Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 31 Mar, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Relative Stability of Stablecoins

Not all stablecoins are worthy of the name. Last year’s collapse of cryptocurrency terraUSD and the depegging of two prominent stablecoins following recent turbulence in the banking sector demonstrate that many stablecoins should be considered a speculative asset class with a considerable risk profile.

According to S&P Global Ratings, stablecoins have over $150 billion in market value, making them one of the fastest-growing asset classes in decentralized finance (DeFi). Stablecoins were developed as a type of cryptocurrency that could act as a bridge between digital and fiat markets by maintaining a stable value. The value and supply of stablecoins are derived from their underlying assets. Typically, stablecoins are fully backed by assets tied to a fiat currency or commodity. Stablecoins are often used by participants in cryptocurrency markets as a medium of exchange and a method of converting value from DeFi investments into fiat currencies.

Not all stablecoins are fully backed by fiat or commodity assets, though. Some stablecoins are backed by crypto-assets, while others are noncollateralized, meaning they rely on software algorithms to preserve their value. TerraUSD was an example of a noncollateralized stablecoin. At the time of its collapse in May 2022, terraUSD was the third-largest stablecoin, with a market cap of nearly $19 billion. There is a considerable difference in volatility between stablecoins claiming to be backed by fiat and those backed by algorithms — stability, in this case, being relative.

According to Paul Gruenwald, global chief economist at S&P Global Ratings, one way to understand stablecoins is to view them as currency board regimes that provide benefits for DeFi in a way that currency boards would for the fiat world, meaning they establish credible exchange rate stability. As with currency boards, the credibility and liquidity of the issuer are key.

Following the recent failure of several banks with exposure to the cryptocurrency sector, two major stablecoins — USD coin and dai — temporarily lost their peg to the U.S. dollar and fell by 13%. Dai weathered the collapse of terraUSD in 2022 but, in both cases, demonstrated considerable volatility. According to S&P Global Ratings, cryptocurrency regulation has thus far focused on the risk that stablecoins pose to the traditional economy; however, recent events demonstrate that risk contagion can pass from the traditional economy to the DeFi sector.

Given the occasional instability of some stablecoins, it might appear that the juice isn’t worth the squeeze. However, stablecoins are necessary both for the evolution of true digital bonds and for the development of commerce in what is known as “the metaverse” — the next-generation digital platform that some believe will replace and subsume the current version of the internet.

Because of these practical and market-spanning applications, stablecoins have attracted increasing scrutiny from regulators. Regulating stablecoins should reduce some of the risks, accelerating and legitimizing their wider use. However, challenges remain. The failure of several banks linked to the cryptocurrency ecosystem and the temporary depegging of major stablecoins demonstrates that stablecoins are difficult to convert quickly into fiat currencies, particularly during times of market turmoil.

Today is Friday, March 31, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Asia-Pacific Sector Roundup Q2 2023: China Rebound Steadies Sector Outlooks

The era of low interest rates and easy credit is over. Amid greater market volatility and slower economies, funding access could tighten sharply. Banks, which dominate the region's funding channels, could turn selective. The banking turmoil could see lenders turning more risk averse, slowing credit availability further for borrowers, especially highly leveraged ones.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

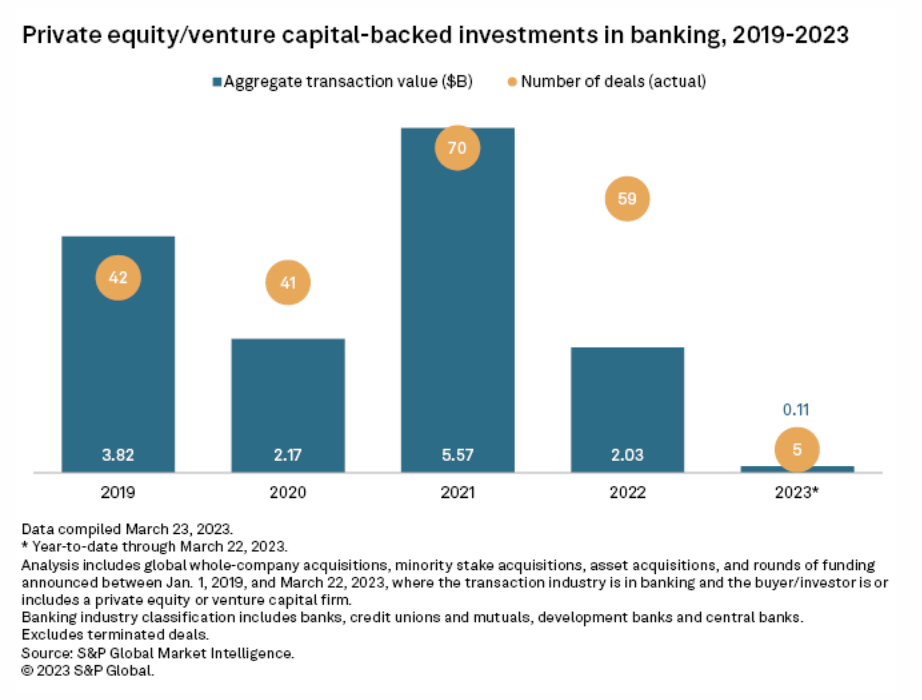

Private Equity Investment In Banking Sector Down More Than Half In 2022

Global private equity and venture capital investments in the banking sector dropped in 2022, reflecting the overall downturn in deals as interest rates rose and concerns over the direction of the global economy increased. The aggregate transaction value stood at $2.03 billion in 2022, down 63.5% from $5.57 billion the previous year, according to S&P Global Market Intelligence data. The number of transactions also fell to 59 from 70 in 2021, according to S&P Global Market Intelligence data.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

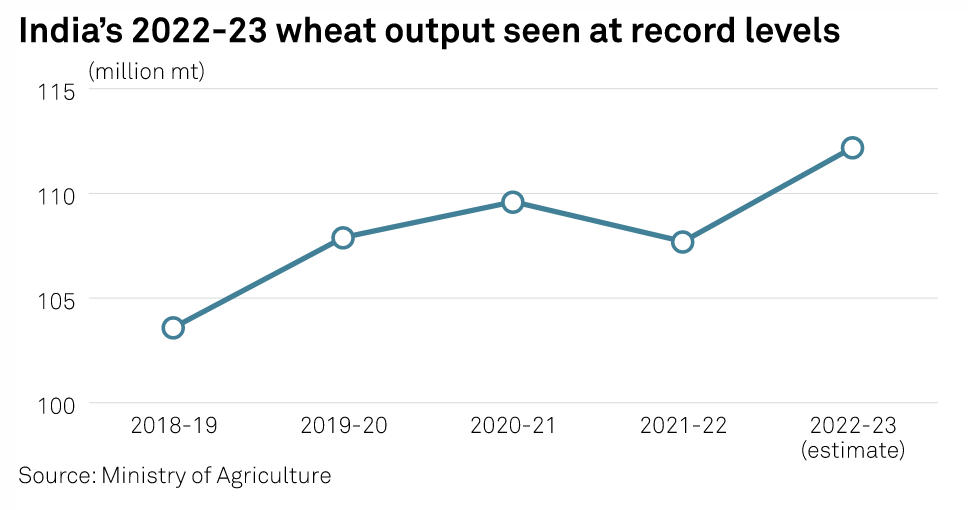

India May Reduce Wheat Output Estimate Due To Unseasonal Showers, Hail

The Indian government could reduce its wheat harvest estimate as unseasonal showers and hailstorms led to sizable damage to the wheat crop in the Indian states of Punjab, Uttar Pradesh and Madhya Pradesh, sources in the agriculture ministry told S&P Global Commodity Insights. The agriculture ministry has decided to conduct a preliminary survey to assess the damage to the crop, an official at the ministry said.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Energy Evolution | Hitting Net-Zero Targets Across Industries, Featuring 8 Rivers President Damian Beauchamp

8 Rivers is a company providing net-zero solutions across a wide range of sectors, including the oil industry, the renewable sector and so-called hard-to-abate sectors such as cement and steel makers. Energy Evolution co-host Taylor Kuykendall spoke with 8 Rivers President and Chief Development Officer Damian Beauchamp at the company's booth during the CERAWeek by S&P Global conference in Houston in early March.

—Listen and subscribe to Energy Evolution, a podcast from S&P Global Market Intelligence

Access more insights on sustainability >

Codes For High-Integrity Offsets Revealed As Voluntary Carbon Markets Look To Restore Trust

A global guidance aimed at tackling quality concerns around carbon offsets was unveiled March 30 as the voluntary carbon markets look to recover from a crisis in confidence. The Integrity Council for the Voluntary Carbon Market finalized its Core Carbon Principles, which lays out what a high integrity carbon credit should look like. "This will reduce confusion, overcome market fragmentation, and give buyers confidence they are funding projects making a genuine impact on emissions," the governance body said in a statement.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 109: Dealing With Uncertainty In Risk Modeling

Risk analytics can be powerful but depend on the quality of data and the underlying model. How can we be certain that the results are valid? Arsene Lui, associate director for quantitative modeling, joins host Eric Hanselman to discuss the challenges of quantifying uncertainty - particularly important in these turbulent economic times. Credit risks are particularly complicated to sort out, given macroeconomic scenarios that seem to shift by the hour.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence