Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 22 Mar, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

In a post-pandemic world, the global healthcare industry may be unrecognizable due to the crisis’ acceleration of disruption. The future of healthcare will likely be shaped by digital options.

As concerns about catching the coronavirus kept swaths of people away from doctors’ offices and hospitals, direct-to-consumer healthcare options including telehealth surged in popularity as a primary means of accessing safe, convenient medical care. Both industry veterans and newcomers have benefitted from the boom. Multinational provider Teladoc Health added 15 million new members last year and enjoyed $383 million in fourth-quarter revenue–a 156% increase in users and a 145% jump in earnings year-over-year. Startup Roman Health Ventures, known as Ro, raised $200 million in Series C funding in July, giving it a valuation of $1.5 billion, according to S&P Global Market Intelligence.

Before the COVID-19 crisis, telehealth was used episodically “as a quick fix to get a bridge to a particular issue. But the COVID pandemic has really redefined this. We now use a lot of these telehealth services for more ongoing care, longitudinal care,” Jennifer Peña, chief medical officer of telehealth provider Nurx, told S&P Global Market Intelligence. “People appreciate not being tethered to that traditional primary care, or some specialty care, brick-and-mortar experience. They want more convenience, they want more control, and that's what telehealth is doing for them.”

“My sense is that we're going to find that point-of-care more and more is going to be point-of-home. And that's one of the reasons why I believe telehealth is going to continue to expand into a truly giant industry,” John Sculley, chairman and chief marketing officer at the pharmacy benefit-management company RxAdvance, told S&P Global Market Intelligence.

Market observers expect Big Tech to make a stronger foray into the healthcare space, with Amazon in the lead. The e-commerce giant is already planning to launch an online pharmacy that could have dramatic implications for traditional providers, like CVS and Walgreens.

“I don't think there is a better place for the high-tech industry to add value than in preventative care,” Mr. Sculley, who is a former CEO of Apple, said. “We will see big tech continue to move into healthcare, but they haven't moved into it with the same level of success that they have in other industries. The problem is that the healthcare industry, a regulated industry, is incredibly complex ... [but] I think that it's only a matter of time until big tech becomes more knowledgeable about the complexity of the healthcare industry.”

To be sure, health officials worldwide have expressed concern that a new public health crisis of critical or advanced illnesses will emerge after a year of missed in-person treatments.

The crisis’ implications for mental health are clear, with 41.1% of U.S. adults reporting symptoms of anxiety disorder or depression this January, according to the National Center for Health Statistics and the U.S. Census Bureau's Household Pulse Survey. In response, digital health companies with mental health platforms have turned to corporations outside of their industry to raise capital and expand their customer base by offering services for employers to utilize for their workforces.

"How do we really use this moment to reduce stigma so folks can start thinking about their mental health in this time of need, and making that available to everyone?" Nicola Kamath, vice president of product marketing at Ginger.io, which works with employers and health plans to provide mental health services, told S&P Global Market Intelligence. Explaining that accessing employer-provided services can help employees feeling trapped by the pandemic, she added that trying such services can “help shape their perspective of ... 'In this world of COVID, where we can't control so much around us, this feels like something that I can affect.'"

Pharmaceutical leaders see their industry transformed by the crisis, largely due to the private- and public-sector collaboration and technological innovation that spurred the rapid response in COVID-19 vaccine development. Some analysts believe the crisis has brought the importance of immunology to the forefront, and scientists are exploring how the mRNA technology used in coronavirus vaccines can be tested and applied in treatments for other serious illnesses.

After “feeling like every day counts for such a long time while infections kept increasing, there was a setting of incredible time pressure coupled with a lack of understanding of the disease that we're trying to study,” Gilead is using lessons learned from the success of Pfizer and Moderna's mRNA coronavirus vaccines to research and develop an inoculation for HIV, the company’s Senior Vice President and Virology Therapeutic Area Head Diana Brainard told S&P Global Market Intelligence.

Today is Monday, March 22, 2021, and here is today’s essential intelligence.

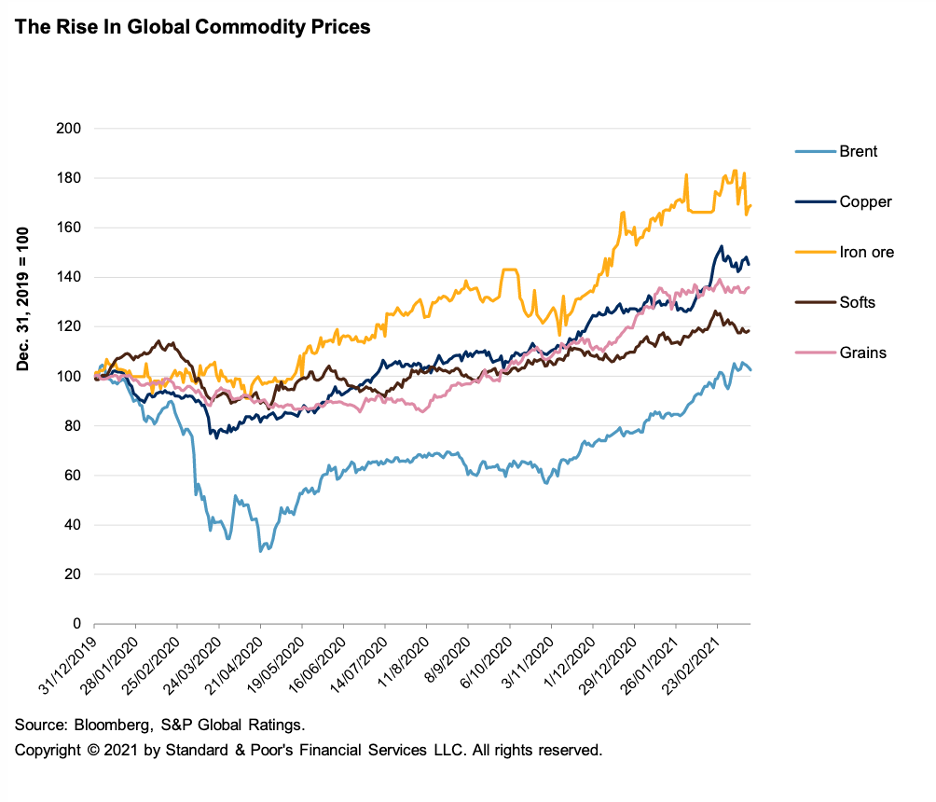

Economic Research: Rising Commodity Prices Are Generally Good News for Emerging Markets—But Watch Out for Inflation

S&P Global Ratings views the recovery in commodity prices worldwide as generally good news for emerging markets. However, a fast rise in commodity prices, in particular oil, brings important challenges for some of these economies.

—Read the full report from S&P Global Ratings

Spain's €11 Billion Aid Package for the Private Sector Signals A Shift From Liquidity to Solvency Support

It is too early to tell how many of Spain's small-to-midsize companies the €11 billion in direct aid that the Spanish government has pledged to the private sector will save from collapse. In S&P Global Ratings' opinion, the evolution of the economic situation both in Spain and abroad will determine whether more support will be needed. Yet for now, the support package, amounting to 1.1% of GDP, is welcome, both among the corporate recipients, and the banks, as it will contain their credit losses.

—Read the full report from S&P Global Ratings

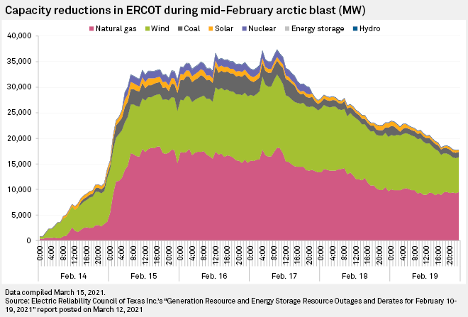

Analysts See Certain Generators, Solar as Beneficiaries of Texas Energy Crisis

Wall Street and rating agencies are sifting through the aftermath of the recent near collapse of the Texas grid to sort out which power businesses can survive, and which may be positioned to thrive.

—Read the full article from S&P Global Market Intelligence

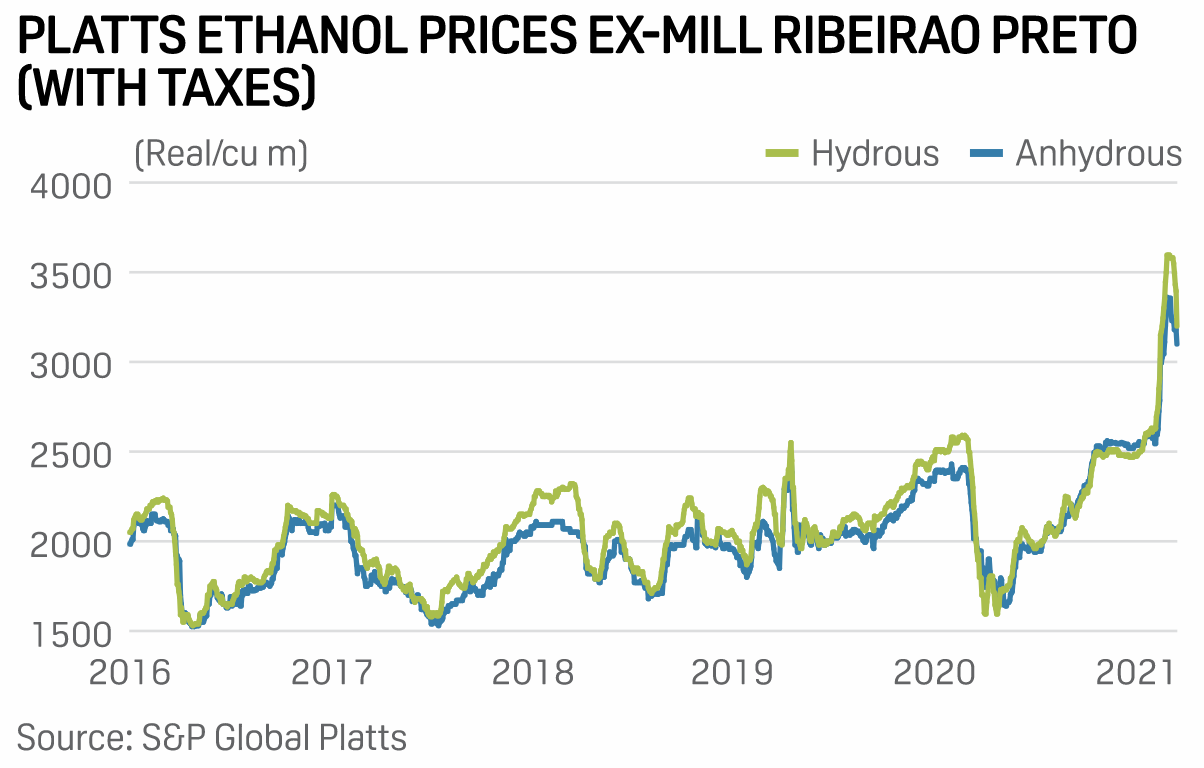

Brazilian Quarantines, International Energy Market Weakness Put Brakes on Ethanol Rally

The recent quarantines enforced throughout Brazil and international energy market weakness have caused a price correction to the recent rally in Center-South ethanol prices.

—Read the full article from S&P Global Platts

For Hydrocarbon-Exporting Sovereigns, Higher Oil Prices Will Not Immediately Reverse Longer-Term Balance Sheet Deterioration

Higher oil and gas prices generally help to improve the government budgets and current account positions of hydrocarbon-exporting sovereigns. However, in the view of S&P Global Ratings, the prolonged and in many cases ongoing structural deterioration in their stock positions—government net debt and net external debt—alongside relatively limited fiscal and economic reform momentum, are also fundamental considerations for hydrocarbon-exporting sovereigns that are rated.

—Read the full article from S&P Global Ratings

FERC Clarifies Order on Distributed Energy, Launches Demand Response Inquiry

The Federal Energy Regulatory Commission on March 18 agreed to make several important clarifications to a landmark rule opening wholesale power markets to aggregations of distributed energy resources, including a key determination that state opt-out rules for demand response resources do not apply to those types of aggregations.

—Read the full article from S&P Global Market Intelligence

New COVID-19 Containment Measures Hurt Mongolian Coal Supply to China: Sources

Mongolian coal supply to China has come under greater scrutiny by Chinese market participants amid the latest coronavirus containment measures implemented March 16 at the Ganqimaodu border -- the gateway for Mongolian coking coal to China, market sources told S&P Global Platts late March 18.

—Read the full article from S&P Global Platts

U.S. Natural Gas Storage Volumes Decline 11 Bcf As Heating Season Winds Down

US natural gas storage volumes in the week ended March 12 decreased by 11 Bcf, to 1.782 Tcf, the US Energy Information Administration reported March 18, as heating season rapidly winds down and Henry Hub futures slide further.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language