Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 14 May, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Has the bull market ended and the bear taken over? Is the recent stock market stumble good news or bad? While market participants may have divergent answers to such questions, it’s clear that dynamics across capital markets are evolving as the global economic recovery solidifies.

While optimism surrounding the economic rebound is intensifying, sentiments surrounding markets are simultaneously shifting. The five biggest stocks in the benchmark S&P 500 equities index—Facebook, Amazon, Apple, Microsoft, and Alphabet, collectively known as FAAMG—have fallen nearly 9% in the past three months and have dragged down the benchmark equities index after boosting it to historic highs last year. At the same time, investors’ concerns over the risk of rapidly rising inflation and low employment growth in the U.S. have sent the CBOE Volatility Index—the VIX, known colloquially as Wall Street’s fear gauge—to 27.59 on May 12 from 16.69 on May 7.

"Uncertainty over the labor market recovery should support heavier Treasury yields in the short-term, but higher yields will eventually return and provide some headwinds for FAAMG stocks," Ed Moya, a senior market analyst with the foreign exchange firm OANDA, told S&P Global Market Intelligence.

Similarly, "the combination of higher inflation expectations and the surprisingly low April jobs figures have called these two tenets into question, resulting in both a higher VIX and lower market," Jim Polk, a senior portfolio manager at Homestead Funds, told S&P Global Market Intelligence, referencing the improving economic data the Federal Reserve's monetary policy. "Investors are concerned whether these tailwinds are transitory or not. A correction like this in the market is healthy, however, given the performance over the past couple of quarters. Expectations were high."

Such concerns haven’t slowed the surge of deal-making and initial public offerings.

Healthcare IPOs doubled year-over-year worldwide in the first quarter, totaling 84 debuts and the highest number of first-quarter IPOs in five years. An S&P Global Market Intelligence analysis found that global insurance and insurtech companies raised approximately $1.88 billion from eight IPOs in January-March, the most since the first quarter of 2016.

The market is still growing for special purpose acquisition companies, or SPACs, that give operating companies nontraditional opportunities to list on public markets through reverse mergers. But new guidance issues by the U.S. Securities and Exchange Commission last month is likely to change regulation and investor interest, bringing forth fewer, but stronger IPOs in the U.S. Meanwhile, executives at Euronext Amsterdam, Deutsche Börse, and the London Stock Exchange have anticipated investor enthusiasm for SPACs across Europe to increase this year. Latin America’s fintech space is currently experiencing a SPAC boom.

Access to capital has decreased for the U.S. oil and gas companies covered by S&P Global Market Intelligence. These companies raised just $1.8 billion in April—down dramatically from the $11.6 billion in the previous month. Earlier this year, some watchers of upstream oil and gas companies in the U.S. were wary about the market’s renewed interest in IPOs across the sector.

A different kind of uncertainty can be seen in the sustainable-finance market. Europe’s green bond market could enjoy exponential growth pending a recent revision to EU rules on classifying sustainable-finance products. Green banks in the U.S. are seeking changes to investment barriers to achieve similar growth, in order to meet President Joe Biden's goal of allocating 40% of clean energy investments toward disadvantaged communities.

Prices for global commodities are popping. The price of copper has been climbing to record highs above $10,000 per metric ton in recent weeks. The economic recovery has driven demand for steel, and as such has bolstered its price. S&P Global Platts expects the rally in global grain prices that started last year to continue through 2021, with weather conditions leading as the primary factor in determining the market direction.

Today is Friday, May 14, 2021 and here is today’s essential intelligence.

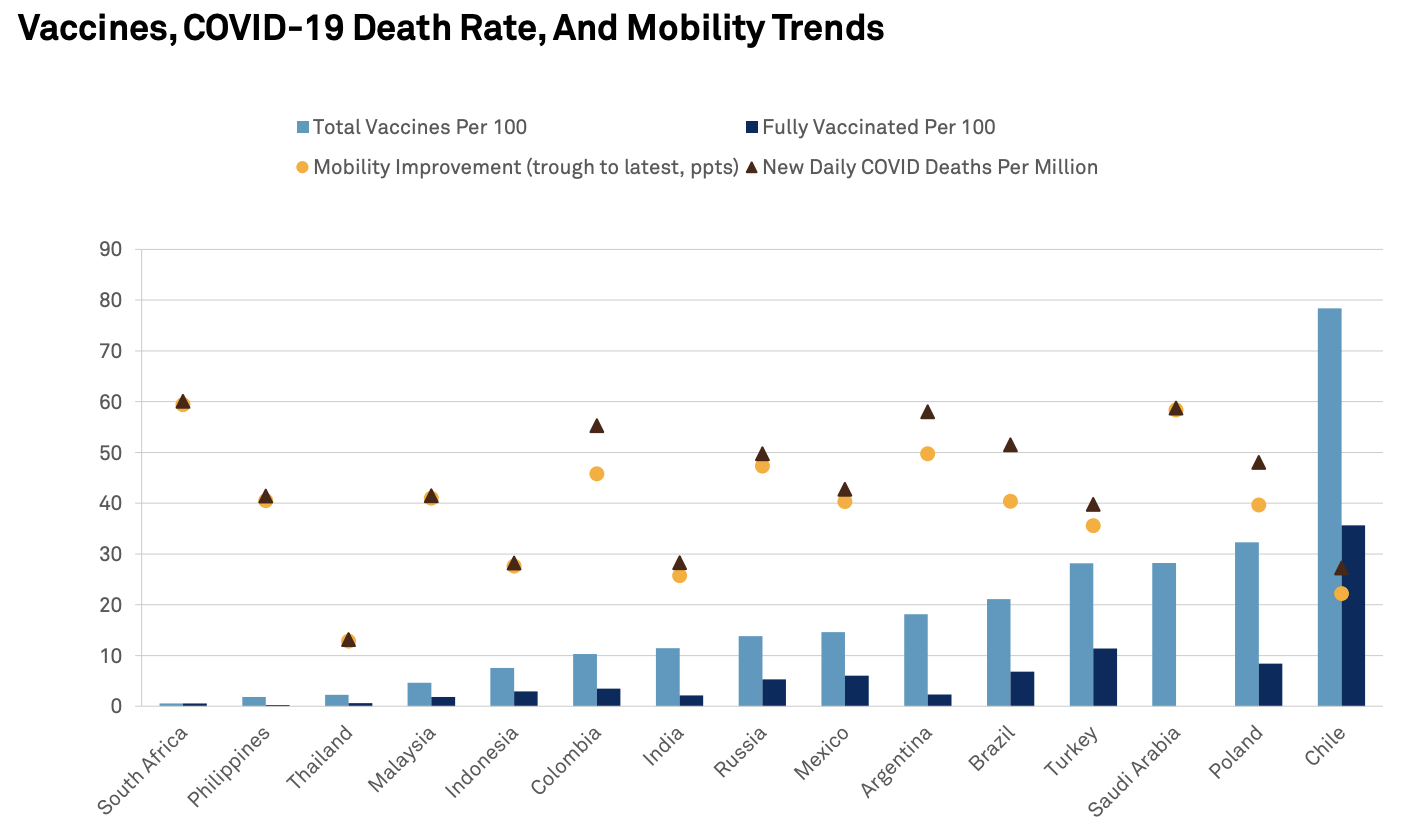

Emerging Markets Monthly Highlights: Slow Vaccination Keeps Recovery At Risk

The economic recovery in emerging markets (EMs) will remain highly vulnerable to pandemic-related setbacks, given the slow vaccine rollout. While it looks that we are past the worst of the latest COVID 19 wave in most of EMs, the likelihood of intermittent lockdowns will remain high for some time.

—Read the full report from S&P Global Ratings

Watch: When Active Management Looks Easier

How can style bias impact the perception of active manager outperformance? S&P DJI’s Craig Lazzara and Anu Ganti discuss how a better understanding of style bias can help market participants interpret active manager performance and S&P Dow Jones Indices’ SPIVA results.

—Watch and share this video from S&P Dow Jones Indices

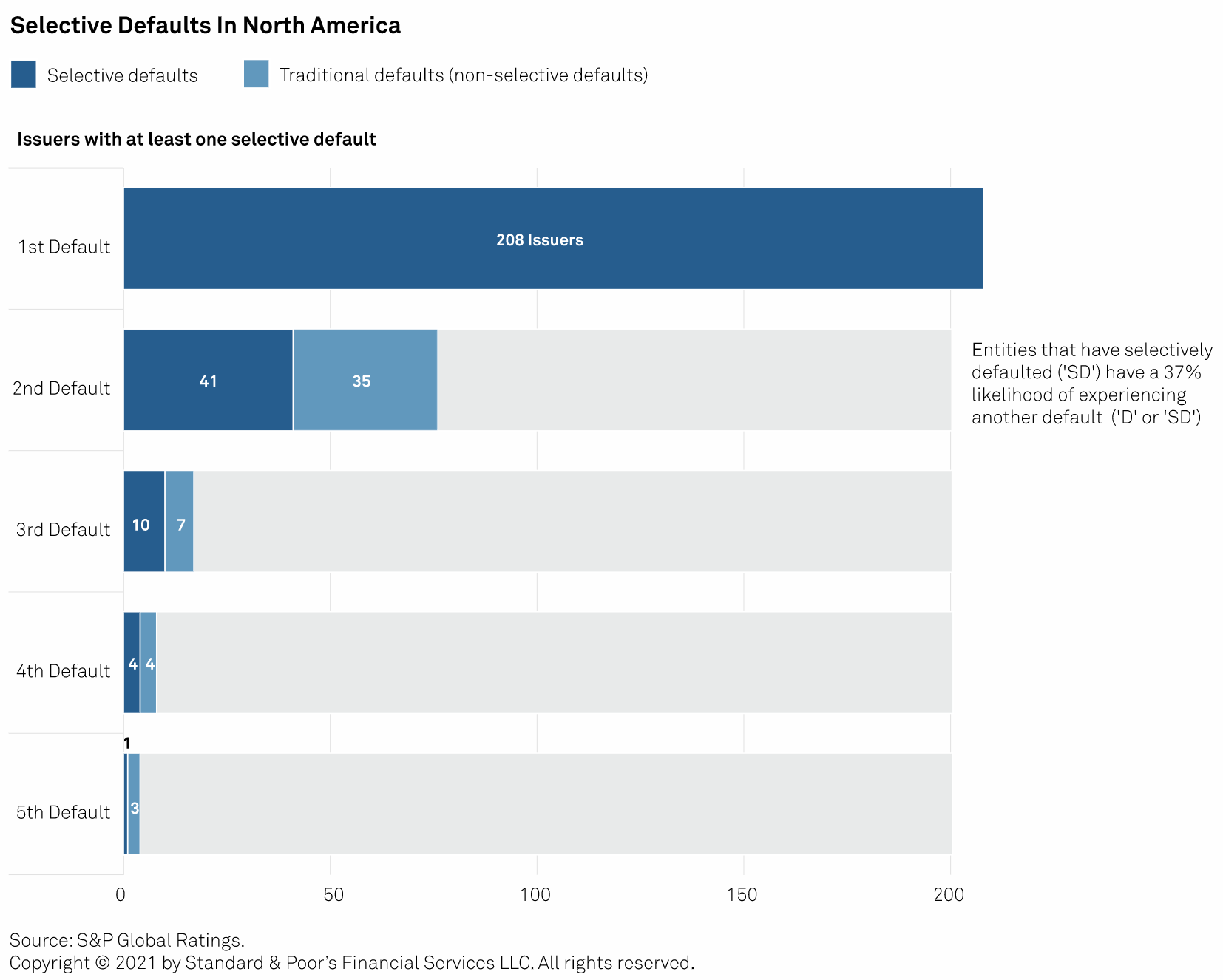

Default, Transition, and Recovery: Out-Of-Court Restructurings May Lead To Repeat Defaults Among Distressed U.S. And Canadian Corporates

Distressed issuers (and lenders) generally view out-of-court restructuring more favorably than a traditional bankruptcy. The increase in issuers restructuring out of court has led to S&P Global Ratings rating more entities as selective defaulters.

—Read the full report from S&P Global Ratings

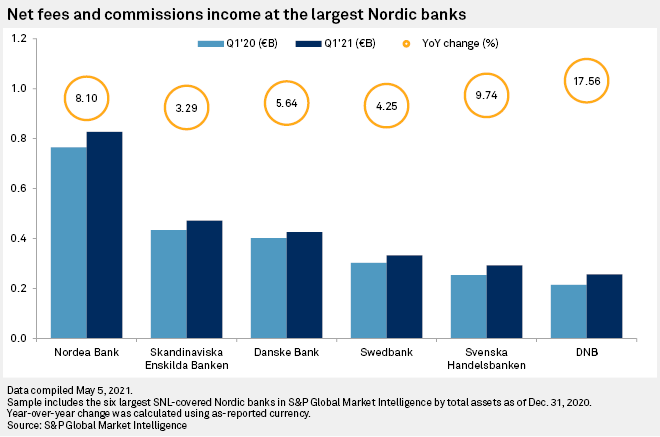

Nordic Banks Expected To Post Higher EPS On The Back Of Strong Q1 Fees Income

Big Nordic banks reported year-over-year increases in their first-quarter net fees and commissions income and assets under management, prompting UBS analysts to upgrade their estimates of the lenders' EPS for 2021 to 2023.

—Read the full article from S&P Global Market Intelligence

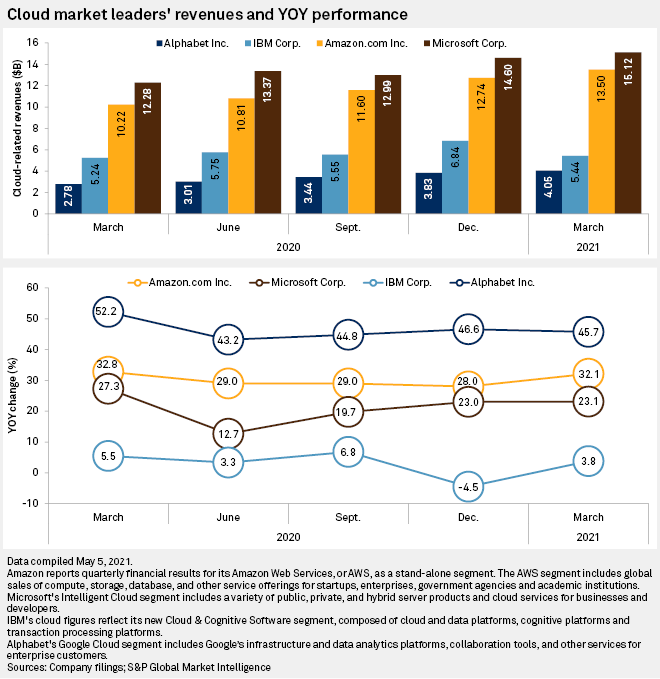

As US Weighs Axing $10B Cloud Contract, Software Providers Ready To Rush In

More than a year after the U.S. Department of Defense awarded a $10 billion cloud contract to Microsoft Corp., a prolonged court battle and a change of administration threatens to break it up, setting off a likely goldrush of smaller bids for more software providers, experts say.

—Read the full article from S&P Global Market Intelligence

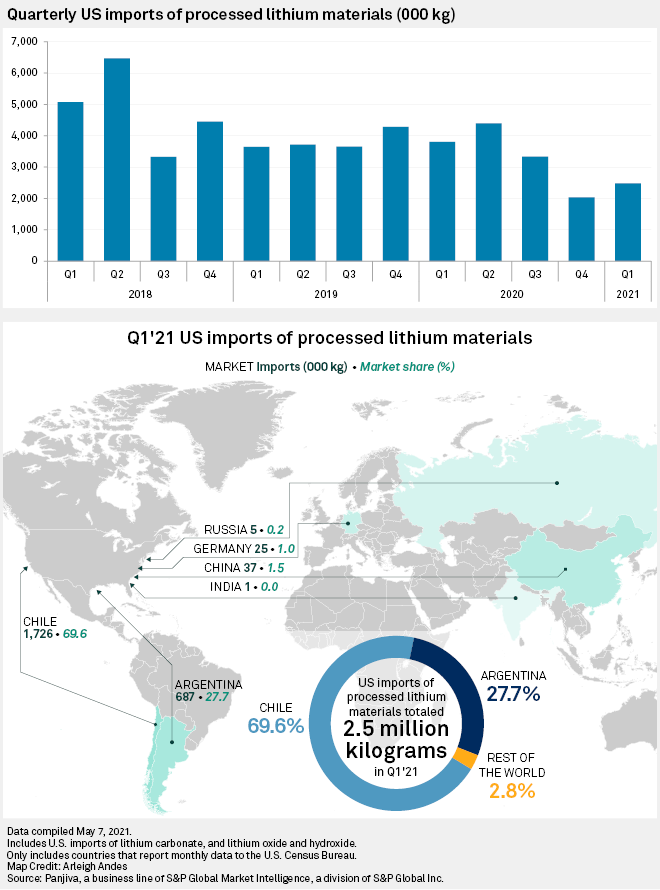

U.S. Lithium Imports Slow In Q1'21 As Parts Of Domestic Supply Chain Lag

The Biden administration may have grand ambitions to revitalize U.S. competitiveness in the race for global battery dominance, but recent data demonstrates the new government has inherited a weak domestic manufacturing base.

—Read the full article from S&P Global Market Intelligence

White House Tackles Outdated Cyber Tools For Federal Networks, Urges Industry To Follow Suit

U.S. President Joe Biden took steps to modernize national cyber defenses with an executive order and encouraged the private sector to similarly pursue ambitious measures to align their cybersecurity investments with the goal of mitigating future breaches.

—Read the full article from S&P Global Platts

Permitting Reform Pitched As Way To Bridge Gap On Infrastructure, Gain On Climate

Bipartisan steps are needed to cull infrastructure permitting inefficiencies, particularly if ambitious U.S. energy-sector carbon reduction goals are to be achieved, participants at a US Chamber of Commerce forum said May 13.

—Read the full article from S&P Global Platts

Listen: U.S. Gulf Coast Crude Differentials Linger At Pre-Pandemic Levels

Global crude prices have staged an impressive rally, recovering to pre-COVID levels. However, many US Gulf Coast crude differentials and regional spreads are yet to normalize, raising the question if the 2020 demand shock and ongoing infrastructure buildout will have a permanent impact on relative prices. S&P Global Platts Americas Crude Managing Editor Laura Huchzermeyer discusses recent price trends on the Gulf Coast and the Platts AGS waterborne crude assessment with Senior Pricing Specialist Kristian Tialios and Associate Director Matt Eversman.

—Listen and subscribe to Oil Markets from S&P Global Platts

U.S. Oil, Gas Rigs Jump 10 To 555 On Week, As Optimistic Q1 Season Wraps

The U.S. oil and gas rig count jumped 10 on the week to 555, rig data provider Enverus said May 13, as upstream operators wrapped up first-quarter calls on an optimistic note because of higher oil prices and an improving outlook for the rest of the year despite an uneven pandemic recovery.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language