Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 3 Nov, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Wall Street is anticipating a victory for U.S. presidential candidate Joe Biden and a “blue wave” of Democratic wins in the House and Senate elections, despite the idea that such an outcome could result in a perceived negative for business: an increase in the U.S. corporate tax rate.

The 2017 Tax Cuts and Jobs Act, seen as U.S. President Donald Trump’s landmark legislation during his presidency, lowered the nominal corporate tax rate to 21% from 35%. Campaigning for a second term, President Trump aims to keep that rate in place and make some of the law’s expiring provisions permanent.

Mr. Biden’s platform favors raising the corporate tax rate to 28%. He additionally has proposed implementing a 15% minimum tax on the profits reported to shareholders of companies with a net income greater than $100 million; applying a 10% offshoring tax penalty on U.S. companies' overseas profits earned on sales back to the U.S. and raising the tax rate on those profits to 30.8%; as well as granting a 10% advanceable tax credit for companies that make investments to create jobs for American workers and accelerate the economic recovery from the pandemic-prompted downturn.

After the passage of President Trump’s tax reforms, consumer companies paid considerably lower taxes, according to S&P Global Market Intelligence. For the companies included in the S&P 500 Consumer Discretionary index, the median effective tax rate last year—calculated as the income tax expense as a percentage of earnings—was 22.2%, compared to 32.6% in 2016 before the cuts were legislated.

Under Mr. Biden’s plan, most companies would see an increase in their effective tax rates, according to S&P Global Ratings. Life insurance underwriters could experience increased tax liabilities, and big technology firms like Amazon and Netlix could be forced to repatriate their funds and pay higher effective tax rates. If Mr. Biden’s proposal were to be enacted, the 10 largest banks in the U.S. could suffer a combined $7 billion decline in their annual net income, and 209 of the country’s publicly traded banks could see a collective drop of $9.36 billion in annual income, according to an S&P Global Market Intelligence analysis of equity analysts' estimates for next year.

Changes to the statuory tax rate, of course, depend on the outcome of both the election and the pandemic.

“Chances for enactment of the Biden proposals depend not only on his being elected president but almost certainly on the Democratic Party retaking control of the Senate and keeping control of the House of Representatives,” S&P Global Ratings said in a recent report. “While Mr. Biden has indicated he would like to make his changes effective from ‘day one,’ the timing of any changes would still be an open question. Given the stresses brought on by the COVID-19 pandemic, the economic recovery may prove to be a greater priority than corporate tax reform, and some Senate Democrats have pushed back against the immediacy of stand-alone tax legislation, citing priority of fiscal stimulus and pandemic-relief bills.”

Today is Tuesday, November 3, 2020, and here is today’s essential intelligence.

Economic Research: U.S. Business Cycle Barometer: Still Signs of Life

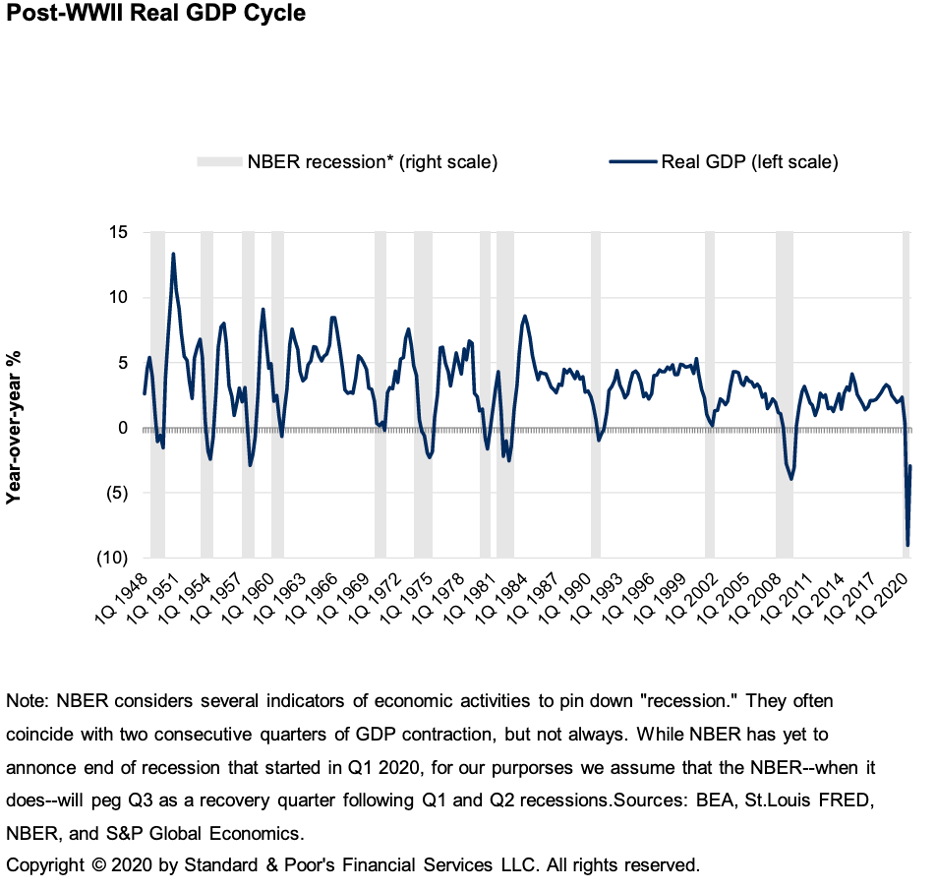

Five months into the recovery, coincident and capacity utilization indicators of the new business cycle show an economy more than half-way out of the hole created March through mid-May.

—Read the full report from S&P Global Ratings

Swiss Re Sets Aside $222M to Pay Beirut Blast Claims

Swiss Re AG established a reserve of $222 million in the third quarter of 2020 to pay for its share of the claims from the Aug. 4 port explosion in the Lebanese capital of Beirut, CFO John Dacey said Oct. 30.

—Read the full article from S&P Global Market Intelligence

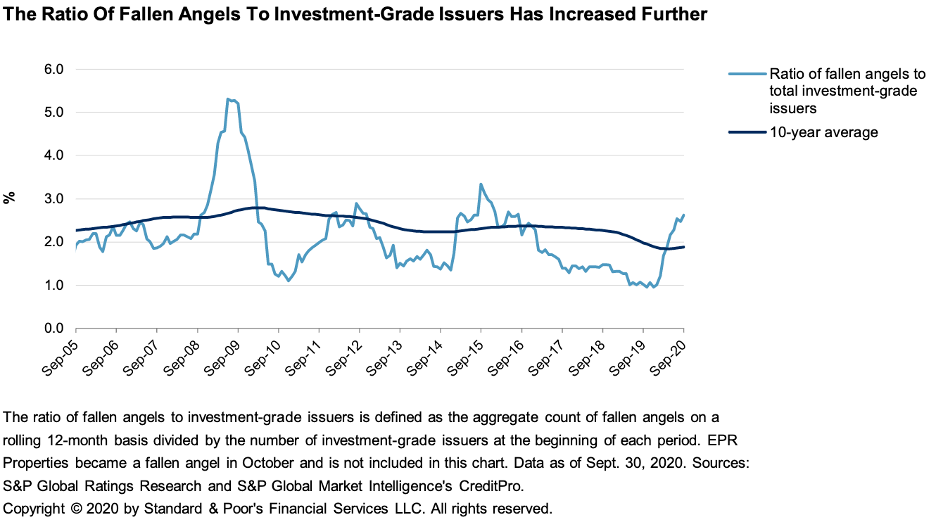

Credit Trends: Potential Fallen Angels Decrease as Immediate Downgrade Risks Recede

Potential fallen angels fell to 111 as of Oct. 12 from 119 at end-August as five issuers moved to speculative grade and four saw revised outlooks. Fallen angels total 46 so far this year, accounting for $366 billion in rated debt (as of Oct. 12).

—Read the full report from S&P Global Ratings

Default, Transition, and Recovery: Three Distressed Exchanges Push the 2020 Global Default Tally to 197

The global corporate default tally has reached 197 so far in 2020, after three companies defaulted due to distressed exchanges this week. While missed interest and principal payments lead corporate defaults so far in 2020, the number of defaults due to distressed exchanges picked up in October.

—Read the full report from S&P Global Ratings

U.S. Leveraged Loan Default Volume Jumps to $2.7B in October

U.S. leveraged loan defaults climbed anew in October after a brief respite from a spike of payment misses and bankruptcies seen in April through July. October's $2.7 billion of defaults in the U.S. leveraged loan asset class, a 93% increase on the previous month, puts the trailing-12-month rate 205% ahead of the comparable 2019 period.

—Read the full article from S&P Global Market Intelligence

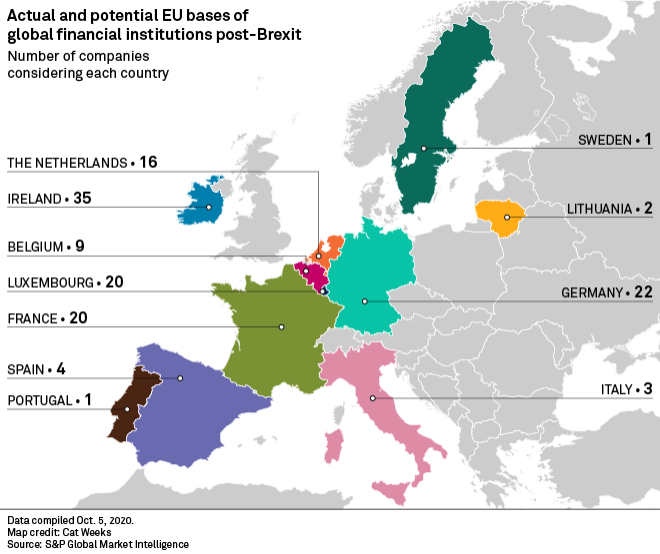

Europe's I-Banking Talent War Enters New Post-Brexit Battleground

Career-minded investment bankers in Europe could see the writing on the wall way back in 2016 when the U.K. voted to leave the European Union.

—Read the full article from S&P Global Market Intelligence

Crédit Agricole's Partnership Push Avoids Cross-Border Consolidation Challenge

France-based Crédit Agricole SA's strategic partnerships with big banks in other countries provide an efficient way to grow while avoiding the complications associated with large cross-border deals, analysts say.

—Read the full article from S&P Global Market Intelligence

Public-Private Partnerships Need Strengthening for AML Challenge, Experts Say

Information-sharing partnerships between banks and national law enforcement agencies are being adopted at pace globally in the fight against financial crime, but they are, in their current form, not sufficient to tackle the scale and complexity of the challenge, according to experts.

—Read the full article from S&P Global Market Intelligence

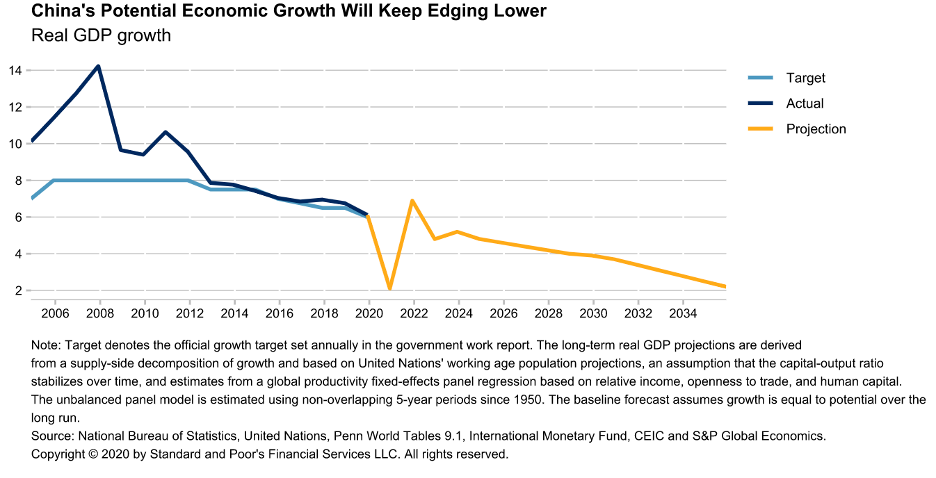

Economic Research: China's Tech Independence Won't Come Cheaply

China's vow to achieve technological self-reliance and establish major breakthroughs by 2035 could mean large parts of the digital economy remain protected from foreign competition.

—Read the full report from S&P Global Ratings

Alibaba Looks to Dominate Grocery Retail on All Fronts with Sun Art Deal

Alibaba Group Holding Ltd.'s $3.6 billion acquisition of a controlling stake in China's largest hypermarket chain, Sun Art Retail Group Ltd., will help the e-commerce company strengthen its position in one of the fastest-growing segments of e-commerce.

—Read the full article from S&P Global Market Intelligence

Specter of Nationalized 5G Continues to Haunt U.S. Wireless Industry

The U.S. wireless industry counts at least three things that will not die: zombies, vampires and the notion of a nationalized 5G network. Policy experts said a nationalized 5G network is unlikely in the foreseeable future. However, they also warn that the idea cannot be ignored.

—Read the full article from S&P Global Market Intelligence

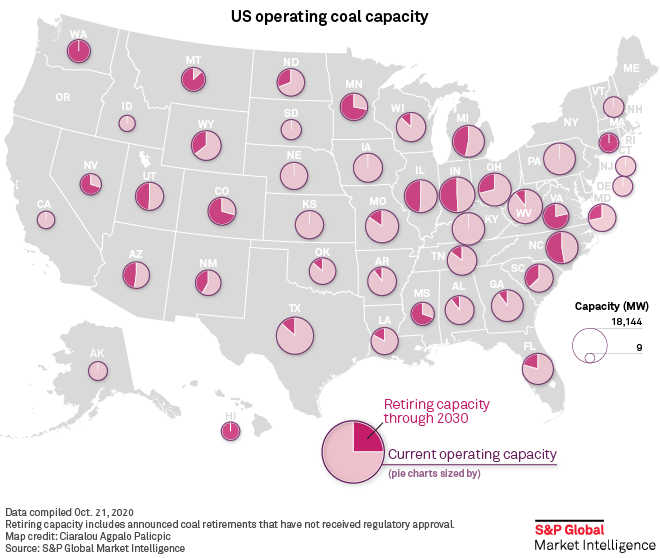

Coal Sees Diminished Role in U.S. Presidential Race with Odds Slim for New Plants

While coal has taken a backseat to other fossil fuels in the 2020 presidential campaign, the first debate raised a big question: Will another coal plant ever be built in the United States?

—Read the full article from S&P Global Market Intelligence

Biden Plan to Make Companies Disclose Climate Risks Key to Decarbonization

Democratic presidential candidate Joe Biden has pledged to make publicly traded companies disclose their climate risks and emissions levels, a move experts say could help companies, investors and regulators make better-informed decisions and pursue decarbonization targets.

—Read the full article from S&P Global Market Intelligence

New Equinor CEO Vows Net Zero Emissions from Operations and Products by 2050

Norway's state-controlled Equinor aims to achieve net zero emissions from its operations and consumption of its products by 2050, new CEO Anders Opedal said Nov. 2, while reiterating the goal of increasing oil and gas output by 3% annually in 2019-26.

—Read the full article from S&P Global Platts

Extreme Weather Events: How S&P Global Ratings Evaluates the Credit Impacts in U.S. Public Finance

Acute physical risks, caused by extreme weather events such as hurricanes, wildfires, and tornadoes can materialize at any time, and can cause significant physical damage and disruption. Across U.S. public finance (USPF), these events can have greatly varied credit impacts.

—Read the full report from S&P Global Ratings

Watch: Market Movers Asia Nov 2-6: Global Markets Await U.S. Election Result

The highlights in Asia on S&P Global Platts Market Movers, with Senior Editor Surabhi Sahu: U.S. presidential election result to influence sentiment across commodity sectors; Asian refiners U-turn on crude import strategies; Malaysia crude sales under pressure as Australian refiners struggle; and dry bulk shipping activity muted in lead-up to Diwali.

—Watch and share this Market Movers video from S&P Global Platts

Beijing's Proposed 14th Five-Year Plan Set to Reshape Commodities Demand

Beijing's proposed 14th Five-Year Plan (2021-2025) did not set an economic growth target but made clear that the path forward for China will be more domestically driven, will focus on technological innovations and on environmental sustainability, all of which will reshape China's commodities demand in the coming years.

—Read the full article from S&P Global Platts

U.S. ELECTIONS: Trump Signs Fracking Order Aimed at Voters More Than Supply

he Trump administration's weekend executive order on fracking -- aimed squarely at the tight election race in No. 2 gas producer Pennsylvania -- is the latest in a string of White House orders on energy that will have mostly messaging impact rather than changing any supply or demand fundamentals.

—Read the full article from S&P Global Platts

More than 25% of U.S. Gulf Crude Oil Still Offline After Hurricane Zeta

Nearly 30% of crude oil volumes from the US Gulf of Mexico remained offline on Nov. 2 after Hurricane Zeta swept through the region and knocked out power in much of southeastern Louisiana.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language