Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 30 Jun, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

After the Hype, the Metaverse Gets Practical

The Gartner Group identified five phases in the hype cycle for emerging technologies: the Technology Trigger, the Peak of Inflated Expectations, the Trough of Disillusionment, the Slope of Enlightenment and the Plateau of Productivity. Over time, these phases play out the same for different technologies, from cloud computing to the blockchain to generative AI. The metaverse, having slid off the peak of inflated expectations, is mired in the Trough of Disillusionment. Finding itself out of favor and out of fashion, the metaverse is getting down to business.

A recent article from S&P Global Market Intelligence examining metaverse technology in Europe provided a useful definition of the metaverse: “A vision of the next iteration of the internet: a single, shared, immersive, persistent, 3D virtual space where humans and machines interact with one another and with data, enhancing the physical world as much as replacing it.”

There are two ways of interpreting this definition. One is that a practical metaverse would have to meet all the stipulations of the definition to be considered a proper metaverse. The other is that this is a list of desired, but not necessary, conditions and that the actual core of the metaverse is a “virtual space where humans and machines interact.” Most progress in metaverse technology seems focused on the latter interpretation.

The latest news on metaverse technologies has been on hardware. On June 5, Apple announced that it would enter the augmented/virtual reality hardware market with the Apple Vision Pro, a VR headset ambitiously priced at $3,499. Apple’s belated entry to the market came as competitors Meta and Qualcomm pulled back on some of their metaverse initiatives. However, new hardware announcements from Meta and HTC indicate the headset market is starting to heat up, which may improve the technology and ultimately reduce the prices for consumers looking to engage with the metaverse.

According to an article by S&P Global Market Intelligence, chip designer MediaTek announced that it is now looking past the metaverse to an “ambient era” of computing. The company is focused on building chips for the higher margin business of connected devices that tap into the metaverse, AI and advanced connectivity. The article’s author, research analyst Neil Barbour, noted, “Many of these advancements would fall under the metaverse umbrella.” But MediaTek seems attached to the notion of ambient computing.

An article by Ian Hughes, a senior internet of things research analyst at S&P Global Market Intelligence, examined the range of possible network architectures that could support the metaverse. The article outlined four potential metaverse architectural patterns — a typical game, a web application, cloud streaming and peer-to-peer networking — that could support the incredible throughput demands of a virtual space where multiple humans interact in real time. Hughes suggested that a hybrid model involving multiple architectures is the most likely outcome, with different architectures fitting according to function.

Barbour and Hughes joined S&P Global’s “Next in Tech” podcast with host Eric Hanselman to discuss the latest on metaverse research — and there was quite a lot to discuss. Hanselman summed up the current state of metaverse development: “We’re into that intermediate stage where there are an awful lot of moving parts that bolt together in a number of different ways and architectures that are still shaking out.”

Today is Friday, June 30, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

The next edition of the Daily Update will be published Wednesday, July 5.

Global Economic Outlook Q3 2023: Higher For Longer Rates Is The New Baseline

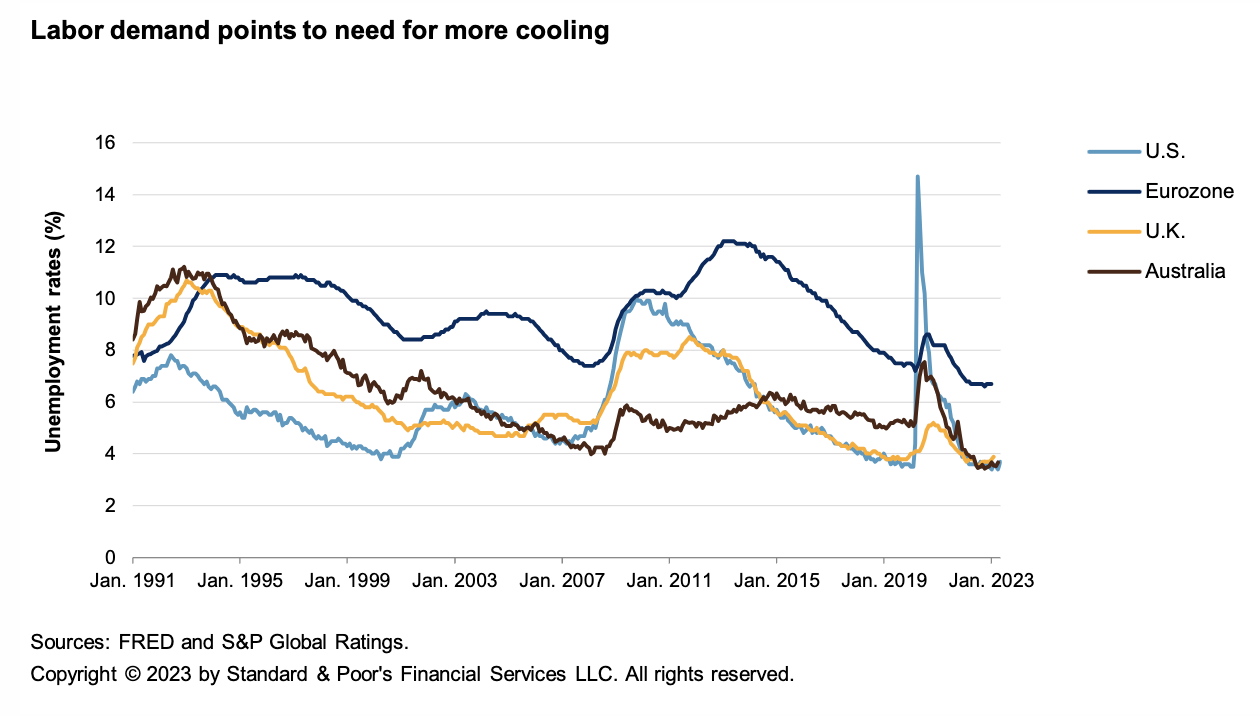

Demand remains surprisingly resilient in the US and many other advanced countries. This is despite cumulative policy rate increases ranging from 350 to 500 basis points since the first half of 2022, and the associated inversion of yield curves, which typically signals a sharp slowdown. Strength remains concentrated in service sectors reflecting pent-up demand for tourism, entertainment and leisure resulting from COVID-19-era restrictions. In some cases, generous fiscal spending and savings and wealth buffers have provided tailwinds.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Large Asian Banks Maintain Strong Capital Buffers As Economic Slowdown Looms

Large Asia-Pacific banks have strong capital buffers that would come in handy as global economic growth cools, S&P Global Market Intelligence data shows. All banks across the region with more than $300 billion in assets, including those in China, India and Singapore, had common equity tier 1 (CET 1) ratios exceeding the minimum regulatory Basel III requirements at the end of the 2022 fiscal year, the data shows. Several improved their CET 1 ratios over the past three fiscal years, including Industrial and Commercial Bank of China Ltd., the world's biggest bank by assets, and Singapore-based DBS Group Holdings Ltd., the biggest lender in Southeast Asia.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

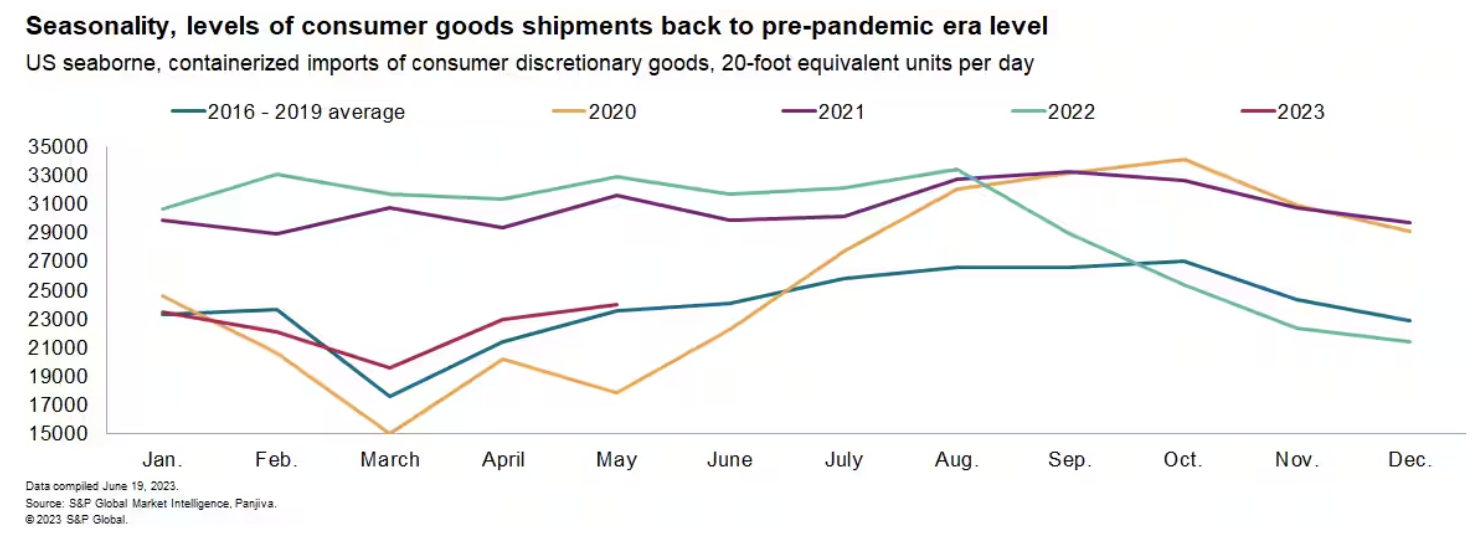

Right Place, Right Time: Supply Chain Outlook For Third Quarter 2023

Supply chains are almost back to normal in terms of activity, inventories and seasonality. Yet, there are plenty of uncertainties in both the government policy and physical risk heading into the second half of 2023 as firms start to implement long-term supply chain restructuring plans. Evidence of a return to normal supply chain activity is now well established, and largely due to a decline in activity. The S&P Global manufacturing PMI shows supplier delivery times have reached their fastest since April 2009 as of May.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

Texas Grid Sets New Peakload Record In Heat Wave, But Renewables Hobble Power Prices

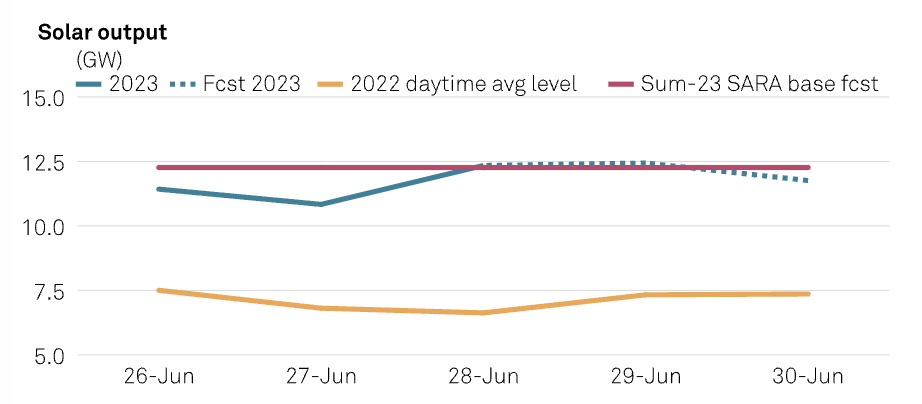

The Electric Reliability Council of Texas set an all-time peakload record of 80.8 GW on June 27 and forecast topping that number June 28-29 as a heat wave spread triple-digit high temperatures across the state, but strong renewable output kept a check on wholesale power prices. The new record beat the 80.1-GW previous record set July 20 and matched June 26, but remains below the base case seasonal peak of 83.4 GW included in ERCOT's updated summer 2023 Seasonal Assessment of Resource Adequacy.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Europe's Q3 2023 Gas Market Fundamentals Finely Balanced

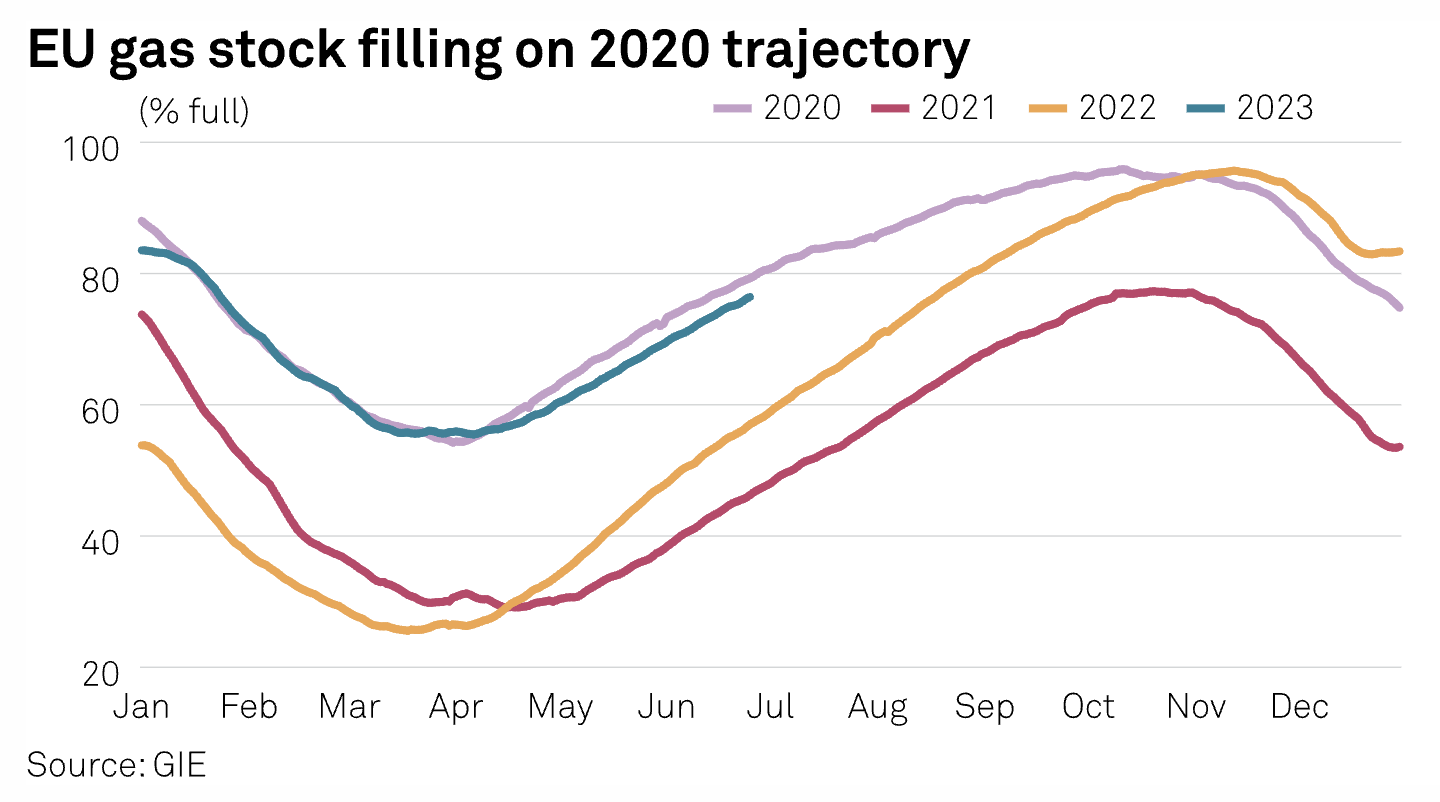

The third quarter will be a telling one for the European gas market, with all eyes on the rate of storage filling, Norwegian summer maintenance progress and competition from Asia for LNG. With EU storage sites already around 77% full, stocks could top out well before winter meaning market players could struggle to find a home for gas in Europe later in the quarter. But concerns over Norwegian reliability and the potential for strong demand for LNG in Asia — in China in particular — could see the market balance remain tight.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

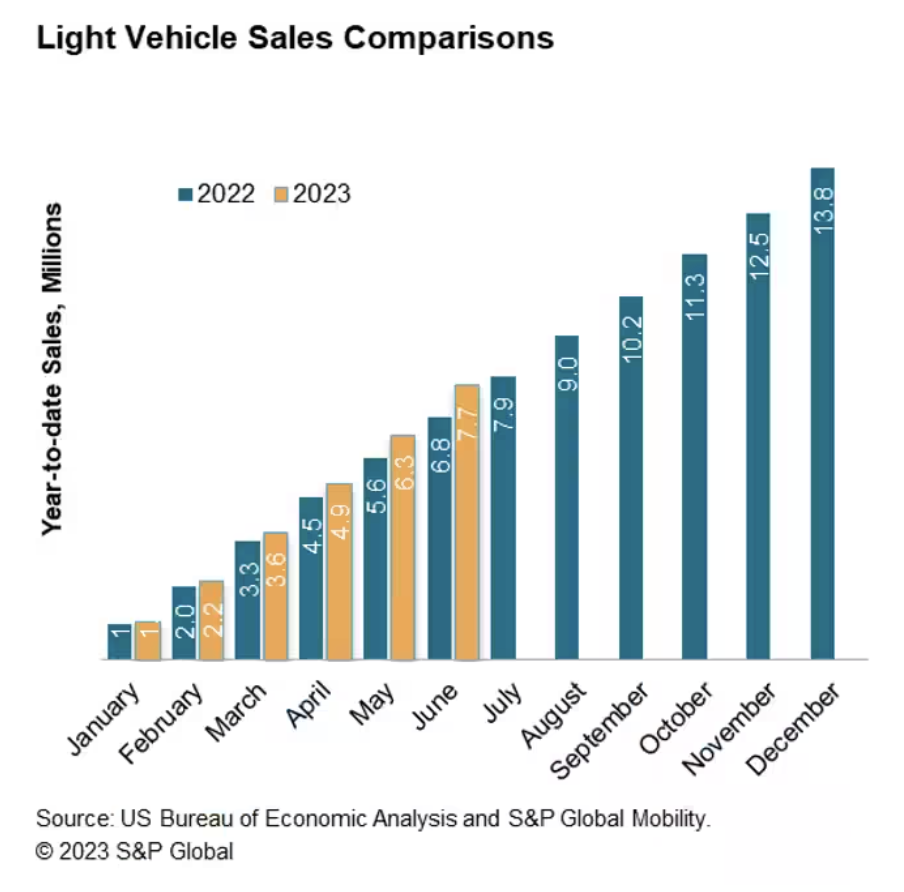

US Auto Sales To Advance Again In June

Signs of green shoots within the auto demand environment continue to emerge as June US auto sales are expected to follow-up on the solid volume levels of the preceding two months. S&P Global Mobility projects new light vehicle sales volume in June 2023 to reach 1.38 million units, up 17% year over year, and representing the 11th consecutive month in which volume has improved from the year-prior level. This volume would translate to an estimated sales pace of 15.9 million units (seasonally adjusted annual rate: SAAR), pressing the 16.0-million-unit level for the second time in the quarter.

—Read the article from S&P Global Mobility

Content Type

Location

Segment

Language