Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 7 May, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Evidenced by strong first-quarter earnings, an uptick in mergers and acquisitions, and a surge of initial public offerings, the healthcare and pharmaceutical industries are enjoying favorable market dynamics.

Despite the brightening outlook for economic recovery, the global health crisis is far from over. Hospitals around the world are still battling surges of sick patients, burnout of healthcare workers, and, in some places, shortages of critical supplies. But recent business activity and investor behavior suggests that market sentiment surrounding healthcare and pharmaceutical companies is optimistic.

Moderna executives said on their earnings call this week that the company’s COVID-19 vaccine generated $1.7 billion in sales in the first quarter, and now project that full-year sales may total $19.2 billion. Surpassing analysts' estimates, Pfizer reported an 8% increase in revenue in January-March. This was without the $3.46 billion brought in by the pharmaceutical giant’s COVID-19 vaccine co-developed and marketed with Germany's BioNTech, which market observers now anticipate will generate $26 billion for the New York-based company in 2021, up from a previous forecast of $15 billion, according to S&P Global Market Intelligence. Comparatively, Gilead Science’s total sales of non-coronavirus-related products fell 11%, while the company’s COVID-19 antiviral treatment Veklury generated a 16% increase in sales growth in the first quarter.

"The market has changed quite a lot versus what we knew six months ago—mRNA vaccines have emerged as the best-in-class vaccines, high efficacy, good tolerability profile, scaled manufacturing, and speed to chase variants in the clinic," Moderna CEO Stephane Bancel said on the company’s May 6 earnings call, according to S&P Global Market Intelligence. "Many companies are still in the clinic with their first-generation vaccine, where we're in the clinic with variant-specific boosters."

Thus far, the healthcare sector’s first-quarter earnings have been mostly positive for credit quality. According to S&P Global Ratings, Johnson & Johnson’s improved performance in medical devices is an indication of the ongoing recovery in procedures; HCA Healthcare’s strong results are favorable for the hospital company to continue to perform closer to pre-pandemic net revenue per equivalent admissions and patient mix; Thermo Fisher Scientific’s main business segments will benefit from trends spurred by the coronavirus crisis; and UnitedHealth Group’s boosted operating results reflect the company’s strength as the largest and best diversified player in health insurance and healthcare services.

Regardless of earnings, investors have overwhelmingly shorted healthcare and biotech stocks on a rollercoaster ride of volatility in the past three months. The 10 most-shorted healthcare stocks—eight of which are biotechnology companies—collectively rose 53% from the start of the year to Feb. 2, but are down 3.7% on the year as of May 4, according to S&P Global Market Intelligence.

"Healthcare was overvalued coming out of 2020 when everyone was throwing money at the sector given the visibility that COVID gave it," Brad Loncar, CEO of Loncar Investments, an index provider for two biotech stock-focused exchange-traded funds, told S&P Global Market Intelligence. "This year the new administration, drug pricing legislation, and other headlines have caused a bit of a headwind."

Against this backdrop, 84 healthcare companies around the world went public with a total valuation of $13.8 billion from January-March, doubling the amount year-over-year and marking the most first-quarter IPOs in the past five years, according to S&P Global Market Intelligence. The first quarter also saw the size and volume of mergers and acquisitions across the pharmaceutical and biotechnology sectors begin to bounce back from last year’s lows. Data compiled by S&P Global Market Intelligence found the aggregate transaction value for healthcare M&A to be five times higher year-over-year.

“Early indications are that favorable trends from COVID-19 benefited life science, diagnostics, and lab companies come from increased demand for testing,” S&P Global Ratings said in a report yesterday. “We expect that will begin to dissipate toward the second half, reflecting U.S. progress on emerging from the pandemic, such as faster-than-expected vaccination rates.”

Today is Friday, May 7, 2021 and here is today’s essential intelligence.

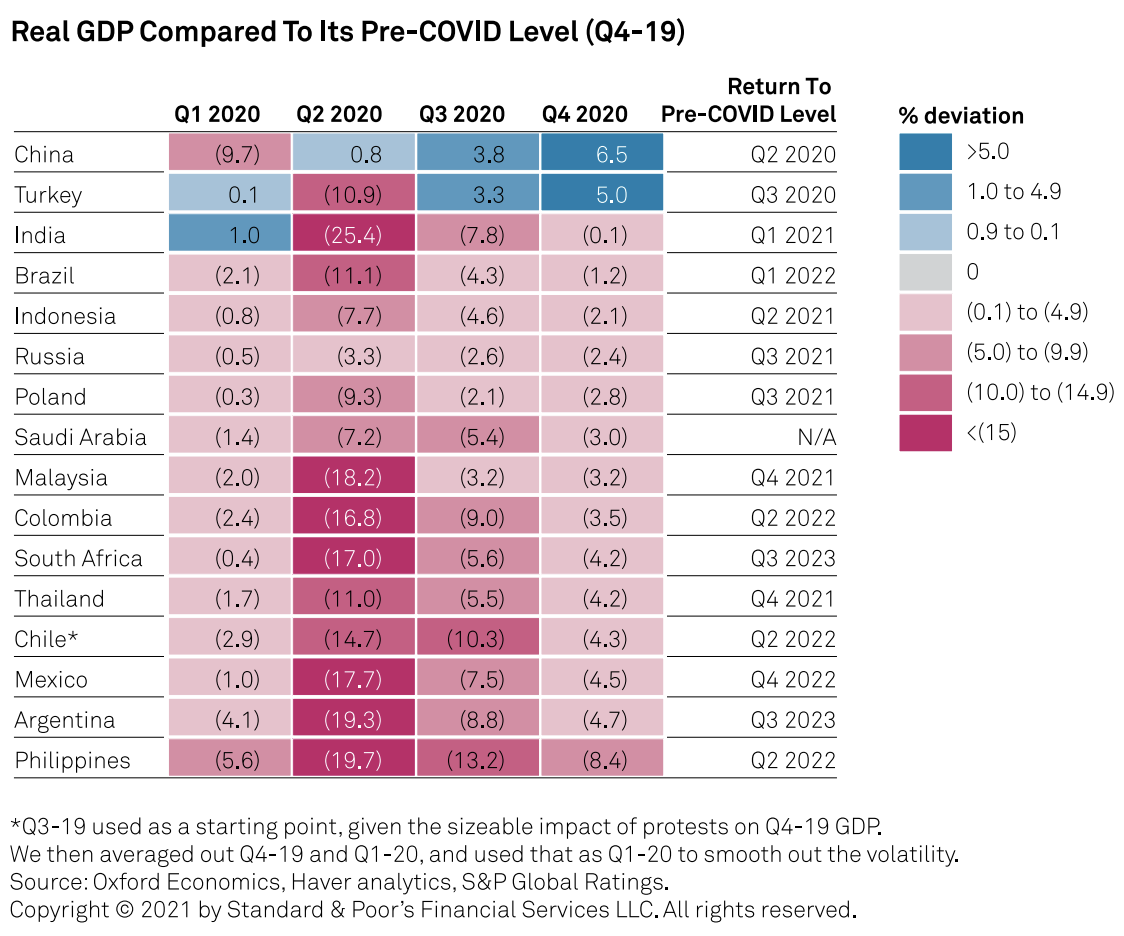

Emerging Markets: Returning To Pre-Pandemic GDP Is Only Part Of The Recovery Story

A great deal of the focus on the economic recovery from the COVID-19 downturn has been on when output returns to its pre-pandemic level. However, in S&P Global Ratings’ view, not enough attention has been paid to the macroeconomic health of economies once they return to those real GDP levels, and in the following years. n some emerging market (EM) economies where output recovers faster, debt and external metrics worsen more than in EMs with slower recoveries, which could have negative implications for economic growth down the line. Focusing on the single GDP metric does not tell the whole story of EM economic recoveries from the pandemic.

—Read the full report from S&P Global Ratings

Property In Transition: Zooming In On The Global Office Reboot

Given the huge acceleration in remote working as a result of the COVID-19 pandemic, office landlords will face challenges in terms of higher vacancy rates and demands for greater environmental quality and more flexibility in lease terms. Still, for key office markets globally S&P Global Ratings does expect recovery to a new normal, most rapidly in key Asia-Pacific cities as well as in the U.S., driven by both economic recovery and, for Asia-Pacific, relatively stronger employee and employer preferences for a return to office.

—Read the full report from S&P Global Ratings

Office Space Will Lag As Hong Kong Property Markets Recover

Office spot rents and occupancy rates in Hong Kong's Central business district won't trough until 2022, with stress lasting longer in non-core districts. Landlords have buffers to absorb the protracted recovery in office and retail rents. S&P Global Ratings estimates residential prices will rise by up to 5% in 2021, buoyed by structural supply shortages and low interest rates.

—Read the full report from S&P Global Ratings

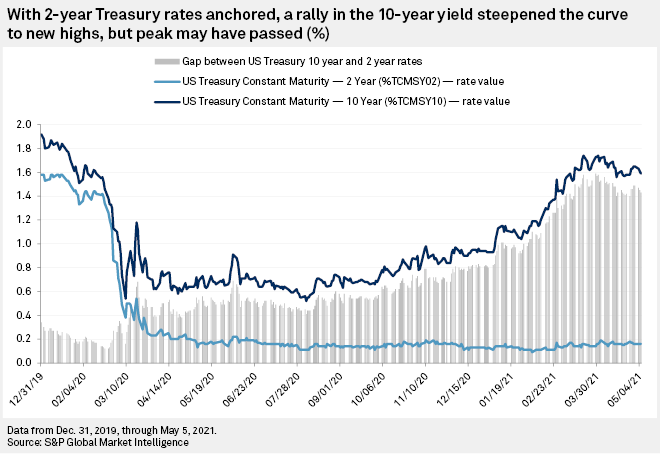

U.S. Government Bond Yields Stagnate Despite Hot Economic Data

A stagnant U.S. government bond market in the face of a warming economy in recent days has fixed-income analysts wondering if the peak in yields has already come and gone.

—Read the full article from S&P Global Market Intelligence

Despite A Pickup In Positive Rating Actions, The Weakest Links Tally Remains High

The global weakest links tally has declined since S&P Global Ratings’ last report to 386 as of March 31, 2021, as positive rating actions pick up, but it remains well above its December 2019 level of 282. By sector, media and entertainment, oil and gas, capital goods, and consumer products together account for 54% of the weakest links issuers.

—Read the full report from S&P Global Ratings

As Issuers And Investors Collaborate To Keep Markets Active, Where Does The Excess Cash Go?

Median LTM leverage peaked at 6.2x in the second quarter of 2020 before dipping over each of the subsequent quarters to 5.7x by the end of the year, mostly because of EBITDA growth rather than debt reduction. In fact, a meaningful portion of the pandemic precautionary borrowings is staying, even though business performance has stabilized. This is keeping cash balances up: On a median basis, companies in S&P Global Ratings’ sample nearly doubled their cash balances since the third quarter of 2019.

—Read the full report from S&P Global Ratings

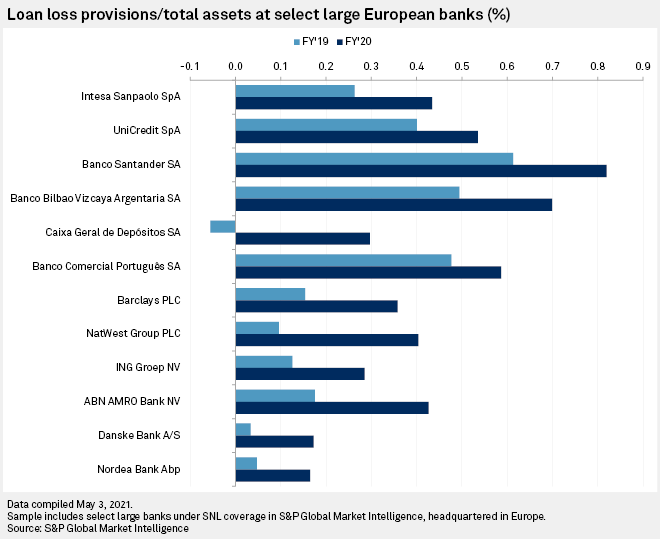

Northern European Banks Release Provisions But Not So For Lenders In The South

Banks in northern Europe have begun to make impairment releases after front-loading loan loss provisions in 2020 due to the COVID-19 pandemic, but the same is unlikely to happen soon with southern European banks, analysts said.

—Read the full article from S&P Global Market Intelligence

Greek Borrowers Gradually Resume Payments On €19.2B Of Moratorium Loans

Greece's "big four" banks put a combined total of €19.2 billion of loans on ice during the pandemic to cushion struggling borrowers from default. Just over a year after the crisis began, many of these clients under debt moratoriums have returned to fully repaying status.

—Read the full article from S&P Global Market Intelligence

Margin Pressure At China's Major Banks May Ease As Economic SOS Wanes

The largest banks in China may see easing pressure on their net interest margins, after they stayed in contraction in the first quarter, as lenders may extend fewer loans at the cheapest interest rates.

—Read the full article from S&P Global Market Intelligence

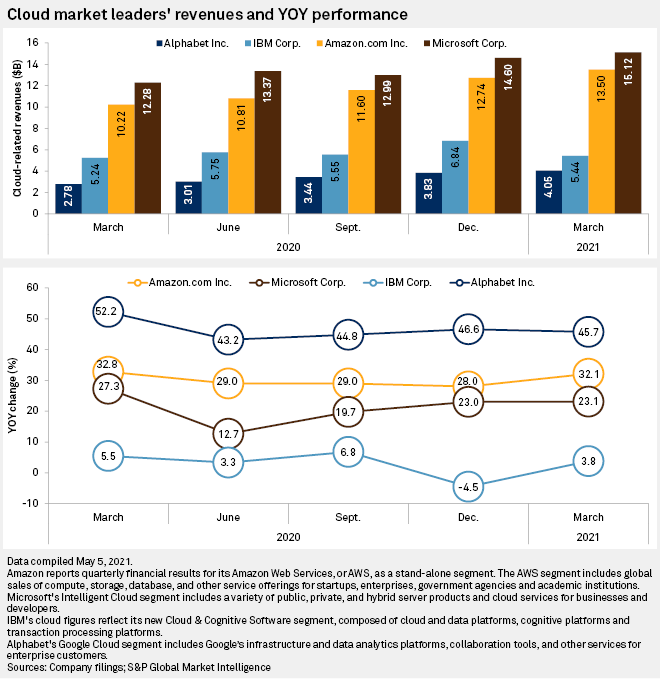

Cloud Platforms Maintain Growth In Q1 As Demand Surges Amid Pandemic

The cloud-computing market continued to thrive in the first quarter, benefiting from the increasing number of organizations that are migrating their workloads to digital formats during the pandemic. All major cloud providers reported year-over-year revenue growth for their respective platforms and touted the growing level of long-term commitments from both existing and new customers.

—Read the full article from S&P Global Market Intelligence

High-Speed Rivalry Between Cable And Telcos Enters New Phase As Infrastructure Proposal Raises Stakes For Broadband Providers

As internet access becomes increasingly important, telcos have focused on their broadband strategies, with investments in fiber and fixed wireless taking on more importance. However, we expect fiber to mostly offset telco's digital subscriber line (DSL) losses to cable, and cable has several advantages over fixed wireless.

—Read the full report from S&P Global Ratings

Listen: Next in Tech, Episode 14: A Quantum of Technology

Quantum computing holds tremendous potential, is the subject of a lot of tech speculation and can be strange and puzzling. Dr. Owen Rogers, research director for the 451 Research digital economics unit and the founder of our Quantum Center of Excellence and James Sanders, research analyst for differentiated silicon and quantum computing, join host Eric Hanselman to discuss where quantum computing is today and what organizations should be considering about its impacts, from qubits to encryption.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence

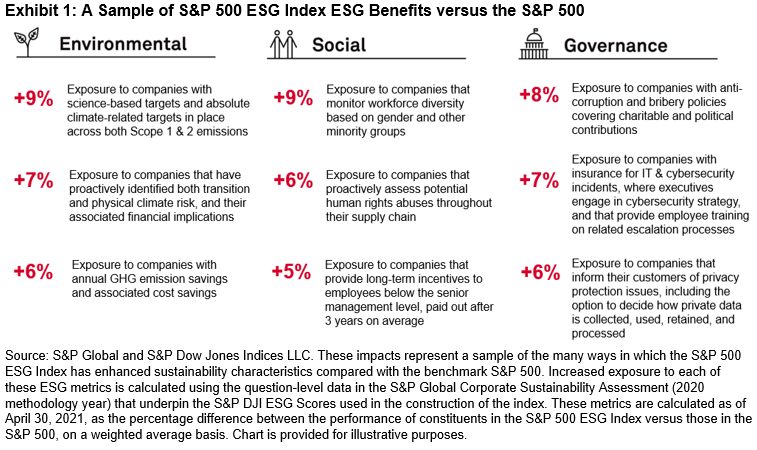

The Rebalance of Power: Tesla, Walmart, & Disney Join the S&P 500 ESG Index, Facebook, Wells Fargo, & Costco Dropped

ESG momentum shows no signs of stopping, with sustainable fund assets nearing USD 2 trillion, following record inflows in Q1. Pressure on firms to perform in sustainability rankings has never been higher, as Wall Street’s hottest topic gets hotter still. But what firms benefit from all this heat? From the assets flowing into S&P 500® ESG Index related products, it seems the balance of power may be shifting.

—Read the full article from S&P Dow Jones Indices

Qatar National Bank’s Green, Social, And Sustainability Bond Framework

In S&P Global Ratings’ view, Qatar National Bank (Q.P.S.C.)'s green, social, and sustainability bond framework, published on May 6, 2021, is aligned with the four components of the Green Bond Principles (GBP) and the four components of the Social Bond Principles (SBP), collectively referred to the Sustainability Bond Guidelines.

—Read the full report from S&P Global Ratings

Multiple Hydrogen Production Pathways Needed To Meet Midcentury Carbon Goal

Blue and green hydrogen will both become critical to a net-zero carbon future, helping the global energy industry to meet emissions reductions targets across its entire value chain, a panel of industry experts said from the S&P Global Platts 2nd Annual Hydrogen Markets Americas Conference.

—Read the full article from S&P Global Platts

Oil Companies Will Struggle To Make Blue Hydrogen Economical: Nel CEO

Blue hydrogen production, promoted by oil companies, will not be economical beyond the short term as green hydrogen costs fall rapidly, electrolyzer producer Nel Hydrogen's CEO, Jon Andre Lokke, said May 6.

—Read the full article from S&P Global Platts

Listen: Cost Concerns, Policy Factors, Competition Pose Challenges For US Nuclear Fleet

The US has the world's largest nuclear generation footprint and has witnessed early retirement of nuclear plants, due in part to low natural gas prices as well as declining costs of wind and solar technologies, as well as policy factors. Today's podcast looks at the major cost concerns of nuclear generation today, how some US states are utilizing Zero Emission Credits, and how these issues are impacting decisions to extend operating licenses.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

China Indefinitely Suspends Economic Dialogue With Australia, Impact Seen Limited

China's National Development and Reform Commission has indefinitely suspended all activities under the framework of the China-Australia strategic economic dialogue with the Australian government, according to an announcement released by NDRC on May 6.

—Read the full article from S&P Global Platts

Russia May Surpass China To Become Largest Gold Producer This Decade: Consultancy

Russia — the second-largest gold producer in 2020, yielding only to China — stands a chance to become the world's largest producer of yellow metal in this decade, as it keeps expanding mining operations while China ramps them down, according to consultancy and analytics firm Institute of Geotechnologies.

—Read the full article from S&P Global Platts

Listen: Will Vaccine Passports Bring The Jet Fuel Market Back To Life?

While the European jet fuel market has yet to recover from the pandemic and continues to trade at low cash premiums, will demand for aviation fuel be boosted by the upcoming easing of travel restrictions within Europe and the potential resumption of non-essential trans-Atlantic flights? In this episode of the Oil Markets Podcast, S&P Global Platts reporters Virginie Malicier and Thomas Washington discuss with Gary Clark the latest news on the travel front and their expected consequences for the jet market.

—Listen and subscribe to Oil Markets, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language