Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 23 Mar, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Crypto in the Time of Conflict

The Russia-Ukraine conflict is bringing the good, the bad, and the ugly perceptions of cryptocurrencies into the spotlight.

Some observers have suggested that Russian entities and individuals may be converting their capital into cryptocurrencies to evade sanctions on financial institutions and bypass money transfers via banks to finance deals. Others believe cryptocurrencies haven’t proven their value as safe haven assets to hedge against the market volatility spurred by the conflict—as popular decentralized assets like Bitcoin and Ethereum plunged within hours after Russia invaded Ukraine, before recovering losses later on. Overall, the Russia-Ukraine conflict may simply represent an extraordinary event for these decentralized assets that prompts more widespread regulatory oversight.

“Demand for cryptocurrencies by Russian residents has surged as sanctions threaten to severely restrict the country from access to the global financial system. This will likely further accelerate the pace of regulatory scrutiny. However, S&P Global Ratings doesn't believe cryptocurrency use has reached a scale that could blunt the likely severe consequences of sanctions on the Russian economy,” S&P Global Ratings said in a recent report. “In our view, the surge of interest in Bitcoin is primarily attributable to customers trying to protect savings against a weaker domestic currency along with other local asset depreciation. Under extreme circumstances such as war and severe sanctions, Bitcoin may be viewed as a way to safeguard wealth and bridge access to reserve currencies.”

Due to the traceable nature of crypto exchanges and their lack of scalability as an alternative form of payments, S&P Global Ratings doesn’t believe cryptocurrencies are being used broadly to evade sanctions on Russian corporations or certain nationals.

Nonetheless, the potential for crypto to be used as a tool for evading sanctions could result in regulatory action. The U.S. Treasury Department warned in October that digital currencies posed a threat to its sanctions program. Just yesterday, the leader of the European Central Bank indicated that it sees cryptocurrencies as a current tool for Russian entities to evade international sanctions.

“When you see the volumes of rubles into stable[coins], into cryptos, at the moment it is the highest level that we have seen since maybe 2021,” ECB President Christine Lagarde said yesterday at a Bank for International Settlements virtual event. Because decentralized finance assets “are certainly being used, as we speak, as a way to try to circumvent the sanctions that have been decided by many countries around the world against Russia,” she added that the ECB has “taken steps to clearly signal to all those who are exchanging, transacting, offering services in relation to crypto assets that they are being accomplices to circumvent sanctions.”

Today is Wednesday, March 23, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

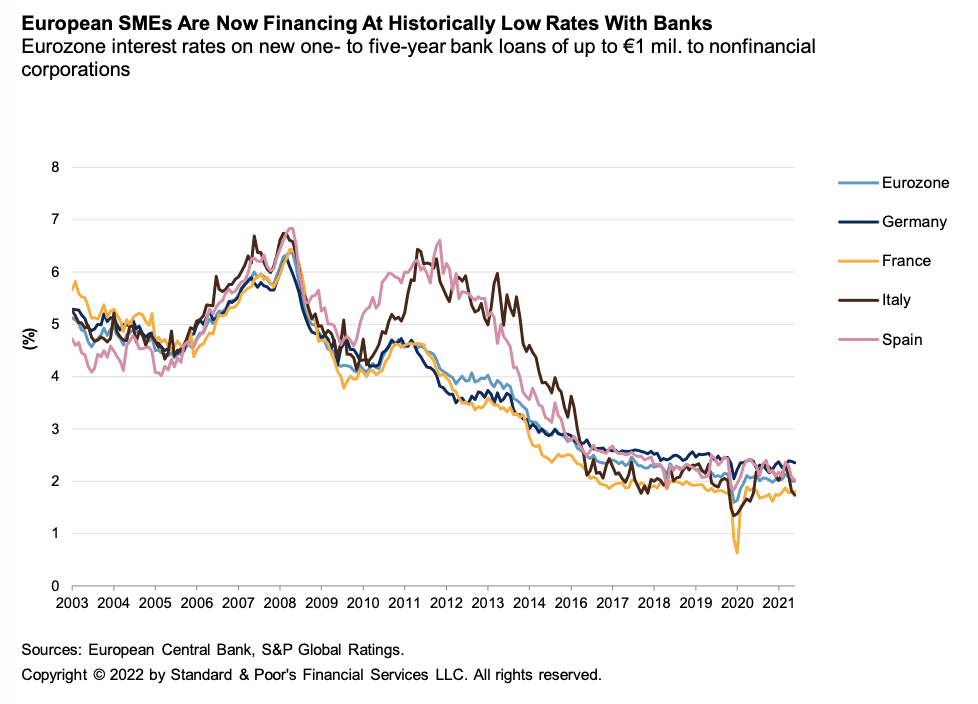

Economic Research: Financing Faster Growth For Europe’s SMEs

How can Europe help its 25 million small and medium-sized enterprises better access finance and grow? These companies account for 99% of all EU businesses, half of its GDP, and two jobs out of three. However, SMEs can find it difficult to access finance given their smaller size, opacity, and somewhat weaker profitability than large firms. They therefore live on bank loans, credit lines, and leasing—their main three sources of financing. What's more, they have generally refrained from accessing capital market funding by issuing bonds or other securities.

—Read the full report from S&P Global Ratings

Access more insights on the global economy >

Listen: Leveraged Finance & CLOs Uncovered Podcast: How Does Recent Events Impact Global Structured Finance?

Hina Shoeb and Sandeep Chana are joined by Winston Chang, Chief Analytical Officer - Structured Finance, where they discuss direct and indirect impact of the geopolitical crisis and how some sectors are more impacted than others.

—Listen and subscribe to CLOs Uncovered, a podcast from S&P Global Ratings

Access more insights on capital markets >

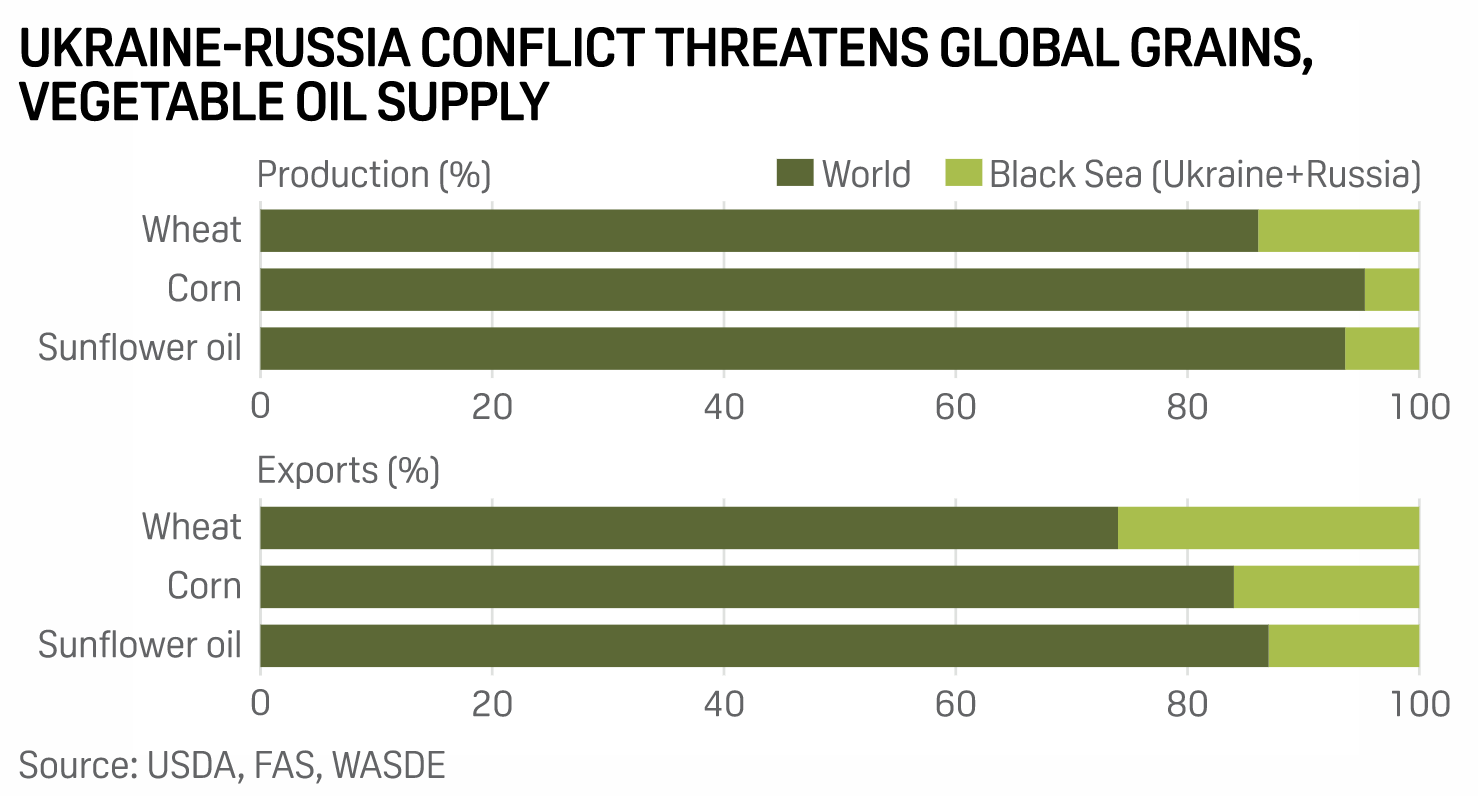

Interview: Trade Restrictions, Panic Buying Key Concerns For Agriculture Markets: IFPRI's Glauber

Potential export restrictions and panic buying could push agriculture prices further higher as the market grapples with growing uncertainty owing to Russia's invasion of Ukraine, Joseph Glauber, senior research fellow at International Food Policy Research Institute said in an interview with S&P Global Commodity Insights. Glauber, who was formerly the chief economist with the U.S. Department of Agriculture, said that the biggest risk that he sees emerging from Russia's invasion of Ukraine is that countries will try to regulate exports to keep prices low internally.

—Read the full article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Tracking Upstream Emissions With U.S. Oil Supply On The Rise

U.S. oil supply is expected to increase this year, and new tools tracking upstream emissions will bring interesting new insights. Deb Ryan, head of low-carbon market analytics for S&P Global Commodity Insights, explains her team's monthly carbon-intensity estimates, which rank upstream emissions from 104 oil fields around the world. She's watching what will happen in the Permian Basin as drillers potentially respond to higher prices but face challenges with gas takeaway capacity. The U.S. Energy Information Administration estimates U.S. oil supply growth at 850,000 b/d in 2022, and S&P Global raised its outlook to 930,000 b/d to account for higher sustained prices.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

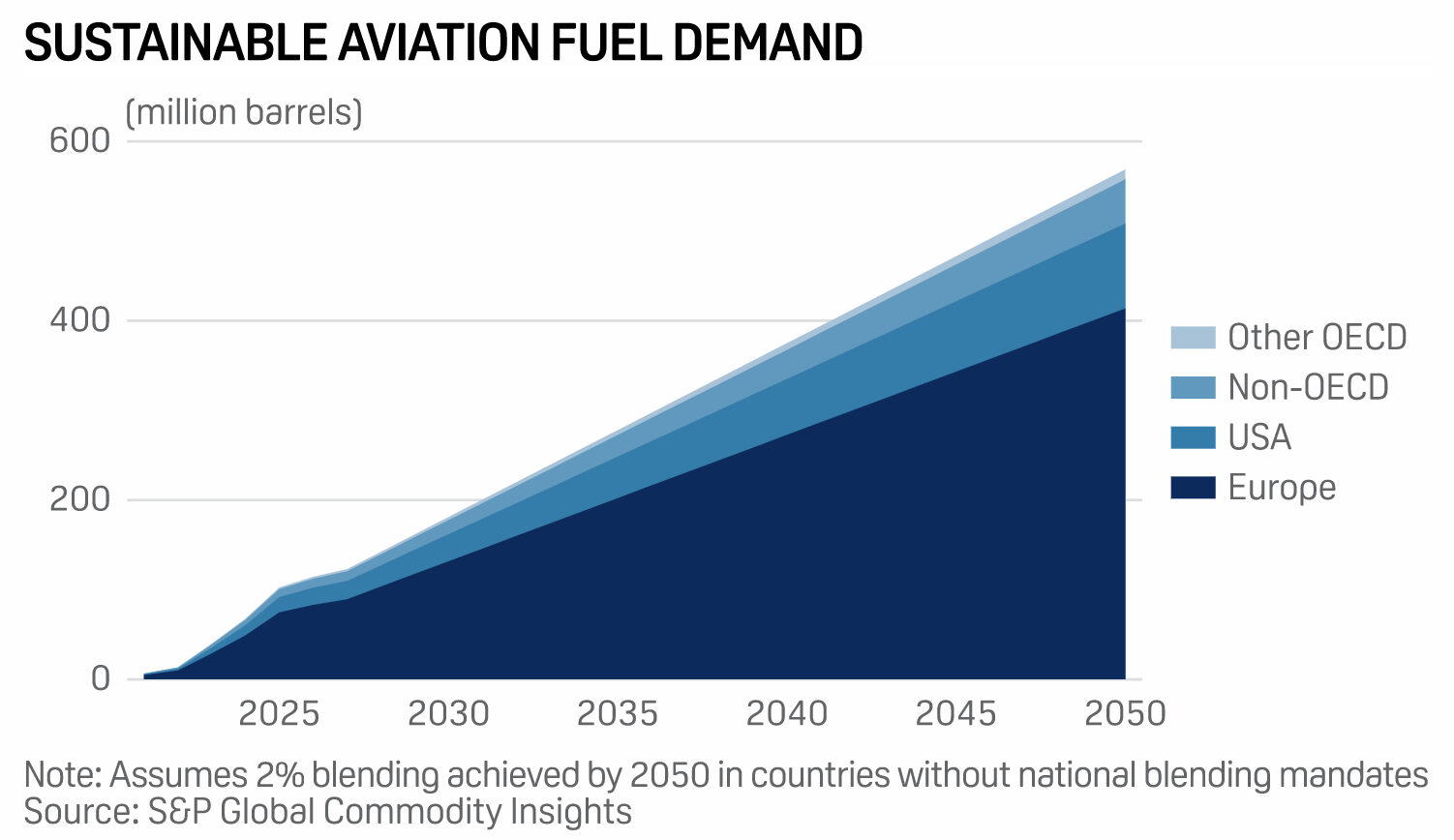

Long-Term Demand For SAF Could Run Into Supply Constraints

The number of countries that have proposed or adopted long-term blending targets for sustainable aviation fuel, or SAF, continues to increase. But with supply limitations potentially constraining growth to 2050, many countries may fall short of their blending targets. Based on current and announced commercial commitments, S&P Global Commodity Insights projects that SAF demand by 2050 could climb to 5.8% of global jet fuel demand, with country-level demands concentrated in Europe and the U.S.

—Read the full article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 57: Cybersecurity And The Ukraine Conflict

The conflict in Ukraine is having dire humanitarian consequences and is creating economic disruption. The impacts that many expected in the cyber realm have been more muted. Scott Crawford and Johan Vermij return to discuss what this means for the evolution of the attacker community and what organizations should be considering with host Eric Hanselman. Alignments between state actors and some criminal groups may not be as tight many expected, but it’s clear that we’re in a very new situation.

—Listen and subscribe to S&P Global Market Intelligence