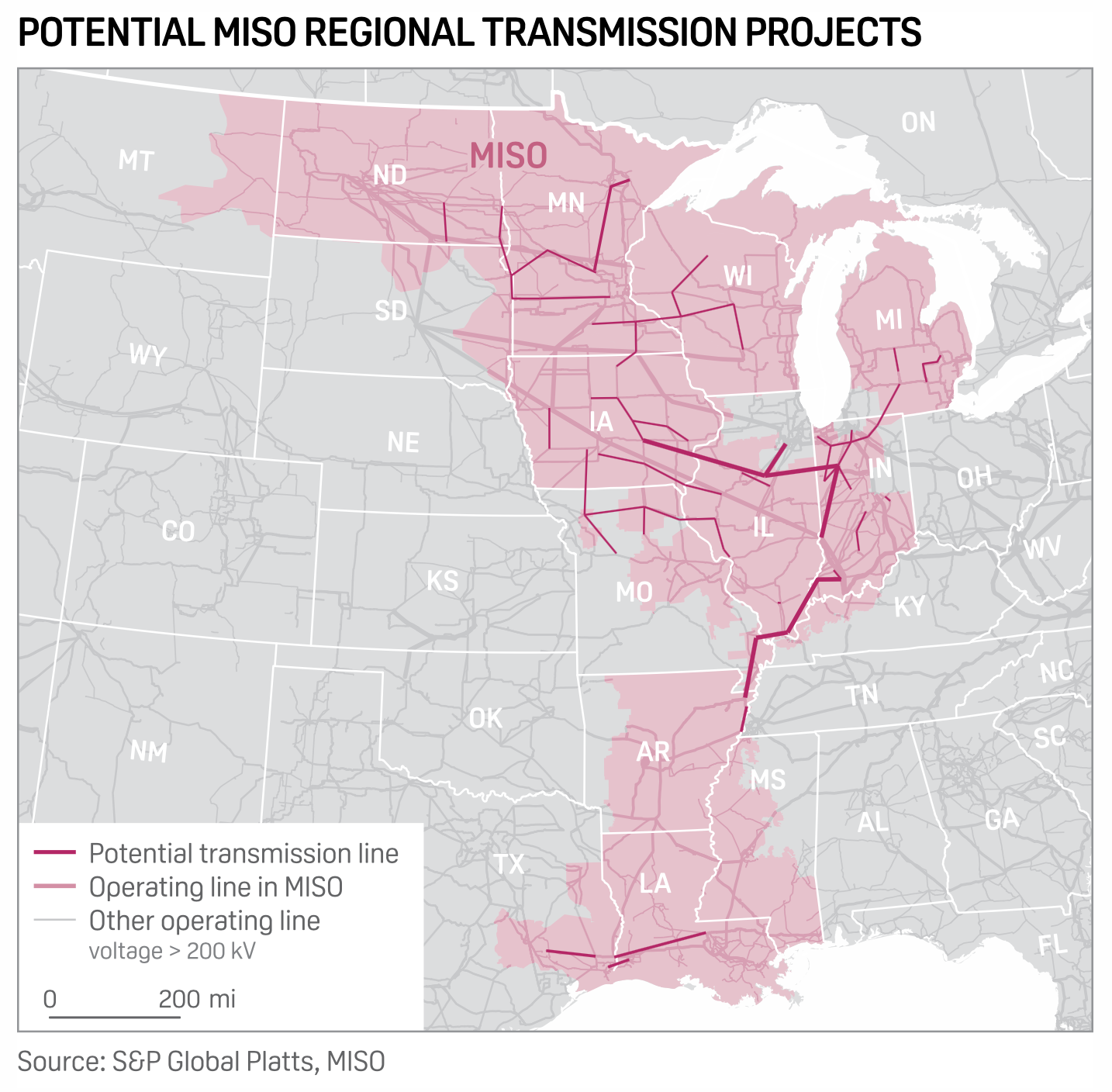

Ameren Sees Benefits In MISO Grid Expansion, Illinois Climate Law

Ameren Corp. sees opportunities in the planned expansion of the transmission grid in Midcontinent Independent System Operator, and the company is eyeing options under a new Illinois energy law that aids investments in solar, batteries, and vehicle electrification, CEO Warner Baxter said Nov. 4.

—Read the full article from S&P Global Platts

COP26: U.S. Joins Commitment To Clip International Public Finance For Fossil Energy

A commitment by the U.S. and at least 19 other nations Nov. 4 at the UN Climate Conference talks in Glasgow to steer their international public finance toward the clean energy transition drew cheers from environmental advocates keen on a quick phaseout of fossil fuels including oil and gas.

—Read the full article from S&P Global Platts

COP26: UAE Targets 25% Of Global Low-Carbon Hydrogen Market By 2030

The UAE is targeting a 25% global market share of low-carbon hydrogen by 2030 with the launch of its "hydrogen leadership roadmap" at the UN Climate Change Conference. The roadmap sets out support for domestic, low-carbon industries and aims to establish the country as a leading hydrogen exporter, the UAE state news agency said Nov. 4.

—Read the full article from S&P Global Platts

COP26: Papua New Guinea Joins Indo-Pacific Carbon Offsets Scheme Initiated By Australia

Papua New Guinea has agreed to join the Australia-initiated Indo-Pacific Carbon Offsets Scheme, which is expected to enable companies in the private sector to purchase carbon offsets generated by partner countries in the region, the Australia government announced late Nov. 4.

—Read the full article from S&P Global Platts

COP26: Indonesia, IRENA Agree To Decarbonize Southeast Asia's Largest Economy

The government of Indonesia and the International Renewable Energy Agency have signed a partnership to decarbonize the country—the largest economy in Southeast Asia. Indonesia took over as President of the G20 group of most industrialized countries for the first time after the group's latest meeting in Rome, where the world's largest economies agreed to stop funding coal overseas.

—Read the full article from S&P Global Platts

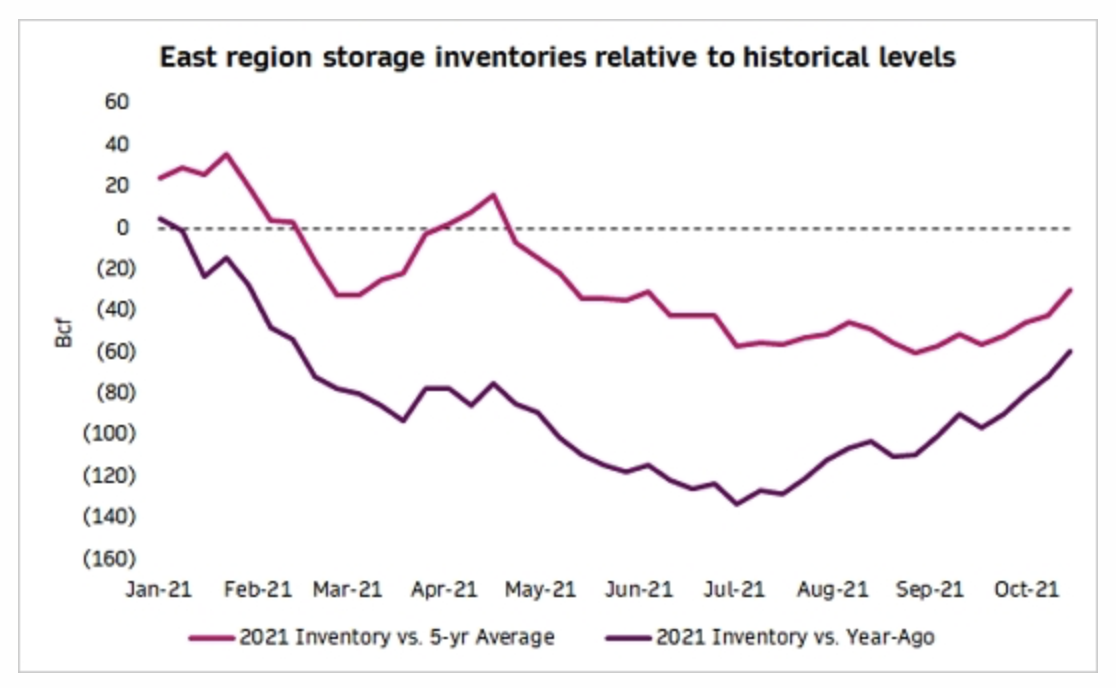

Spotlight: U.S. East Injection Rates Far Exceed Historical Averages, Bringing Stocks Closer In Line With Normal

Storage inventory levels in the Northeast lag the five-year average, but injection rates are higher and decreasing at a slower pace than seen over the past five years as the end of the 2021 injection season nears.

—Read the full article from S&P Global Platts

U.S. Pivots Steel, Aluminum Tariff Talks To Japan

Trade officials have begun preliminary talks Nov. 4 regarding the future of the U.S.’s steel and aluminum tariffs against Japan, which are also enforced against many other global producers under Section 232, after the U.S. replaced the tariffs on the EU with a tariff-rate quota on Oct. 30.

—Read the full article from S&P Global Platts

German Steel Pricing Outlook Bullish Despite Lower Production Expectations: Platts Survey

German steel producers, distributors, and traders were found to be bullish on pricing over November, following the BlechExpo fair, where participants left with expectations of higher prices for Q1, though the short term is still expected to be mostly stable, data from the S&P Global Platts monthly steel sentiment survey showed.

—Read the full article from S&P Global Platts

Listen: With Energy Prices Surging, Why Are Clean And Dirty Tanker Markets Lagging Behind?

While energy prices are moving higher and higher, there's a clear laggard in the commodities space: the tanker freight market. Why are clean and dirty tankers not keeping pace? S&P Global Platts shipping market experts Pradeep Rajan, Vickey Du, and Sameer C. Mohindru examine the factors shaping the clean and dirty tanker markets and their path to recovery.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language