Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 5 Mar, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

The global oil market is recovering faster than anticipated, but producers aren’t returning to business as usual.

The 13 member nations of the Organization of the Petroleum Exporting Countries and their allies—that together are known as OPEC+ and control approximately half of the world’s oil supply—agreed on March 4 to mostly maintain historic production cuts for April that were implemented last year to curb the crash in petroleum prices.

The agreement will ultimately keep roughly 8% of pre-pandemic supply, or 8 million barrels per day of crude production, off the market for another month, according to S&P Global Platts. Saudi Arabia said it will continue curtailing its voluntary cut of an extra 1 million barrels per day, while Russia and Kazakhstan will be allowed increased production capacity of 130,000 and 20,000 barrels per day, respectively.

The development delivered a blow to many market participants who hoped for an overall increase in output, and pushed crude prices higher. While some analysts anticipate that global oil demand will recover by year-end to pre-pandemic levels of 100 million barrels per day, other energy executives expect the second half of 2021 to provide the momentum needed for a full rebound by 2022.

OPEC+ delegates cited their concerns over the ongoing economic volatility spurred by the pandemic, alongside the effects of the uneven vaccine rollout and the potential for additional strict lockdown measures, as drivers of their decision to keep their grip on oil production tight, according to S&P Global Platts.

Leaders had urged caution over the outlook for the oil market and urged nations to practice restraint ahead of the discussions.

"We must emphasize in strong terms: cautious optimism, cautious optimism, cautious optimism," OPEC Secretary General Mohammed Barkindo said on March 2, projecting global oil demand to grow by 5.8 million barrels per day in 2021, to reach 96 million barrels per day, according to S&P Global Platts. Pre-pandemic production capacity totaled roughly 100 million barrels per day.

At the onset of the talks, Saudi Energy Minister Prince Abdulaziz bin Salman acknowledged that “there is no doubt that the global oil market has improved since we last met in January," but added that “before we take our next step forward, let us be certain that the glimmer we see ahead is not the headlight of an oncoming express train." He had urged the group to “have a contingency in reserve to ensure against any unforeseen outcomes.”

The path forward for petroleum producers will contain additional uncertainty brought on by geopolitical issues, including a potential thaw between the U.S. and Iran, and the energy transition that has pushed countries and companies alike to establish net-zero targets.

Today is Friday, March 5, 2021, and here is today’s essential intelligence.

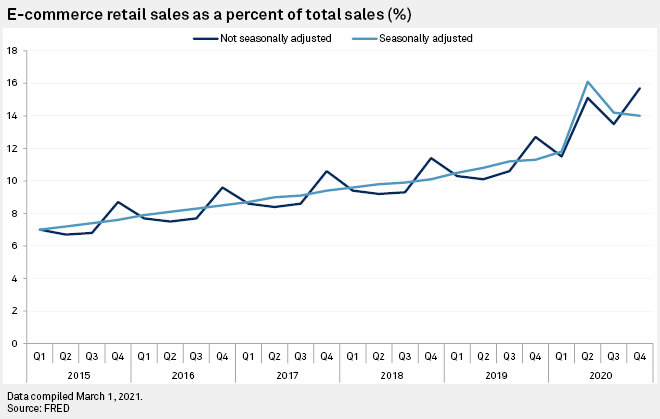

Next Round of Stimulus Checks Could Further Lift U.S. E-Commerce Sales

Large e-commerce players including Amazon.com Inc., Walmart Inc. and Target Corp. are likely to benefit from a third round of stimulus checks included in U.S. President Joe Biden's $1.9 trillion COVID-19 rescue package bill, with the cash infusion expected to spike already elevated digital retail sales.

—Read the full article from S&P Global Market Intelligence

Listen: Fixed Income in 15 – Episode 16

In this edition of Fixed Income in 15, Joe Cass is joined by Ruchir Sharma, Chief Global Strategist at Morgan Stanley Investment Management and our own Global Head of Sovereign Analytics & Research, Roberto Sifon. The discussion focused on the outlook for global sovereigns, the impact of ESG on nations and the rise of Bitcoin. There was also time for Roberto and Ruchir to discuss cooking, sprint training and what they miss about travelling.

—Listen and subscribe to Fixed Income in 15, a podcast from S&P Global Ratings

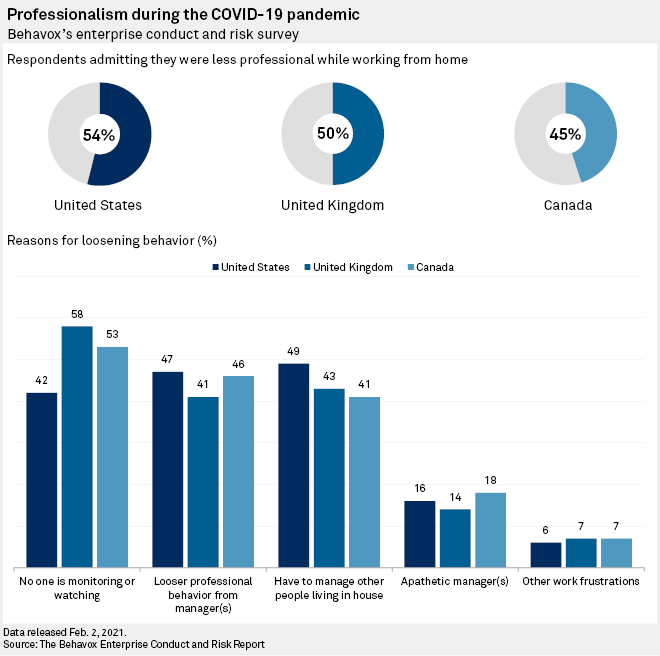

Banks Voice Need For Staff to Return to Office as Pandemic Takes Toll on Culture

The coronavirus pandemic was proof for many banks that working fully remotely is possible, but it has a downside impact too. Some bank executives are now voicing the need for employees to return to the office to maintain company culture, promote good behavior and ensure quality of work.

—Read the full article from S&P Global Market Intelligence

Greensill Case Could Trigger Loss of Confidence In Supply Chain Finance Market

Amid news of investors suspending funding to Greensill Capital (UK) Ltd., industry players fear it could cause a ripple effect on the supply chain finance market as a whole, to the detriment of small businesses in need of liquidity now more than ever.

—Read the full article from S&P Global Market Intelligence

Blank-Check Companies 'A Good Thing' For Mining, Private Equity Expert Says

A surge in the popularity of blank-check companies in the U.S. as a means to raise money and list on a stock exchange has carried over into the mining sector, with one mining investment expert lauding the capital-raising method as an overall positive for metals and mining.

—Read the full article from S&P Global Market Intelligence

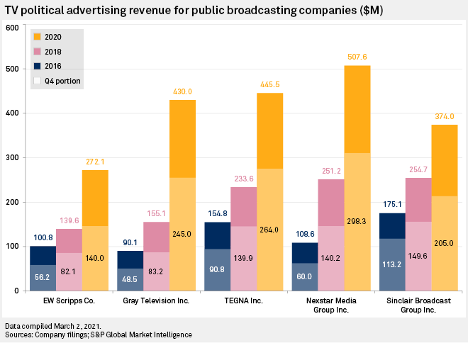

Following Record 2020, TV Groups Eye Robust Political Ad Revenues From Mid-Term

2020 was rough in many respects, but it was a great year for political ad spending. Five of the largest TV station owners were among the big beneficiaries of that spending, as TV remains the principal means by which candidates and parties disseminate their messages. The broadcasters said robust fourth-quarter 2020 spending capped a record year for political ad revenues. The bounty has executives already looking ahead to the category's prospects during what is expected to be a competitive 2022 mid-term cycle.

—Read the full article from S&P Global Market Intelligence

6G Wireless: What It Is and When It's Coming

Although it is still early days for 5G wireless technology, top industry players are already busy working on its successor. But analysts say 6G is at least a decade out, noting it will take time to develop the necessary infrastructure to support the new technology while also ironing out kinks in existing 5G networks.

—Read the full article from S&P Global Market Intelligence

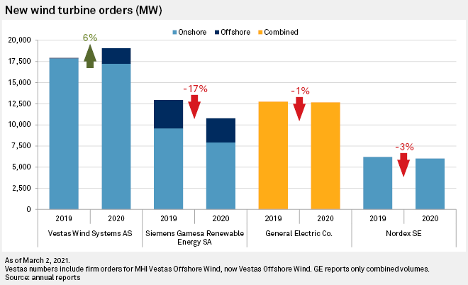

Wind-Turbine Makers Weathered Pandemic Year Largely Unscathed, Orders Show

The big Western wind-turbine manufacturers saw broadly stable order books in 2020, indicating a robust year for the industry despite monthslong lockdowns that disrupted installation work and led renewable energy developers to push back projects.

—Read the full article from S&P Global Market Intelligence

Technology, Artificial Intelligence are the Way to Reach Net Zero

The pathway to achieving net-zero emission goals is through continued technology advancements to bring down costs and more intelligence on the grid, power industry experts said March 4 at the CERAWeek by HIS Markit conference, held virtually.

—Read the full article from S&P Global Platts

China's Two Sessions Expected To Target Steel Industry Carbon Emissions: Analytics

S&P Global Platts Analytics expects a number of carbon emissions-related policy changes to China's steel industry to be announced during China's National People's Congress and Chinese People's Political Consultative Conference, or the Two Sessions, starting in Beijing on March 4.

—Read the full article from S&P Global Platts

Listen: Fleet Vehicle Electrification Could Be Big U.S. EV Growth Driver

In this edition of the Platts Commodities Focus podcast, Jared Anderson, senior writer with S&P Global Platts, speaks with John McClure, managing director at Nomura Greentech, about EV market growth, investment trends and how greater EV usage could impact US power markets.

—Listen and subscribe to the Commodities Focus, a podcast from S&P Global Platts

Asian Refiners Hopeful For Iranian Crude, Condensate Trade Resumption Under Biden Administration

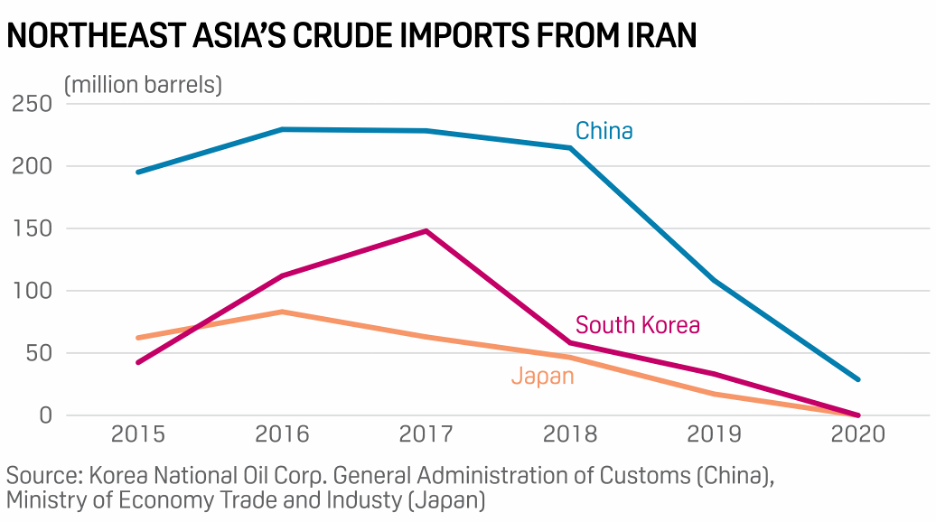

Asian refiners and petrochemical makers have started to prepare for a possible resumption in Iranian crude imports amid growing optimism that tensions between Washington and Tehran could improve under the Biden administration, with several Asian oil companies and trading firms reviewing recent Iranian crude official selling prices and S&P Global Platts South Pars condensate price assessments.

—Read the full article from S&P Global Platts

Resource Nationalism Surge Could Spell Tough Times for Mining Sector: Verisk Maplecroft

Resource nationalism – government assertion of control over a country's natural resources – saw an increase in 34 countries worldwide in 2020, with the mining sector likely to experience rougher times ahead due to the economic impacts of COVID-19, analysts at Verisk Maplecroft said in a report March 4.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language