Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 17 Mar, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

The use of environmental, social, and governance (ESG) metrics by companies and investors began to develop prior to the pandemic spread in 2020 as compounding crises gripped the global economy. Now, with a recovery on the horizon in a world where the unprecedented has become the normal, long-term resiliency plans are more vital than ever before.

“Nobody could look back on 2020 and not see the implications of the pandemic, social inequities through the Black Lives Matter movement, the disproportionate impact of the pandemic on different minority groups, and the real climate issues that we see every day on the television,” Martina Cheung, president of S&P Global Market Intelligence and head of ESG for S&P Global, told the Essential Podcast. “What I would hope to see five years from now is that companies, sectors, and governments have made meaningful progress in actually incorporating all of this into planning and decision-making. I was on a call recently where somebody said, ‘I hope that five years from now, we're not talking about sustainable finance—we'll just be talking about finance.’ This really is table-stakes for a successful transition, and so anything that we can do to prepare to support the companies that need to disclose, to support the formation of capital markets around sustainable finance, to incorporate sustainability so heavily into how the financial system operates so that it becomes just part of the fabric, I think will be very important. And I do believe that we have a lot of the right pieces in place to help with that.”

This year will likely see improvements in ESG data in response to demand and regulatory drivers; a new sense of climate urgency in the U.S. under the Biden Administration; a strong environmental spotlight on nature and biodiversity risks; more nuanced conversations about the energy transition that focus on climate resilience; investor engagement on worker safety and diversity issues; and global policy that centers social issues, according to Ms. Cheung.

"We're seeing a focus on appointing people of color to boards and top management positions. We're talking a lot more about pipelines and how you're ensuring women and people of color are included in the leadership pipelines and in kind of all different aspects of the company, and really in the economy," Courteney Keatinge, a senior director of ESG research at Glass Lewis, which provides research and recommendations on how investor clients should vote on proposals from management and shareholders, told S&P Global Market Intelligence’s ESG Insider podcast. "This kind of very broad focus on the issue and very intensified focus on this issue is going to play out in the coming year."

This future agenda—aptly characterized as the “race to resilience”—has been shaped by recent events. No longer niche, ESG’s entree into the mainstream will likely bring forth a proliferation of green, social, and sustainable bonds to the tune of $700 billion worldwide this year alongside a surge in transition finance, according to S&P Global Ratings.

“Our projection reflects the acceleration of green-labeled bond issuance (of up to $400 billion in 2021) driven by climate policies and the transition to a low-carbon economy, combined with momentum in social and sustainable debt instruments as the pandemic highlighted the need for these amid rising unemployment, income inequality, and strains on housing, health care, and education systems,” S&P Global Ratings said in a recent report.

In addition, more companies are expected to disclose nonfinancial data metrics, and governments are likely to encourage such reporting. The European Union has already introduced nonfinancial reporting requirements for sustainable investment funds under its Sustainable Finance Disclosure Regulation, which could be completed as soon as this month and implemented next year, while the U.S. Securities and Exchange Commission’s top official this week signaled that a standardized corporate ESG disclosure framework could be introduced by the regulator in the short-term.

Today is Wednesday, March 17, 2021, and here is today’s essential intelligence.

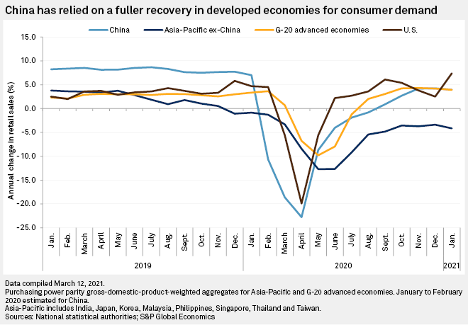

Weak Chinese Consumption Holds Back Global Economic Recovery

Soaring demand from other developed economies has breathed life into China's economy, while China's own sluggish recovery in domestic consumption is a weight on the global resurgence both in terms of the country's growth and demand for the products of exporting countries, experts say. That contradicts the narrative that China — considered the growth engine for the global economy this century — is leading the world's recovery, said Shaun Roache, chief economist, Asia-Pacific at S&P Global Ratings.

—Read the full article from S&P Global Market Intelligence

Economic Research: This Time, Europe Is Set to Stage A Jobs-Rich Recovery

The employment recovery should be faster than after the global financial crisis. Short-time work schemes have worked well at cushioning the European labor market. Plus, structural reforms over the past 10 years have also made labor markets more responsive to growth in Europe—especially in Spain, but also in France and Italy. S&P Global Ratings thinks wage growth is unlikely to decline by much in a fast jobs recovery but is likely to hit a ceiling because of the shock to firms' productivity.

—Read the full report from S&P Global Ratings

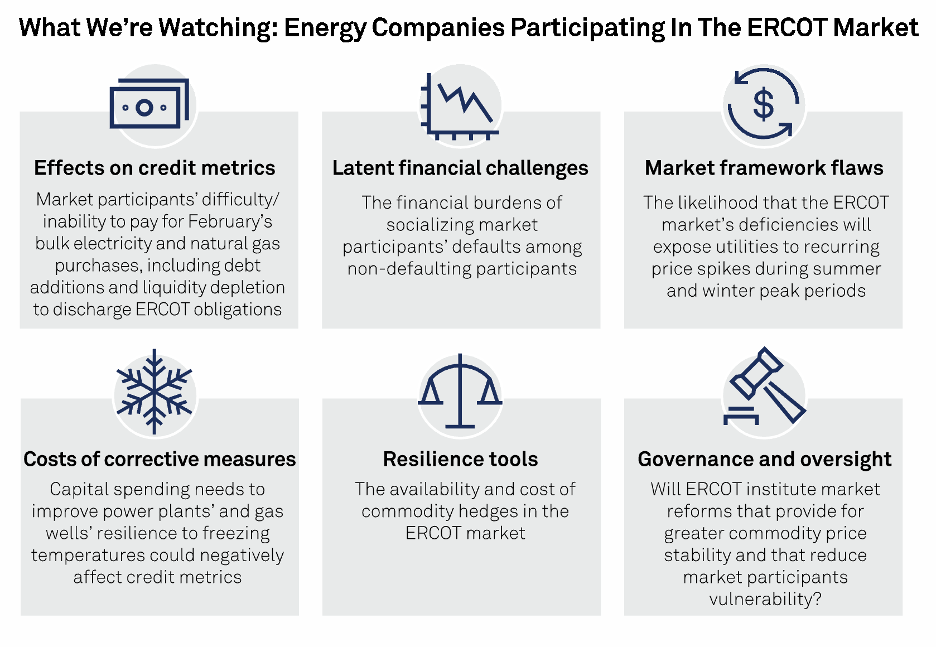

Winter Storm In Texas Will Continue To Be Felt In Utilities' Credit Profiles

Electric cooperatives and public power utilities have had the most credit exposure. Unpaid bills for wholesale purchases of electricity and gas are the most significant financial exposures. S&P Global Ratings’ negative rating actions have been concentrated among entities that were short electricity or natural gas. The ERCOT market's operational shortcomings and expectations that ERCOT will socialize defaulted payments among non-defaulting market participants presents ongoing negative credit risks.

—Read the full report from S&P Global Ratings

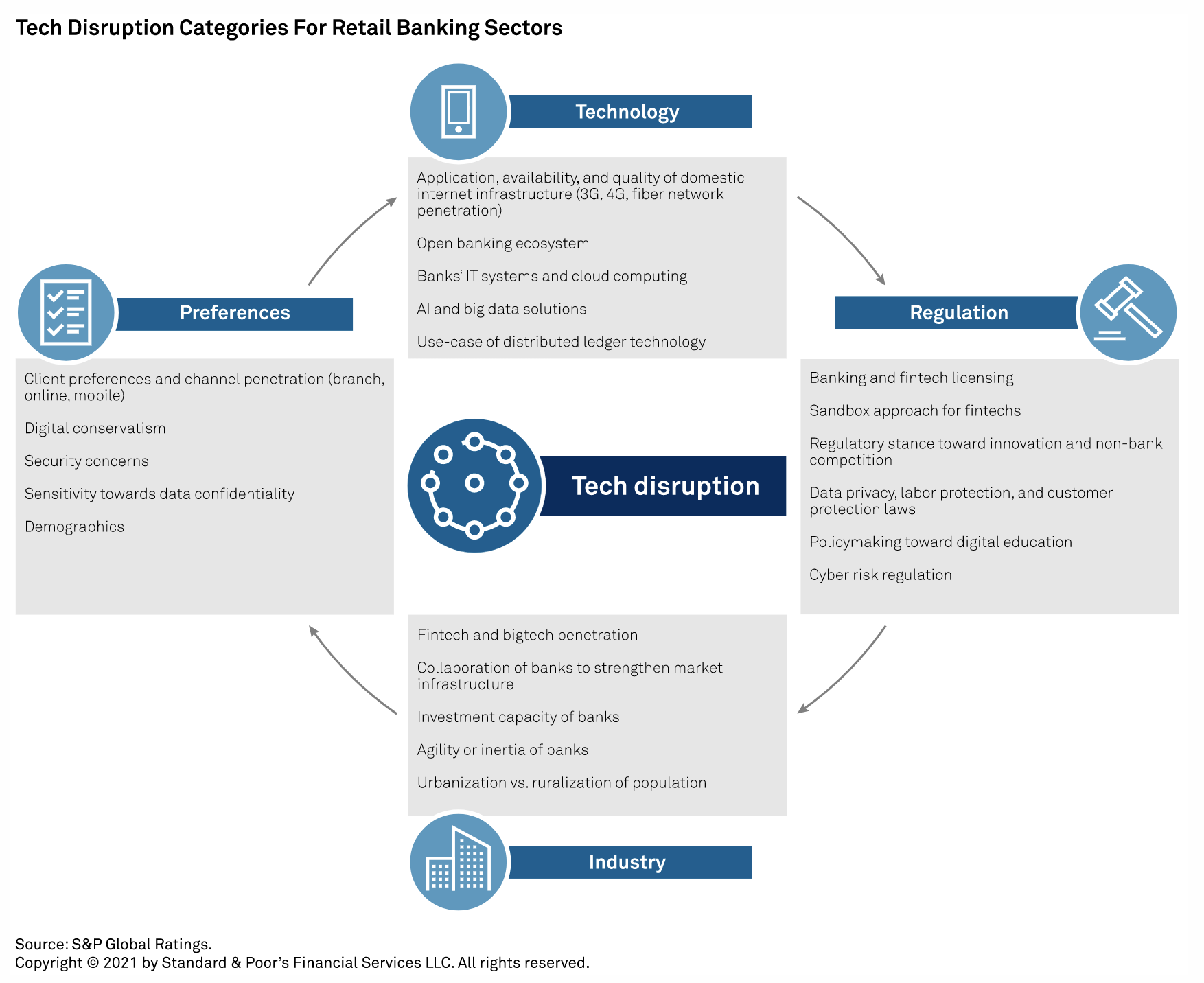

The Future of Banking: The Incumbents Strike Back

The pandemic is accelerating traditional banks' digitalization drive, challenging virtual banks. S&P Global Ratings expects soft economies in Asia-Pacific and elevated asset quality strains will weigh particularly heavily on purely digital institutions. Regulatory developments in some banking jurisdictions in Asia-Pacific were delayed due to COVID but are now moving ahead.

—Read the full report from S&P Global Ratings

Worst May Be Over For France's Big 3 Banks as Cost of Risk Peaked In 2020

The cost of risk at the largest three banks in France by assets has been on the rise since 2018, reaching its peak in 2020 through the COVID-19 pandemic, according to S&P Global Market Intelligence data.

—Read the full article from S&P Global Market Intelligence

Digital Banking Coming To the Philippines Soon; Winning Trust Is Key To Success

The Philippines may see its first purely digital banks by 2022 as the central bank prepares to issue them licenses. But the challenge for the neobanks will be to build trust and convince customers in a country with low financial services penetration and a preference for face-to-face interaction, analysts say.

—Read the full article from S&P Global Market Intelligence

Listen: Energy Evolution: The Mess With Texas

A February winter storm that crippled the Texas power grid, left millions of residents without light and heat, and drove natural gas prices to record highs has helped to clarify threats to the system's reliability and resilience, electricity infrastructure experts told S&P Global Market Intelligence's Energy Evolution podcast.

—Listen and subscribe to Energy Evolution, a podcast from S&P Global Market Intelligence

China's Energy Transition Plan 'Underwhelming,' May Cool Green Financing Hype

The absence of an emissions cap and more aggressive peak-carbon policies in China's energy transition roadmap for 2021-2025 is likely to cool enthusiasm for the nation's green financing in the near term, experts say.

—Read the full article from S&P Global Market Intelligence

Watch: Market Movers Asia, March 15-19: All Eyes on Oil, LNG, PVC Price Movements

The highlights on S&P Global Platts Market Movers - Asia with Petrochemicals Associate Editor Shilpa Samant: Markets assess China's oil data for cues on its stock levels and export prospects; tensions, rising oil prices add to Asian oil importers' woes; LNG demand robust despite recent rally; steel demand from auto sector falls; and global supply shortage raises PVC prices in Asia to multi-year highs.

—Watch and share this Market Movers video from S&P Global Platts

Myanmar Protests Reduce Imports As Shipping Lines Suspend Operations

Shipping lines suspending operations at Myanmar ports due to widespread protests against the country's military coup has dampened physical trading activity, caused container shipment delays and significantly reduced imports, trade sources said March 16.

—Read the full article from S&P Global Platts

World Oil Demand May Have Peaked In 2019 Amid Energy Transition: IRENA

Global oil demand may have hit the peak in 2019 and natural gas will follow suit around 2025, the director general of International Renewable Energy Agency said March 16, as the energy transition gathers pace, echoing forecasts made by BP last year.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language